In stock trading, the essential part is to move quickly in and out of the position to profit more.

Guy Avtalyon

Everyone who even thinks about trading must understand the importance of stop-loss and why the Traders-Paradise team likes to say stop-loss first.

The stop-loss is one of the simplest tools from any trader’s toolkit. This order is connected to the stock’s movement, no matter if the fundamentals for the company have changed. The stop-loss first, because if you use it you’ll have a greater chance to outperform the market. Let’s explain this. When the price of the stock goes down, the stock becomes more volatile, which means more risk.

Correlations between stocks and the market increase more when markets are dropping than when they are growing. So, the portfolio risk rises, and therefore diversification impact reduces. Increased volatility and higher risk, can expose stop-loss order as extremely important in risk exposure control. The gain could be potentially made by reducing the risk and getting a higher risk-adjusted return.

Using stop-loss strategies you can reduce your emotional reactions while trading, and overcome the volatile market. So, the saying “stop-loss first” covers many situations when it is beneficial and we’ll show you some of them.

Why stop-loss is the first consideration

Stop-loss is the primary guarantee for profiting in the stock market. When you set your stop-loss order you’ll avoid risk, protect your principal, and survive the market volatility. It’s like the insurance premium.

Risk control is the most important. For example, you just learned to ride a motorbike. What you have to know as a must? You’ll have to know how to control the speed of falling. You’ll be safer.

But when it comes to stop-loss orders, not every trader is confident where to set this order. Some even avoid thinking about it. Let us explain something. The stock market is a risky one, while you have one winning trade you might have up to ten losing trades. Don’t worry, that’s normal. But you cannot depend on good luck or count on it. What do you need? Skills and capacity to profit consistently. Otherwise, the stock market will dump you out.

Why is stop-loss important?

One of the reasons to use stop-loss is because you trade with limited capital. That’s the rule, no matter if you are the richest trader in the world. Limited capital is required due to the necessity to protect your whole capital from losses. It is possible only if you use a stop-loss order. In other words, you must know what the maximum losses you can take per trade, per day, week, or month. That is trading discipline. You can maintain it only if you set a stop-loss order for each of your trades.

Moreover, if you consider a stop-loss first, before your entry point, you’ll be able to profit faster and reach your financial goals. In stock trading, you don’t want to hold stock for a long time, and you’ll want to sell them. But if the desired price isn’t reached, you’ll need to close the losing position as fast as possible and move onto another trade. Of course, you’ll have to compensate for your losing trade elsewhere. That to be said, in stock trading the essential part is to move quickly in and out of the position to profit more. Move your money quickly and with profit, that’s the point. But if you do it randomly you’ll be faced with losses. You have to ensure your trades. How to do that? By using stop-loss first, then you can think about new entries. Also, the bounce backs will be easier in case you have losses. The math can confirm that.

For example, it is easier for $1000 to fall to $800, but a lot more difficult for $800 to bounce back to $1000. This is a loss of 20%. To compensate for this loss you’ll need about 25% appreciation and come back to the initial capital. But even after a 100% bounce, the stock will be back to its buying price. That’s why you need to use stop-loss orders. If you wait there is a chance for momentum to go more against you.

What does stop-loss determine

In trading, using a stop-loss order is important to overcome the imperfection of indicators. You have to exit a trade if it goes against you. If you’re a buyer, your stop-loss order will be a sell order. Consequently, if you’re a seller your stop-loss order will be a buy order.

If you’re a buyer, the stop-loss order is a sell order. And vice versa, if you’re a seller, it’s a buy order. For example, if you set your stop-loss order at 3%, you’re actually setting the amount of money you’re prepared to lose per trade.

Stop-loss relates to indicators, money, or time. It’s up to you to choose what type of stops you want to use. For instance, you’re buying a stock at $50 because the indicators you use are showing that for this particular stock potential gain could be $100. This means the stock price could reach $150. Your initial stop could be at $25 which is 50% of your initial capital and to get a chance to make $100. Here we come to the risk-reward ratio. In this case, it would be 100:25 which is 4:1.

In short, it determines how big a position to take.

Why to use stop-loss first?

To avoid the concentration of positions

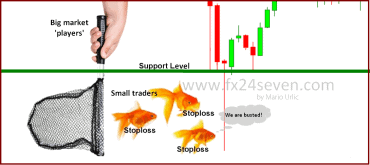

As a trader, you’ll run the risk if you extend your exposure excessively. For example, if you keep holding onto positions or average them, then the concentration can occur in your picked stocks.

For example, you bought a stock at $50 and if it goes down to $45, you might want to average your position. You’ll want that to reduce the cost of holding, for instance. But if the stock price continues to drop, you might be motivated to average your position again. So what could happen? You’ll fall into the loop. You’ll repeat this mistake, and repeat again and again in an attempt to reduce the cost of holding. The better choice would be to use a stop-loss order at the level of the first decline and cut your position. Why would you like to keep a few positions and end up overexposed to their cumulative risks?

Getting higher leverage

In stock, trading leverage is important because it provides you to trade with margin. For example, you put in a margin of $100.000 into your trading account. But you want to trade a stock whose current price is $1.800. So, you could buy about 55 shares. But your broker allows you 4 times more leverage because the company is highly liquid and you now can open positions up to $400.000. Instead of 55 shares, you can buy 220 because it’s the cover order. Let’s assume that the support level for this stock is at $1.750 and you set your stop-loss at $1.700. Let’s calculate your trading risk.

220 x (1.750 – 1.700) = $11.000

Since you have a margin of $100.000 in your account, the cover order reduces the risk. Yes, but only if you plan a stop-loss first.

Advantages of this order

If you count a stop-loss first, you’ll be able to cut your losses and you’ll be able to protect your trades against bigger losses when the stock price drops sharply. Further, the stop-loss will be automatically triggered if the stock price moves to a certain price. Moreover, you can maintain the risk-reward ratio. For example, you are willing to take a 3% or 5% or 10% risk to get a particular profit. A stop-loss order will help you to achieve that. One of the advantages is that you’ll be able to make trading decisions without emotions and despite the market noise. Also, the stop-loss will help you to execute your trades based on your trading strategy and to stick with it.

Disadvantages of using a stop-loss

Nothing is 100% sure in the stock trading so even the stop-loss has some drawbacks. For example, you set a limit order and also, you set a stop-loss order, to buy a stock on a particular date. What if your stock opens at a lower price (gap-down) during the pre-opening session? Well, your stop loss will never be triggered. You will end up with losses. Here is a possible scenario. You set a stop-loss at $25, but the stock opens on a gap-down at $23. The stock price didn’t reach your stop-loss so your sell order will not be achieved.

Also, a stop-loss can be triggered by short-term fluctuations. For example, the stock price first fell to $24 but then bounced and Increased to $35. But you set the stop-loss at $25 and your holdings will be traded automatically as that price is reached.

When you calculate where to place a stop-loss order examine what was the range of the historical fluctuation for that stock. For example, you will not place a stop-loss at 3% for the stock with a daily fluctuation of 6%.

If you want to be a profitable trader, you’ll need to plan every single action. Just like you know the buying price, you must know where to set a stop-loss first and take a profit level. If you don’t do this well, the whole process might end up in big losses. Also, poor stop-loss orders can cause them. The stock trading history is full of both great and ugly stories, so many ups and downs, winning trades and failures.

Learn stop-loss first, then consider your entry! That’s the whole wisdom.