DEFINITION of basis points

Basis points are a unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument. It is the smallest measure of quoting the yield on a bond, note, or another debt instrument. They are also known as bps or “beeps,”

WHAT IT IS IN ESSENCE

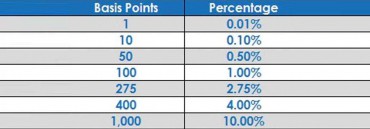

One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form. Likewise, a fractional basis point such as 1.5 is equivalent to 0.015% or 0.00015 in decimal form.

This term avoids the ambiguity in discussions about rates. Confusion could arise in a statement such as, “a 1% increase from a 10% interest rate.” The 1% increase could be interpreted as either an increase from 10% to 10.1% (relative) or 10% to 11% (absolute).

One basis point is equal to one-hundredth of one percent (0.01%): one percent of a yield equals 100 basis points. For example, an interest rate of 5 percent is 50 basis points higher than the interest rate of 4.5 percent. Similarly, a spread of 50 basis points (between the bid price and offer price of a bond) means the investor must pay 0.5 percent more to buy it than he or she could realize from selling it.

HOW TO USE

Using them clarifies the amount in question. The statement, “… a 100 basis point increase” would signal that the rate has increased from 10% to 11%.

We can use them in finance. Changes in the values of financial instruments or interest rates are tagged in basis point. We can use them to describe quantities of less than one percent. For example when the Federal Reserve lowers its fed funds rate by a half a percent. The media will report that the fed funds rate is getting lower by 50 basis points.