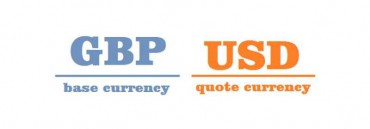

DEFINITION of Base currency

The base currency is the coins against which exchange rates are generally quoted in a given country.

WHAT IT IS IN ESSENCE

For example, USD/JPY, the US Dollar is the base money. Also EUR/USD, the EURO is also. In trading this term has two main definitions:

- It is the first price quoted in a forex pair: the two banknotes that investors use to trade forex.

- The accounting currency is used by banks and other businesses. It is usually the domestic money of the country the company is operating in.

The second value in the pair is the quote or the counter. It represents the amount of that price which buyer has to give to buy a single unit of the base currency.

Or, in other words, this is the simple relationship behind a Forex pair. Where the first currency (base) is quoted against the second currency and we get its relative value.

The most important and most traded Forex pairs have nickname Majors. Traders often refer them by nicknames.

EUR/USD – “Fiber”

USD/JPY – “Yen”

GBP/USD – “The cable”.

(This nickname has its origins in the time when a cable under the Atlantic Ocean helped synchronize the GBP/USD quotes.)

AUD/USD – “Aussie”

USD/CAD – “Loonie”.

(This nickname comes from the bird on the Canadian coin.)

USD/CHF – “Swissy”

HOW TO USE

Long forex trade will involve buying the base banknote while selling the quote banknote.

Now, we know what a Forex currency pair is. But let’s find out what happens when we open a transaction on a currency pair.

Let’s say we open a long transaction on EUR/USD at the price of 1.2000. This actually means that we buy the Euro against the US Dollar. If Euro strengthens, or US Dollar weakens or both, the price will go up. And the Euro is worth more than it did when we opened a long position.

In this case, if we have a long position and the value of the base currency increases and when we close our transaction, we actually sell the base currency to earn a profit. We bought the base when it was cheap and we sold it when it was more expensive.

When we go short on a currency pair, we sell the base currency against the quote/counter currency. If the counter currency strengthens (USD in our example above) or the base currency weakens (Euro in our example) or both, the price will go down.

Remember, when we close a transaction we actually take the opposite trade to our initial one. However, when we buy back Euro, we do so at a lower, cheaper price. We sold it when it was expensive. And we bought it back when it was cheaper. So, we earned a profit.

These are the basic mechanics behind a Forex trade. However, some of the most important things are to know how much to invest in a single trade. Also, when to go long or short.