DEFINITION of Base rate

The base rate is the minimum rate set by the central bank below which banks are not allowed to lend to their customers.

WHAT IT IS IN ESSENCE

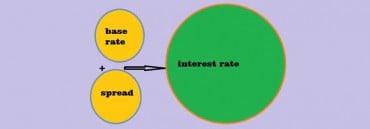

It is decided in order to enhance transparency in the credit market. And ensure that banks pass on the lower cost of funds to their customers. Loan pricing will be done by adding a base rate and a suitable spread depending on the credit risk premium. In the years after some recession, many central banks kept interest rates at record lows.

For example, this causes most commercial banks to charge low-interest rates on loans to customers. But also offer low-interest rates on money held in accounts. With the cost of borrowing low, consumers should, in theory, be encouraged to spend money instead of saving it. In that way, they are giving a boost to businesses and the economy.

The base rate is the INTEREST RATE. The commercial banks are using it to calculate rates of interest. It will be charged on bank loans and overdrafts to their customers.

For example, a large company might be charged an interest rate of base rate plus 2% on a loan. Whereas a smaller borrower might be charged, say, base rate plus 4%. Formerly, base rates were linked directly to BANK RATE but are now fixed by reference to the ‘official’ rate of interest.

HOW TO USE

If the bank cut this rate, you would expect banks to cut their mortgage and lending rates.

If the bank put up the base rate, you would expect banks to increase their mortgage rates.

The reason is that if commercial banks find it more expensive to borrow from the central bank, they will increase their lending costs to compensate. If it is cheaper to borrow from the central bank, they can reduce their mortgage rates and keep the same profit margin.

In 2008, banks were short of liquidity and they wanted to increase their deposits and improve their balance sheets. Therefore, they were reluctant to lend and keen to attract savings. Therefore, they didn’t want to cut mortgage rates and lending rates. In effect, they were making it more profitable; they could borrow at 0.5%, but they were lending out at 4%.