DEFINITION of the Auction market

An auction market is a market in which buyers indicate the highest price they are willing to pay and sellers indicate the lowest price they are willing to accept.

WHAT IT IS IN ESSENCE

A trade occurs when the buyer and seller agree on a price. In trading, it is the process by which the prices of shares are determined before the open, after the close. Or during intraday volatility auctions to build or stabilize the order book.

They allow traders to place market or limit orders directly on an exchange. The set price of some share is visible as the highest amount that a buyer is willing to pay for it. And the lowest amount that a seller is willing to sell. Because there are several competing bidders and sellers, there are several offers and asking prices.

It is the system in which buyers enter competitive bids. And sellers enter competitive offers simultaneously. It is opposite to the over-the-counter market, where we can find negotiations. Examples are the NYSE and the AMEX. also called the double auction market.

The New York Stock Exchange (NYSE) is one of the world’s foremost auction markets. NYSE agents known as specialists act as auctioneers and match up orders in order to promote an efficient marketplace.

HOW TO USE

An auction is where the property is sold at a specific time and place to the highest bidder. Most auctions require a person to get a bidder number or other identifying item prior to bidding. Many of the high record-setting prices that people get for the property is done at auction.

The majority of the trading is going via computer. But auction markets can also work via open outcry. Whereby buyers and sellers physically call out prices to each other.

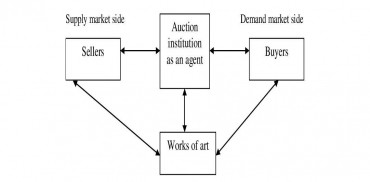

Auction markets serve to connect buyers and sellers in the most efficient manner possible.