Trading meaning we buy and sell, buy and sell

While investors, when researching a stock, look at the fundamentals of the company, such as sales, producing advantages and disadvantages , costs and efficiency, in-house projections on the industry and more, we do not really care about all these.

We do, to only some point of degree, because we act on a small time frame – from minutes to several week/months. Never few years.

What we actually want to pursue is these investors’ moves.

Basically… Trading is a big mess

Buying, selling, trying to buy low, but sometimes the price is already high,

trying to sell high, but not knowing what high is more than enough.

Charts, indicators, lots of data, lots of noise.

That’s a small part of the difficulties you’ll face trying to trade stocks or forex… or cryptos…

Timing, strategy, tolerance. That’s what trading is all about.

We’ve been investigating the stock market for the past decade, and I can now save you years of research:

There is no “one way” to keep winning your trades. No one indicator, no one line on a chart. Not a recommendation and no nothing.

But—

There are definitely ways to profit while trading

and I will share those with you in this article.

Buying low is not just a phrase

When trading stocks, your strategy is basically buy as low as you can and sell as high as you can (an vise versa when shorting).

It’s not just a saying, it fits right in the math:

If a stock is $10 at the moment, and you buy at that price. and the price then drops to $5, then I buy, and then the price goes back up to around $15.

Both of us are profiting at this moment, but while your profit is at 50%, mine is at 150%.

So you always want to buy the lowest you can buy.

The smartest people in the world

The stock market is powered mostly by the smartest people in the world. Just think about it, everyone from everywhere in the world, can trade stocks online and use their knowledge and skills at high math, statistics, physics, computer science. PhDs from all around the world. They all can participate in the trading game, and they are. They take the money of all the new traders, the dumb traders, those who buy the news.

Buy the rumor sell the news

That’s how some of the traders you can read about their successes online make their trades. They have their ways to reach to the rumors and then they analyze it to see what effect it will have on the stock’s price, and only then decide if it’s good enough deal or not.

But most traders use multiple resources to analyze a stock before trading.

I use the Traders-Paradise.com trading ideas algorithm

And you can use it also, it’s free!

How to use it:

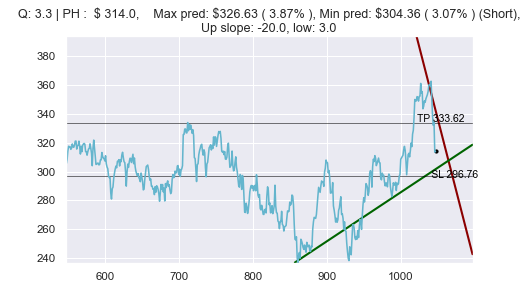

You get the trading idea looking like this:

Meaning: If the price go down to $304.36, then buy to around $326.63.

Once that happens, I go in a buy long position and profit:

Real screenshot of that trade on “TradeStation” platform:

I buy 3 stocks symbol “PH” for $304.36, total worth of 3*304.36 = $913.

Then I sell at around $324, gaining almost $20 per share, while having 3 generate me a profit of $60, or in other words: +6.5% yield (math: (60/913)*100).

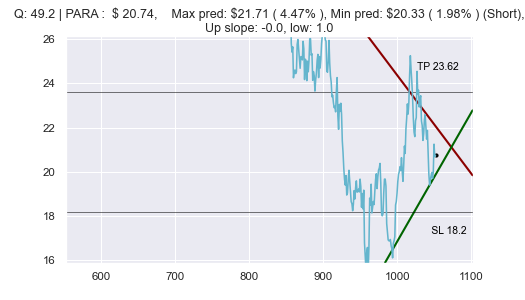

Or in this example I get this idea on a stock symbol “PARA”:

it says – if the price goes to $20.33 buy.

Well.. It did.. And I bought..

Real screenshot of that trade on “TradeStation” platform:

I buy 49 stocks symbol “PARA” for $20 each, total worth of 49*20 = $980.

Then I sell at a bit above $22, gaining more than $2 per share. Having 49 generates me a profit of $98, or in other words: +10% profit yield (math: (98/980)*100).

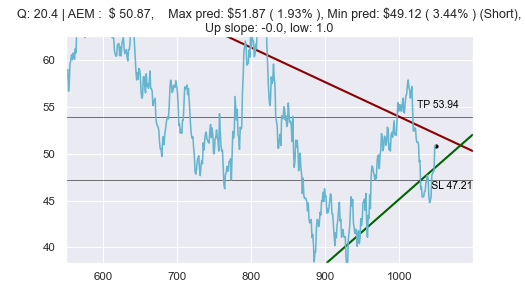

Those were easy, but what about this one?

Here I see the price need to fall 3.44% to price of $49.12 in order to buy. That’s intimidating. Because, I do want to buy low, so I want price to drop, but if it drops almost 4%, doesn’t it mean it could be a “Falling knife” ?

Well, the price did fall to that exact predicted spot. And did not drop more, allowing me to profit without any stop loss worries.

On this simple trade I bought at 49.12, and sold at 51.87, adding up to a +5.6% profit yield.

More examples:

Trade on “LUMN” stock: +4.5%

Couple of trades on “TU” stock over time: Average of +5%

Trade on TXT stock. Did not predict the lowest point, but did not reach stop point: +3% profit.

Trade on CAT stock: Buy at 183 and sell at 212 generating +15.8%!

A dangerous long trade on a clearly down trend on CMI stock: Buy at 225, sell at 232 generating +3% profit.

And, of course, same goes for shorting a stock. Same idea, but opposite:

Short trade on UNH stock:

Sell short at 497 and buying back to cover at 469, generating +5.6% profit:

Short trade on TROW stock:

Sell short at 125 and buying back to cover at 112, generating +10% profit:

It is not 100% accurate

As you can also see in the images. IT DOES NOT always know when it’s the lowest or when it’s the highest. No one and no computer can predict the future. But, and that’s a big but, there are parameters you can use to predict what will happen, IF something will happen, and that’s where all the magic is about.

We trust this algorithm with our money

The images above, those are only part of the trades we’re making. Of course, we lose sometimes, but our risk management method, backed with these trading ideas, keeps us always on the winning side, even compared to market performance.

As you can see from the images attached, these are real trades with real fund and real money. This is our personal money we use to trade.

Everyone can use these ideas

The ideas are presented free on our daily posts. There is a premium section where you can have access to more exclusive ideas and tools.

Strategies to trade include stop loss and take profit

While the take profit is somehow a suggestion (it’s not), the stop loss is essential tool and you cannot trade without it as for our recommendation for trading.

You saw the “PARA” trade above. It was an after trade image. Here’s a “during” the trade image:

You can see there is clearly a profit strategy and a stop strategy. The strategies are always varied.

Always test new ideas or strategies on demo account first

When testing out new ideas it’s best to do that on small funds or demo account. We use small funds most of the time as we find it’s more motivational to not repeat any trading mistakes when it’s real money on the line.