3 min read

HFT uses practically basic and simple strategies. High-frequency trading is not about implementing the strategy, it is all about speed of execution and flexibility.

Well, the main strategy of HFT is to run faster than others. Of course, the principles of high-frequency trading (HFT) firms are secrecy, strategy, and speed.

Algo trading is linked with the execution of trade orders. But HFT refers to the implementation of proprietary trading strategies.

High-frequency trading consists of a variety of AT.

Yes, both enable traders and investors to speed up the response on market data.

The society of market participants using HFT is extremely mixed.

There is a crowd of various organizations with various business forms that use HFT and there are many hybrid models.

For example, some brokers and exchanges are utilizing HFT systems. So, in the estimation of HFT, it is essential to consider a practical perspective.

It doesn’t matter if HFT is just an add-on technology to realize trading strategies.

Liquidity providing is one of the HFT strategies.

Well, the most frequent HFT strategies are to serve as a liquidity provider.

How does HTF provide it?

HFT liquidity providers have two primary reservoirs: when they provide markets with the liquidity they pocket the spread between the bid and ask limits. Also, there is a trading income by granting discounts or lowered transaction fees. The aim is to increase market quality and attractiveness.

HFT firms will never discover their ways of acting. The significant experts linked with HFT are undercover. Well, this is not quite true. Maybe we could say they want to be in front of the public eyes less than others.

Those firms operate with various strategies to trade and earn money. The strategies are often many kinds of arbitrage. For example, volatility arbitrage, or index arbitrage.

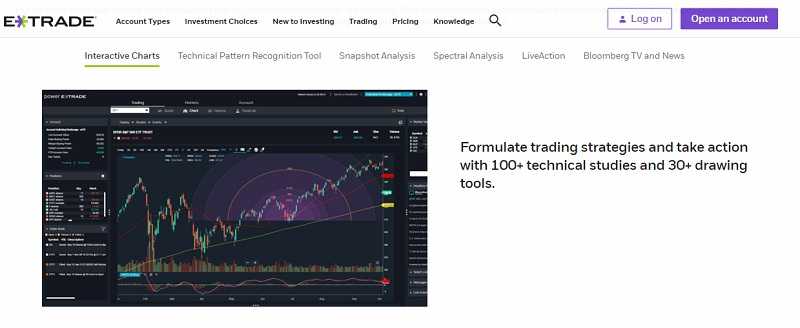

HFT employs software that is incredibly fast. They have access to all market data and can make connections with minimum latency.

HFT firms regularly use own money, own technology and a number of special strategies to produce profits.

There are numerous strategies applied by traders to earn money for their firms.

Even the controversial strategies.

For example, HFT firms may trade from both parties.

Hence, they can place orders to sell using a limit order above the market price. Also, they can place the buy order a little bit below the market price.

And, voila! There is a profit for them. The difference between the two prices. They are market makers. All these transactions are very fast, in a millisecond by using algorithms and robust computers.

Spread capturing as HFT strategy

HFT firms are liquidity providers. They profit from the spread between the bid and ask prices.

How?

They are buying and selling securities all the time.

With each trade, they receive the spread between the price at which shareholders buy contracts and the other at which they can sell contracts.

Rebate driven strategies

The liquidity provision strategies are developed on particular stimulus systems.

In order to encourage liquidity providers, some trading venues use unsymmetric pricing. They charge a lower fee or give a rebate for market makers or passive trading.

Why?

Such traders bring liquidity to the market.

On the other side, for more aggressive tradings they charge a higher fee. Why? Such traders remove liquidity from the market.

An unsymmetric fee arrangement aims to boost liquidity provision.

Point is: traders supplying liquidity earn their profits from the market spread. Fee discounts or rebates stimulate a market‘s liquidity.

On this way, those markets look promising comparing to their rivals.

Arbitrage

Chances to perform arbitrage strategies generally survive only for fractions of a second.

But computers mission is to examine the markets in a millisecond. That feature causes the arbitrage to become the main strategy employed by HFTs.

To conduct arbitrage HFT use the same method as traditional traders. But they use an algorithm to profit from short-lived differences between securities. The other types of arbitrage are not restricted to HFT and such, they are not the subject of this post.

Latency arbitrage

The latency arbitrage is the ability of HFTs to recognize new market information before other market participants even get it.

The latency arbitrage uses direct data feeds and co-located servers to short the reaction time. Latency arbitrageurs profit from speed power. Such market participants can reduce the prices at which other traders are able to trade. That’s why you can find them under the name of predatory.

Liquidity detection

HFTs try to recognize the patterns other traders leave and adjust their actions accord to them. The focus of liquidity detectors is large orders.

Liquidity detectors are getting information about algorithmic traders is usually called sniffing out the other algos.

The bottom line

HFT is not a trading strategy. It is the usage of advanced technology that performs traditional trading strategies. The individual trading strategies need to be assessed rather than HFT as such.

HFT should never be banned. It would be contrary to market efficiency. High-frequency trading contributes to market liquidity and to the ability of the price creation.

However, any strategies that have a contradictory influence on market integrity or enable market abuse, has to be are completely reviewed.

This is particularly important for HFT. If anyone believes this technology promotes the implementation of abusing strategies, moreover, makes them more profitable and creates unfair circumstances on the market, should check the other participants too.

Our confidence in technology is huge, but we are very cautious when it comes to the people.

Technology by itself is without morality. The people are those who can add it to high-tech.

Fortunately, we, ordinary people, don’t have any access to HFT.

Don’t waste your money!

The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.

The high-frequency trading algorithm or HFT provides fast and profitable trades. Learn how.

Here are Traders-Paradise’s suggestions for the automated trading software we examined.

Here are Traders-Paradise’s suggestions for the automated trading software we examined.