DEFINITION of Agent/agency agreement

This represents an independent person or legal entity that acts on behalf of another (the ‘principal’). In international transactions, refers to a sales representative. Such one operates on behalf of a foreign principal, earning a commission on sales eventually concluded between the principal and the ultimate client.

WHAT IT IS IN ESSENCE

We have to highlight differences between an agent, which isn’t the same as sales through employees and subsidiaries. They are not independent, or through distributorship relations, which involve the distributor’s buying and reselling in their own name.

Sales agents should also be distinguished from buying or purchasing agents, as the respective rights and obligations are quite different.

Agency trade is, buy or sell order that some brokerage firm initiated on behalf of a customer. An agency trade is in contrast to a trade that is initiated directly by the customer. If a customer has given a brokerage firm discretion to manage his or her account, then any trades from that account are agency trades.

The agency broker must look after its clients’ best interests.

That involves filling client orders at the lowest price and in the fastest way. The responsibility of an agency broker is to find the best execution for its clients.

The agent agrees to maintain an adequate inventory of the assets. So as to be able at all times to provide samples to prospective customers.

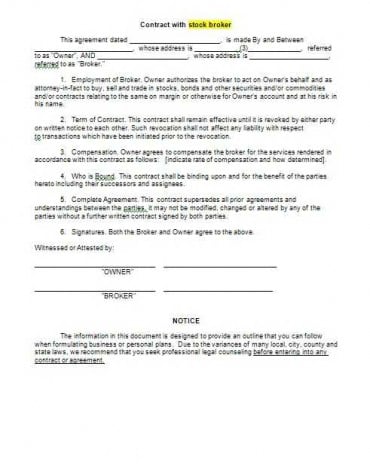

The agent/agency, according to Agent/agency agreement shall immediately take whatever steps may be necessary to compliance requirements. They have to keep the trader informed of their efforts. The agent/agency has to advise the trader or investor on any asset in the customer’s name.

HOW TO USE

Investors and traders may hire a stockbroker to act as an agent between them and the stock market. Traders may lack the expertise to act effectively on their own. So, it is a good idea to hire an agent to manage investments and provide advice.