DEFINITION of earnings per share (EPS)

Earnings per share is a measure of how much profit a company has generated.

WHAT IT IS IN ESSENCE

Companies usually report their earnings per share on a quarterly or yearly basis.

It is an important metric in a company’s earnings figures.

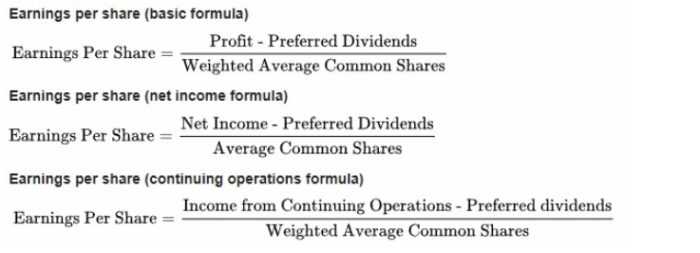

It is calculated by taking the difference between a company’s net income and dividends paid for the preferred stock. And then dividing that figure by the average number of shares outstanding.

EPS is used to determine the value attached to each outstanding share of a company. In a market where the amount of profit made by companies and the number of shares on exchanges can vary, EPS gives a per-capita way of evaluating companies.

EPS is a very important factor when examining a business’s fundamentals.

Earning per share is the same as any profitability or market prospect ratio. Higher earnings per share are always better than a lower ratio.

Because this means the company is more profitable and the company has more profits to distribute to its shareholders.

Although many investors don’t pay much attention to the EPS, higher earnings per share ratio often make the stock price of a company rise. Since so many things can manipulate this ratio, investors tend to look at it but don’t let it influence their decisions drastically.

HOW TO USE

The basic earnings-per-share formula only takes a company’s outstanding common shares into account. But the diluted earnings-per-share calculation takes all convertible securities into consideration.

A company might have convertible preferred shares or stock options that could theoretically become common stock.

If this happens, the result would be a reduction in earnings per share. And as such, a company’s diluted earnings per share will always be lower than its basic earnings per share.

Earnings can cause stock prices to rise. And when they do, investors make money. If a company has high earnings per share, it means it has more money available to reinvest in the business. Or distribute to stockholders in the form of dividend payments.

In either scenario, the investors win.