DEFINITION of Arbitrage

Arbitrage refers to the practice of buying an asset then selling it immediately to take advantage of a difference in price.

WHAT IT IS IN ESSENCE

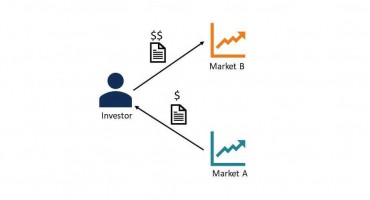

The asset can be sold in a different market, different form, or with a different financial instrument, depending on where the difference in price happens. This practice can happen in practically all financial instruments: forex, options, commodities, shares, or derivatives.

In trading, it is a strategy to take advantage of differences in prices across markets to make a profit.

Let’s say, a trader has an opportunity to buy stock cheap somewhere and sell somewhere else for more expensive, which landed him profit. This is arbitrage.

This kind of opportunity comes and goes in the blink of an eye. Sometimes selling and buying must even occur simultaneously.

When it comes to trading, it is not an idea unique to cryptocurrency. Tons of exchanges have emerged globally. As a result, the market is ripe for different strategies to take advantage of this chaos. More commonly, people recognize arbitrage opportunities with pricing or even geography.

But there is a major arbitrage opportunity that flies under the radar for many new investors: the Listing Arbitrage. When coins get listed on large exchanges, they tend to have a window of opportunity for lucrative price arbitrage due to the buy demand for users on the new exchange.

HOW TO USE

For instance, in stocks, it can come when a stock is listed on exchanges in two different countries. Because of a foreign exchange change in one of the countries, the price of the share can be different from between the two exchanges. But if you sell the stock on one exchange and buy it on the other at the same time, the trader can take advantage of the price gap for immediate profit.