How to read this report

Every report will start with a short “Market News” section. In this section, we scraped the latest financial news regarding the financial markets. This is a more macro vision of the market. Interest rates, unemployment reports, inflation, oil and energy, earning season, etc.

After the news report section we head to the trading idea section. Every idea is divided into 4 important parts:

-

-

-

- The company and its sector and description

- Recent news about the company

- Chart and its boundary lines

- A table with the company peers and competitors, including their financial and fundamentals.

-

-

A new report will be generated on a daily basis.

Does it work?

In short, yes.

you can read here how we use these methods for our real life trades.

Short declaimer

This report, including all content, is made for educational purposes only. Use on your own risk!

Most recent news about the financial markets

- All bets off if S&P 500 closes below 3950, says McMillan.

The VIX and its tradeable products are positive, but all bets are off if the S&P 500 closes below 3950, writes Lawrence McMillan. The sell signals are flashing across the stock market now, but bulls still have one chance.

- Peter Lynch explains why he likes boring companies.

For investors, boring can be wonderful. Peter Lynch says it’s almost as good as a company with a boring name if it does boring things and has a good name together. – Peter Lynch, “Boring Can Be Wonderful”

- Don’t dismiss the simplest of solutions as too simple to be effective.

Don’t dismiss the S&P 500 as being too simple to be effective, as it’s a good starting point for retirement planning and investing. It’s not a must-have, but it is a useful starting point. It can be easily adapted to suit different circumstances.

- ETF could be yours for as little as $5.

This Warren Buffett ETF could make you a millionaire. It can maximize your earnings while minimizing risk. It’s a powerhouse investment that maximizes earnings and minimizes risk. It’s easy to invest without lifting a finger and it’s safe to do so.

- Core PCE price index rises 0.3% monthly, 4.6% annually. riskier assets higher despite stronger-than-expected print

The Personal consumption expenditure (PCE) price index grew 0.1% in April from the previous month and 4.2% annually. That’s down from 5% in February and short of economist expectations of 4.6%. Core PCE, the Federal Reserve’s preferred inflation gauge that excludes food and energy, rose 0.3%, up from 4.7%. The slowdown in the rate of inflation led risky assets higher, with the SPDR S&P 500 ETF Trust gaining 0.5%, and Treasuries yields lower.

- GDP will go negative as market reaches new all-time highs.

The market moves in opposite of the news, which makes people confused. The market reached new all-time highs as the GDP will go negative as the market reaches new highs, according to Sentiment Speaks. The substance of news will not direct the market moves.

- Tax efficiency and trading tips with ETFs.

We discuss bond ETFs, options trading, market efficiency and tax efficiency with ETFs and market efficiency with options trading with ETF’s. We also discuss tax efficiency and trading tips with the exchange traded funds (ETFs) with the topic “Tax Efficiency and Trading with Exchange Traded Funds”.

#1 Trading idea on GWW

Company Name: WW Grainger Inc

Symbol: GWW

Sector: Consumer Discretionary

Company Description: W. W. Grainger, Inc. is an American Fortune 500 industrial supply company founded in 1927 in Chicago by William W. (Bill) Grainger. It is one of the largest manufacturers of industrial supplies in the world. It supplies a variety of industries.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GWW — Union Pacific is among 12 companies to announce dividend increases in first half of May.

Union Pacific and Northrop Grumman are among 12 companies to announce dividend increases in the first half of May. Click here for a detailed analysis of the companies’ dividend increases. . for more information. for details, click here for the analysis.

- News story for GWW — Q1 top line gains on strong performance across High-Touch Solutions North America.

Grainger’s (GWWW) Q1 top line gains on strong performance across the High-Touch Solutions North America (N.A.) and Endless Assortment segments. Grainger beats Q1 earnings estimates and ups ’23 Guidance.

- News story for GWW — Earnings and Revenues beat estimates by more than 120% and 7%, respectively.

W.W. Grainger delivered earnings and revenue surprises of 12.14% and 0.74%, respectively, for the quarter ended March 2023, beating the estimates by 12% and 1%. The company is expected to report results for the first quarter of 2018.

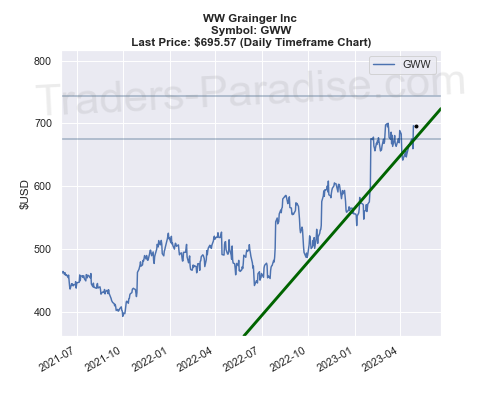

TECHNICAL ANALYSIS

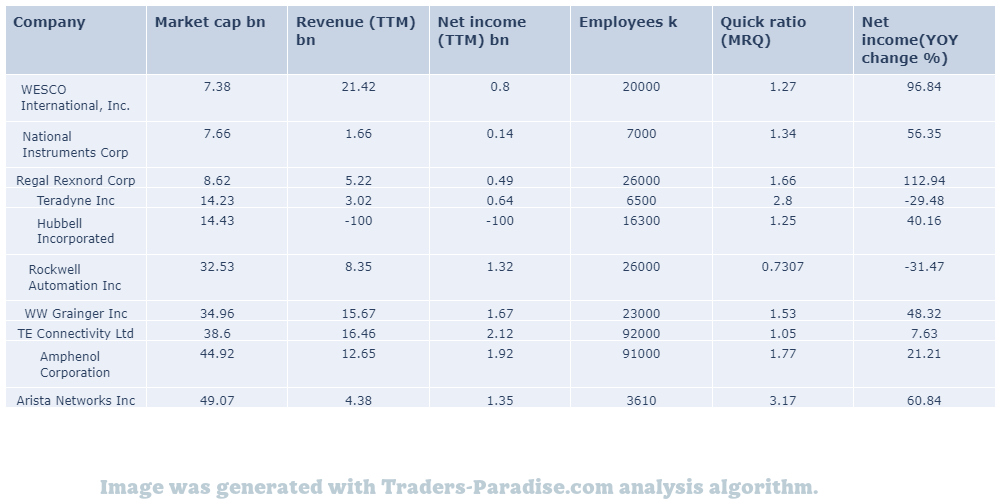

PEERS AND FUNDAMENTALS

#2 Trading idea on GGG

Company Name: Graco Inc.

Symbol: GGG

Sector: Industrial Goods

Company Description: Graco Inc. designs, manufactures and markets systems and equipment used to move, measure, control, dispense and spray fluids and powders worldwide. The company is headquartered in Minneapolis, Minnesota, and is a subsidiary of General Electric Co. (GE).

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GGG — Strong performance from all segments.

Graco’s (GGG) Q1 results benefit from the solid performance of all its segments and beat the expectations. The company’s revenues increased y/y by 1.5% and profits increased by 2.7% from Q1 2013 to Q1 2014.

- News story for GGG — Helen of Troy, Accuray, Meta Platforms all post gains. Lennox International, Hasbro, Materialise also move higher

Helen of Troy Limited shares rose 19.1% to $97.39 after the company announced better-than-expected Q4 results. Bel Fuse Inc. gained 18.3%, Accuray Incorporated (NASDAQ: ARAY) climbed 15% and Ardagh Metal Packaging S.A. (NYSE: AMBP) jumped 13.5%. Overstock.com, OSTK and Materialise NV also recorded gains.

- News story for GGG — Key metrics to consider when assessing Graco’s performance.

Graco Inc. (GGG) reported first-quarter results for the quarter ended March 2023. It’s worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals to get an idea of how the company performed.

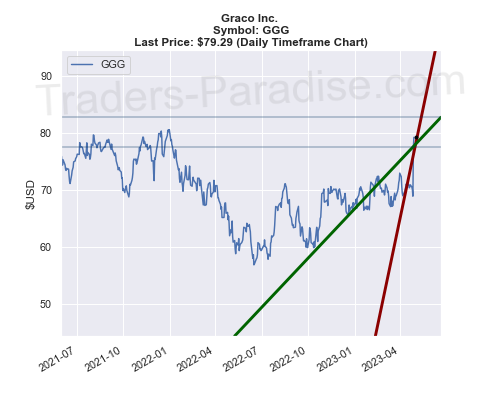

TECHNICAL ANALYSIS

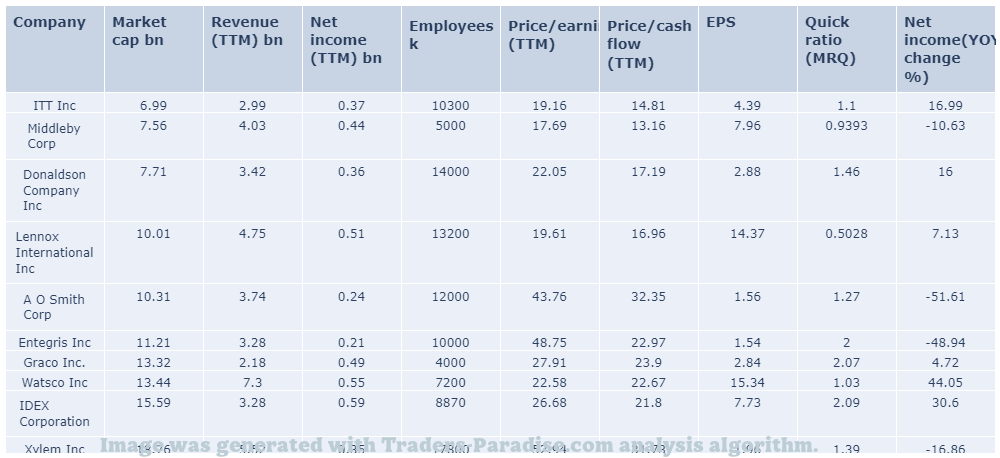

PEERS AND FUNDAMENTALS

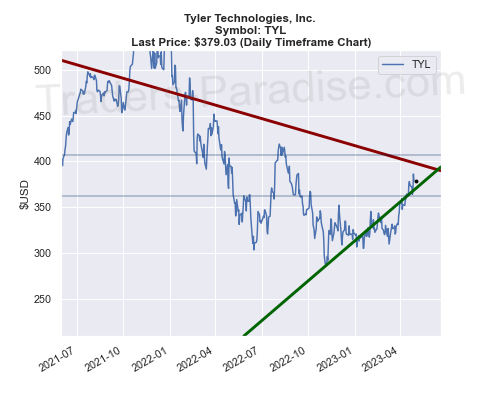

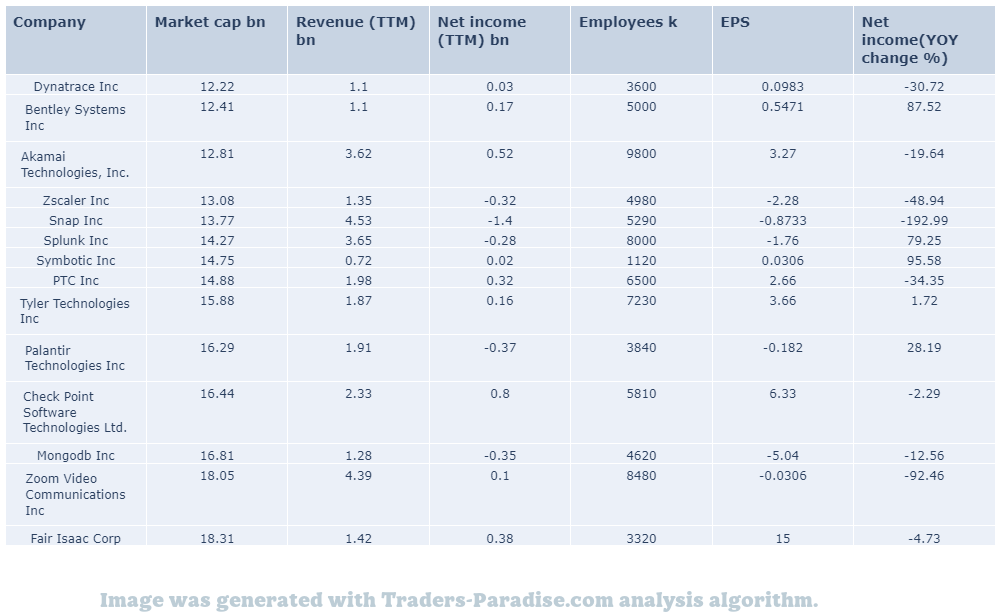

#3 Trading idea on TYL

Company Name: Tyler Technologies, Inc.

Symbol: TYL

Sector: Technology

Company Description: Tyler Technologies, Inc. is the largest provider of software to the United States public sector. It is based in Plano, Texas. It provides software for the following industries: military, healthcare, education, and government. .

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TYL — Revenues, earnings per share (EPS) and sales growth rates all look good.

Tyler Technologies (TYL) reported its first quarter results for the quarter ended March 2023. Key metrics for Tyler Technologies compare with Wall Street estimates and the year-ago numbers. Tyler Technologies’ revenue and EPS for the first quarter were higher than Wall Street’s estimates.

- News story for TYL — 800-244-0167 800-244-0167 800-244-0167 800-244-0167 800-244-0167 800-244-0167 800-244-0167 800-244-0167.

Tyler’s first-quarter results reflect the benefits of heightened subscription arrangements as it continues its transformation to a fully software-as-a-service-based model from a license-based one. Revenues missed the estimates. Tyler’s Q1 earnings beat, but revenues missed estimates.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

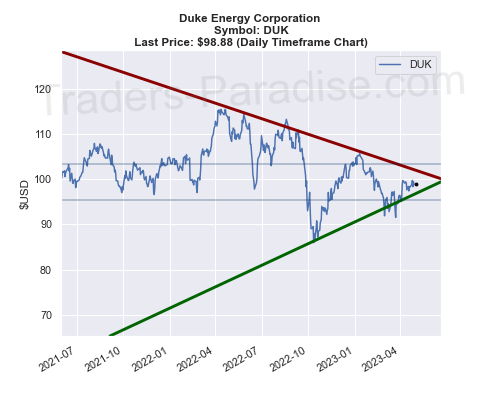

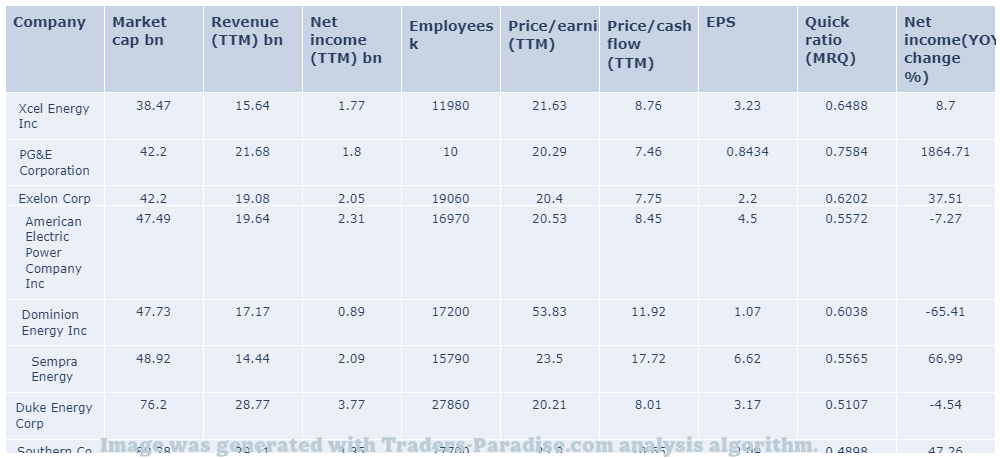

#4 Trading idea on DUK

Company Name: Duke Energy Corporation

Symbol: DUK

Sector: Utilities

Company Description: Duke Energy Corporation is an American electric power and natural gas holding company headquartered in Charlotte, North Carolina. It owns the Duke Energy and Carolina Power and Light Company. It also owns the Carolina Natural Gas Company. Its stock is trading on the New York Stock Exchange.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DUK — Is it a good thing to have a monopoly?

The Fundamentals of Investing in Monopolies explains how a monopoly can be good for investors and how it might be bad for the economy as a whole, but not bad for investors. . for more information on this topic visit:

- News story for DUK — FirstEnergy’s first-quarter earnings miss estimates. Revenues surpass same quarter last year

FirstEnergy’s first-quarter earnings miss estimates, while revenues surpass the same. FirstEnergy’s Q1 Earnings Lag Estimates, Revenues Beat Estimates, but Earnings Still Missed Estimates. FE’s First-quarter revenues beat the same, but earnings still missed estimates.

- News story for DUK — Earnings and revenue missed analysts’ expectations.

NorthWestern (NWE) delivered earnings and revenue surprises of -1.87% and 10.11% for the quarter ended March 2023, compared to the expected -10.11%. NWE’s stock has lagged Q1 Earnings Estimates.

TECHNICAL ANALYSIS

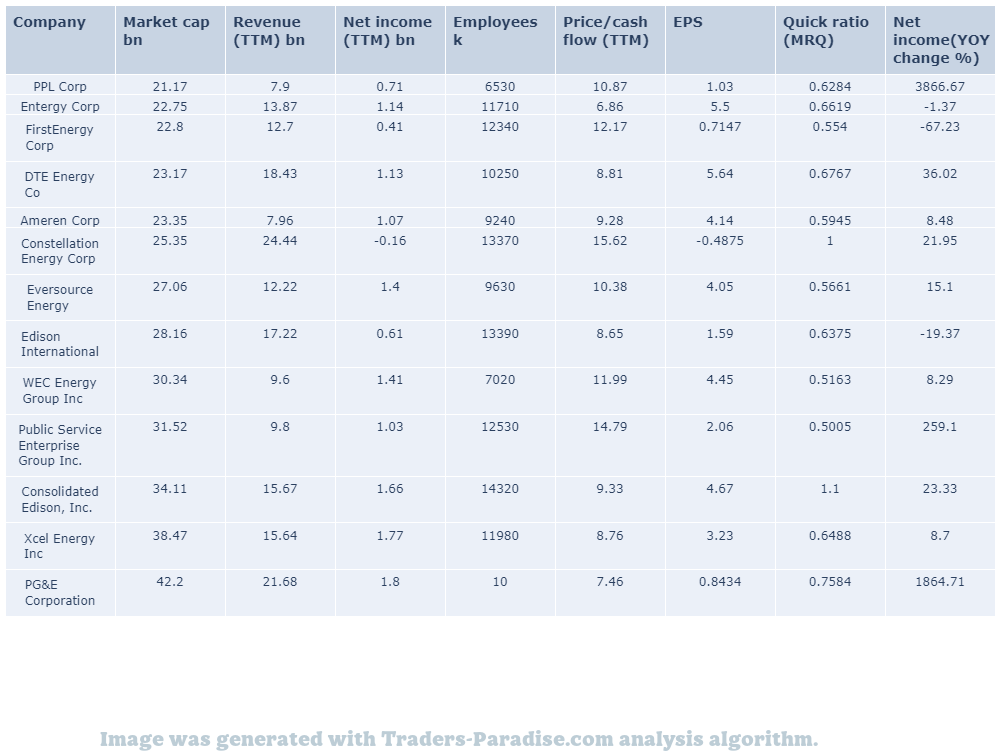

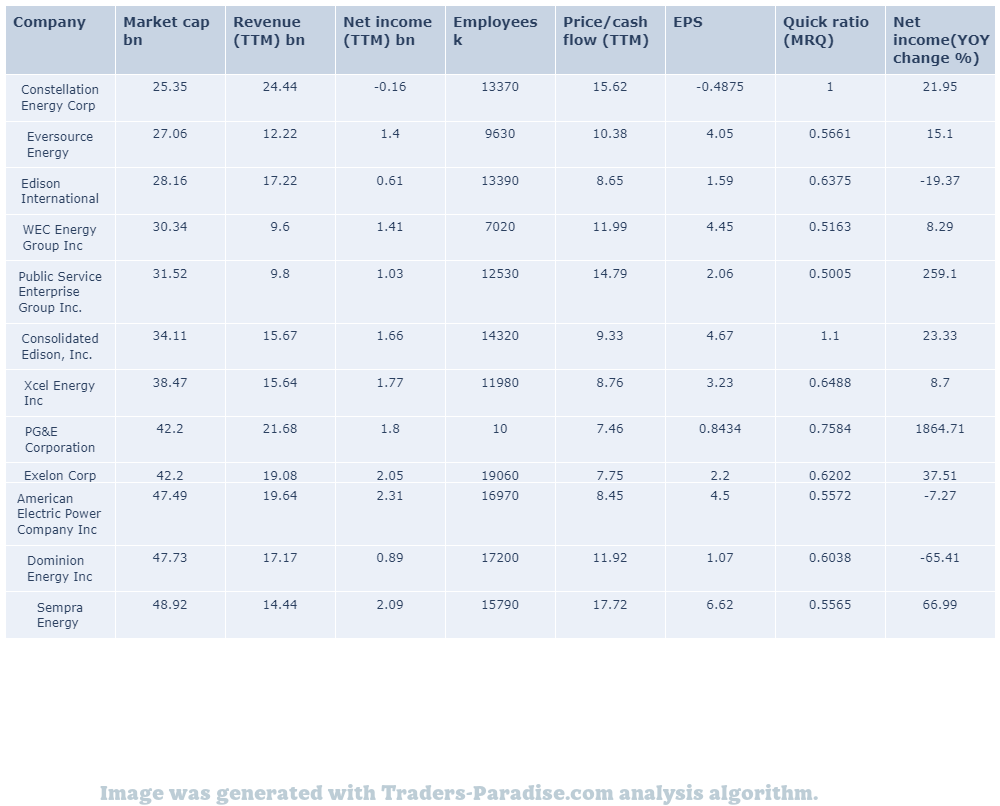

PEERS AND FUNDAMENTALS

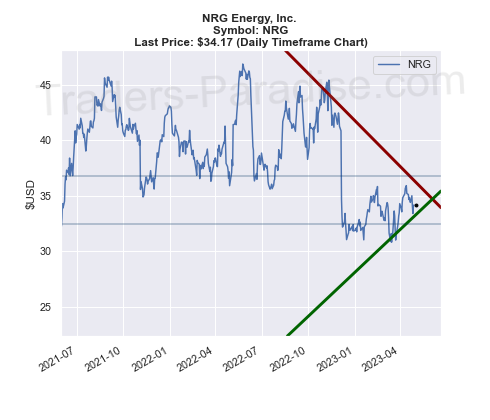

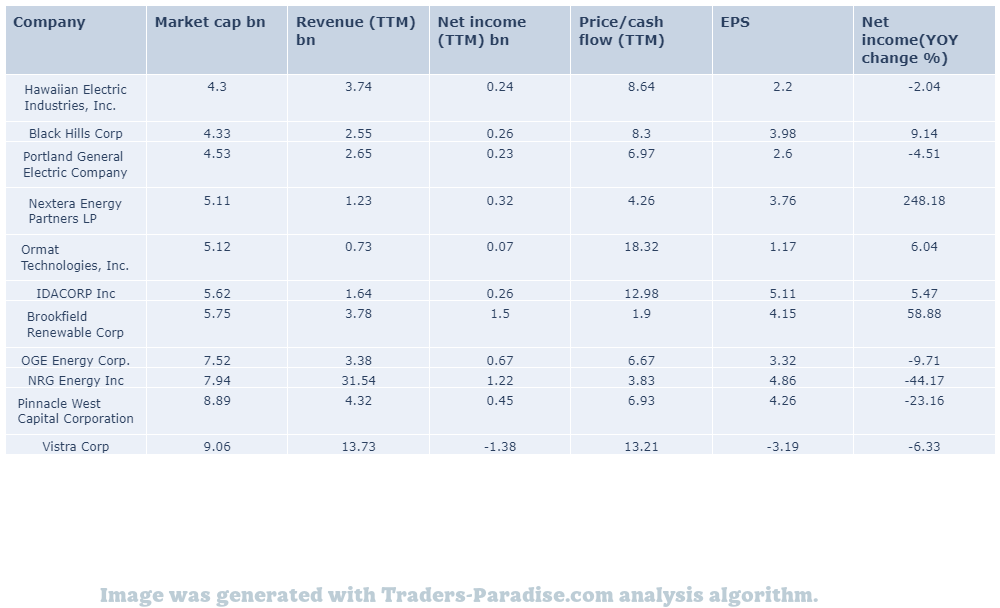

#5 Trading idea on NRG

Company Name: NRG Energy, Inc.

Symbol: NRG

Sector: Utilities

Company Description: NRG Energy is a large American energy company based in Houston, Texas. It is involved in energy generation and retail electricity. It was formerly the wholesale arm of Northern States Power Company (NSP), which became Xcel Energy, but became independent in 2000.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for NRG — Analysts expect NRG to report better-than-expected earnings.

NRG Energy’s earnings are expected to grow next week. NRG doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations ahead of NRG’s earnings release next week and stay tuned.

- News story for NRG — NRG Energy (NRG)

NRG Energy (NRG) closed at $33.40 in the latest trading session, marking a -1.94% move from the prior day. NRG Energy Dips More Than Broader Markets (BME) in the latest session.

- News story for NRG — Is NRG Energy (NRG) a great dividend stock to own?

NRG Energy (NRG) is a great dividend stock right now. NRG has what it takes to be a great stock. nrngenergy.com. For confidential support call the National Dividend Service on 1-800-273-8255.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

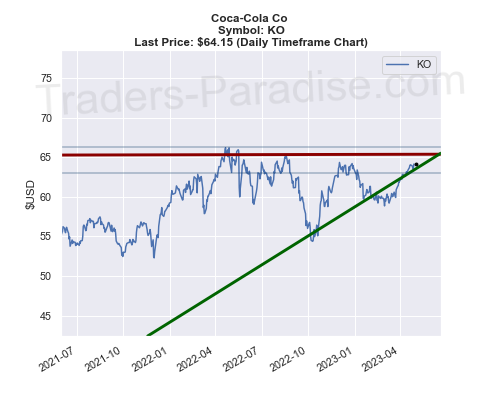

#6 Trading idea on KO

Company Name: Coca-Cola Co

Symbol: KO

Sector: Industrial Goods

Company Description: The Coca-Cola Company is an American multinational beverage corporation incorporated under Delaware’s General Corporation Law and headquartered in Atlanta, Georgia. It has interests in the manufacturing, retailing, and marketing of nonalcoholic beverage concentrates and syrups, and in the production of sodas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for KO — Softness in hard category continues to weigh on results.

Boston Beer’s (SAM) Q1 results reflect the impacts of continued softness in the hard seltzer category. Declines in shipments and depletions, along with higher costs, hurt the results. SAM reports a Q1 loss and lags revenue estimates.

- News story for KO — Is Coca-Cola a Buy? The beverage giant just gave investors good news for fiscal 2023.

Coca-Cola just gave investors more good news about fiscal 2023. Coca-Cola stock is a good buy. Coca Cola shares are up 1.7% this morning. The company has a market value of $80 billion.

- News story for KO — Shares of the company have been trading in the green recently.

Coca-Cola Company (The) (KO) has been one of the most watched stocks by Zacks users lately. It is worth exploring what lies ahead for the stock to find out if it’s a good buy now. For more information, visit Zacks.com.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

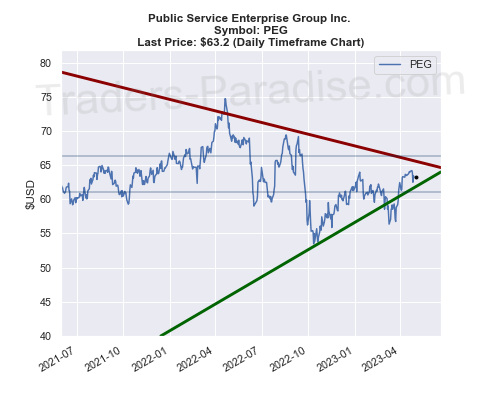

#7 Trading idea on PEG

Company Name: Public Service Enterprise Group Inc.

Symbol: PEG

Sector: Utilities

Company Description: The Public Service Enterprise Group (PSEG) is a publicly traded diversified energy company headquartered in Newark, New Jersey. PSEG has a diversified portfolio of assets, including renewable energy resources, natural gas, electricity, and water. Â

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PEG — Portland General Electric reported better-than-expected earnings and revenues.

Portland General Electric (POR) delivered earnings and revenue surprises of 1.27% and 11.06% for the quarter ended March 2023, respectively, which beat estimates. The company is expected to report results for the first quarter of 2018 on April 25th.

- News story for PEG — Utility to report higher interest expense, weather-related costs.

Public Service Enterprise’s (PEG) Q1 results are likely to reflect moderate weather pattern impacts amid higher interest expense. PSEG is expected to report Q1 earnings on April 25th. PEG is a subsidiary of Public Service Enterprise, a public company.

- News story for PEG — Utility giant is scheduled to report its second-quarter earnings on Tuesday, July 25.

Eversource Energy’s earnings are expected to grow. The company doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for Eversource’s upcoming report and buy the stock.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#8 Trading idea on D

Company Name: Dominion Resources, Inc.

Symbol: D

Sector: Utilities

Company Description: Dominion Energy supplies electricity in Virginia, North Carolina, and South Carolina and natural gas to parts of Utah, West Virginia, Ohio, Pennsylvania and North Carolina. Dominion also has generation facilities in Indiana, Illinois, Connecticut and Rhode Island. Dominion Energy is headquartered in Richmond, Virginia.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for D — Earnings Preview: Dominion Energy (D) Q1 Earnings Expected to Decline

Dominion Energy’s Q1 earnings are expected to decline. The company doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for Dominion Energy’s upcoming earnings report and prepare to lose money.

- News story for D — Dominion, 3M, and Omega have all suffered share price declines.

Winnie the Pooh is to blame for my inaction on Dominion Energy, 3M, and Omega Healthcare, according to the investment advice from the book “Winnie The Pooh: Investing for the Betterment”. The book is based on a story about a fictional bear.

- News story for D — Dominion Energy (D)

Dominion Energy (D) stock closed at $57.31 in the latest trading session, marking a -0.37% move from the previous day’s closing price of $56.31. For confidential support call the National Suicide Prevention Lifeline at 1-800-273-8255 or visit www.suicidepreventionlifeline.org.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#9 Trading idea on MPW

Company Name: Medical Properties Trust Inc.

Symbol: MPW

Sector: Financial

Company Description: The Medical Properties Trust, Inc. was formed in 2003 to acquire and develop net-leased hospital facilities. It is a self-advised real estate investment trust. It’s managed by a private investment company. It has a portfolio of hospital facilities in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MPW — Two stocks with 10% yields are not worth getting rid of.

2 Dividend Stocks With 10% Yields Investors Should Avoid. The dividend income you might receive from these stocks just isn’t worth the risk and awful returns they might generate. – The risk is not worth the reward and the returns aren’t worth it.

- News story for MPW — Medical Properties Trust posted better-than-expected results in Q1.

Medical Properties Trust management posted in the Q1 results that tenant results are getting better as the industry recovers. Click here to read our take on MPW. Â for more information on Medical Properties Trust, click here for their website.

- News story for MPW — I Almost Made This Big InvestingMistake That You Can Avoid.

I almost made a big investment mistake. I’m glad I stopped to rethink my decision before moving forward. I almost made the wrong decision, but I am glad I didn’t move forward. I am not sure if I should have done anything at all.

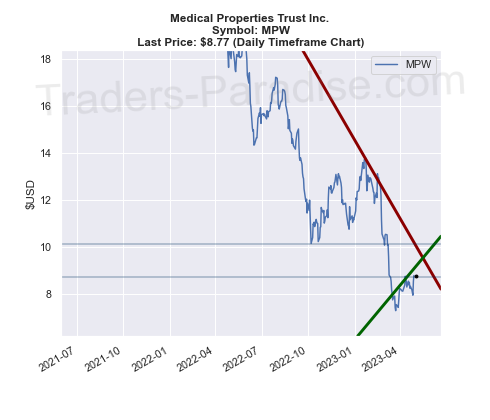

TECHNICAL ANALYSIS

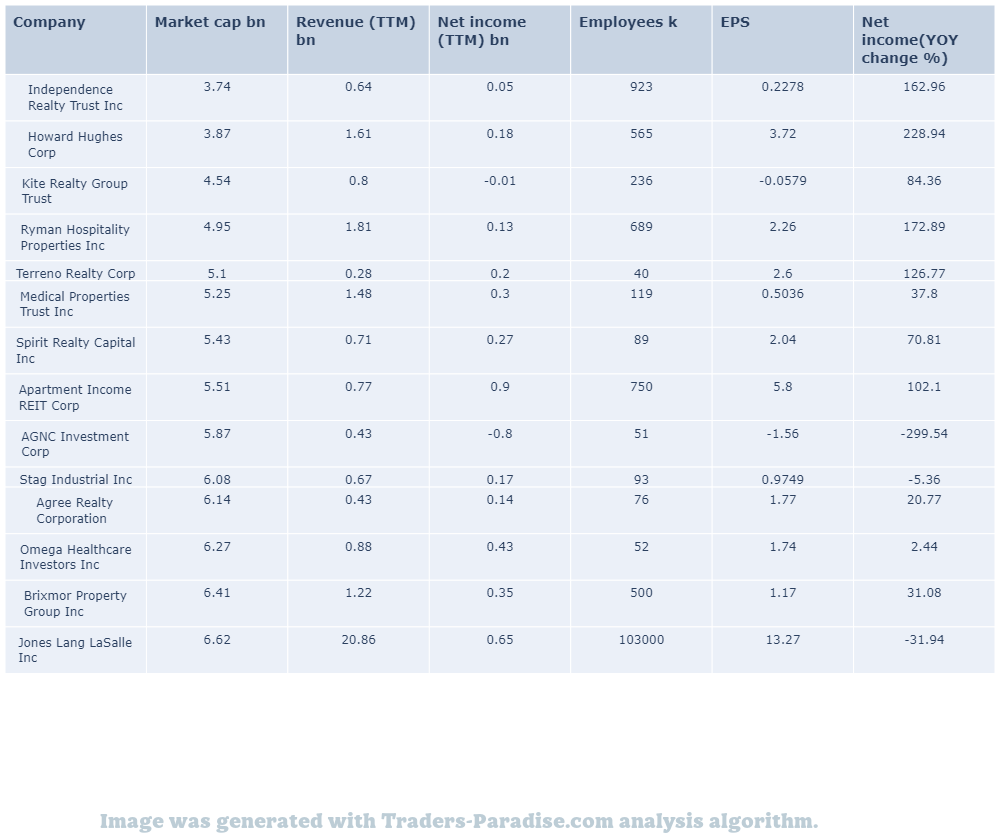

PEERS AND FUNDAMENTALS

#10 Trading idea on HON

Company Name: Honeywell International Inc.

Symbol: HON

Sector: Industrial Goods

Description: Sorry, no description at the moment.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HON — Investors are flocking to fast-growing tech stocks.

3 Growth Stocks That Could 10X Over the Next 10 years. These companies are investing in paradigm-shifting trends and could grow 10X in the next 10 years or more. They are: Apple, Facebook, Google, Microsoft, and Samsung.

- News story for HON — Earnings call for the quarter ending March 31, 2023.

Honeywell International (HON) will hold an earnings call for the period ending March 31, 2023. The conference call will be held on Tuesday, March 21, at 10:00 AM ET. HON will discuss its Q1 2023 earnings.

- News story for HON — Liz Young of BNY Mellon named Energy Select Sector Fund as her final trade.

Liz Young of BNY Mellon Investment Management named Energy Select Sector SPDR Fund (NYSE: XLE) as her final trade. Jason Snipe of Odyssey Capital Advisors picked Honeywell International Inc. as his last trade. Honeywell reported better-than-expected Q1 EPS and sales results and raised FY23 outlook.

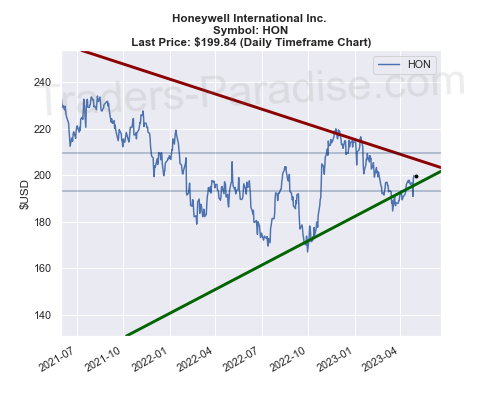

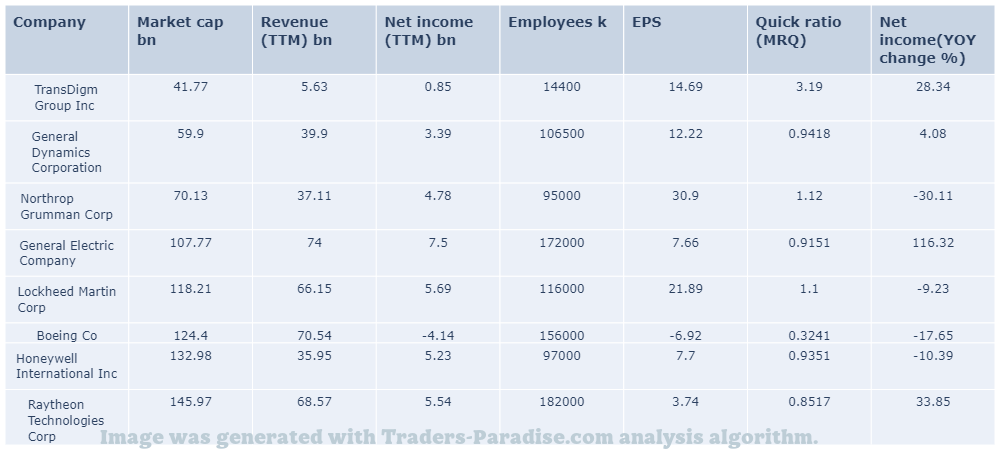

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#11 Trading idea on MMM

Company Name: 3M Company

Symbol: MMM

Sector: Industrial Goods

Company Description: The 3M Company is an American multinational conglomerate corporation operating in the fields of industry, worker safety, US health care, and consumer goods. The company produces over 60,000 products under several brands. It is based in Maplewood, a suburb of Saint Paul, Minnesota.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MMM — 3M just reported better-than-expected earnings, but is it a buy?

3M just reported better-than-expected earnings. The industrial giant is not for the faint-hearted, but it’s not a bad stock to buy either. 3M stock is not a good buy, but is it a good stock to consider buying?

- News story for MMM — Stocks with highest dividend yields in the Dow Jones.

The three highest-paying blue-chip stocks in the Dow Jones offer dividend yields above 5% and all offer dividend hikes above 5%. The three stocks offer a total yield of over 7.5% for the past five years.

- News story for MMM — Dominion, 3M, and Omega have all suffered share price declines.

Winnie the Pooh is to blame for my inaction on Dominion Energy, 3M, and Omega Healthcare, according to the investment advice from the book “Winnie The Pooh: Investing for the Betterment”. The book is based on a story about a fictional bear.

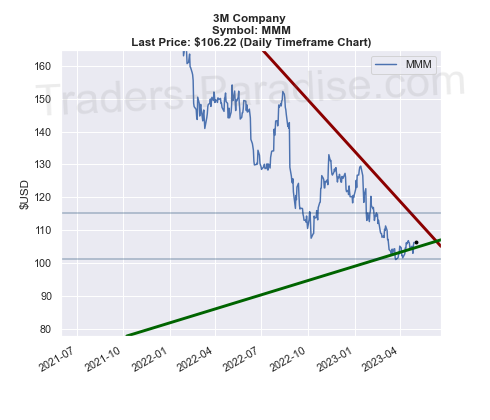

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

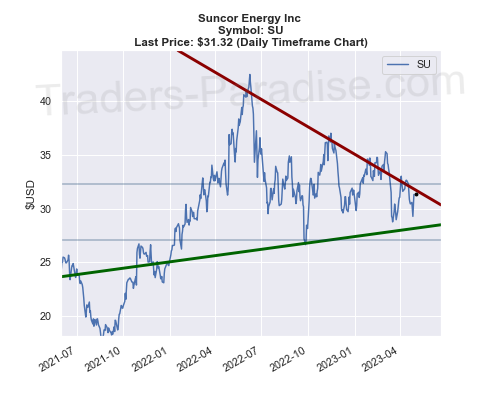

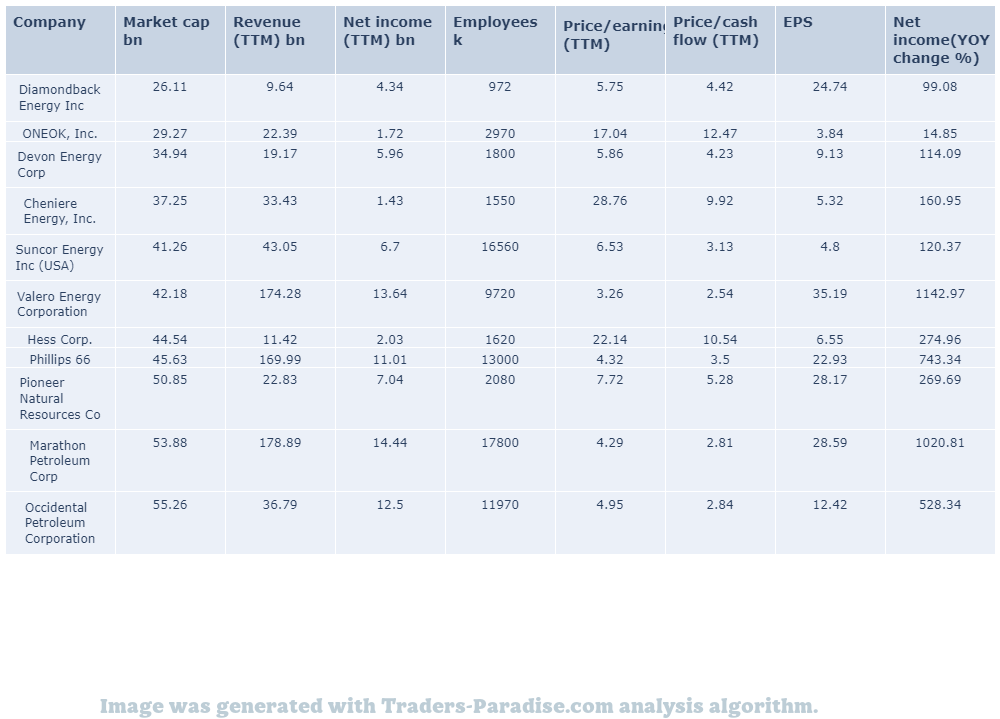

#12 Trading idea on SU, might be reaching some kind of top

Company Name: Suncor Energy Inc

Symbol: SU

Sector: Energy & Transportation

Company Description: Suncor Energy Inc. is an integrated energy company. The company is headquartered in Calgary, Canada, and it’s a major producer of oil and natural gas in Canada. It’s one of the largest energy producers in the world. It has operations in Canada and the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SU — Earnings, revenue beat estimates on higher crude oil prices.

Imperial Oil (IMO) delivered earnings and revenue surprises of 8.97% and 21.26% for the quarter ended March 2023. The company’s Q1 earnings beat estimates by 8% and by 21%. IMO is expected to do well in the future.

- News story for SU — Cenovus reported better-than-expected earnings and revenues.

Cenovus Energy delivered earnings and revenue surprises of 9.09% and 8.91% for the quarter ended March 2023. The company’s shares rose by 9.9%. in the after-hours trading. The stock rose by 8.8%.

- News story for SU — Suncor Energy (SU) closed at $30.58 in recent trading session

Suncor Energy (SU) closed at $30.58 in the latest trading session, marking a +0.46% move from the previous day. Suncor Energy outpaced the stock market gains by 0.46%, according to Bloomberg data.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

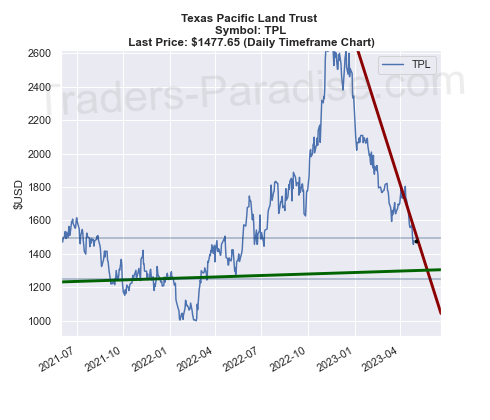

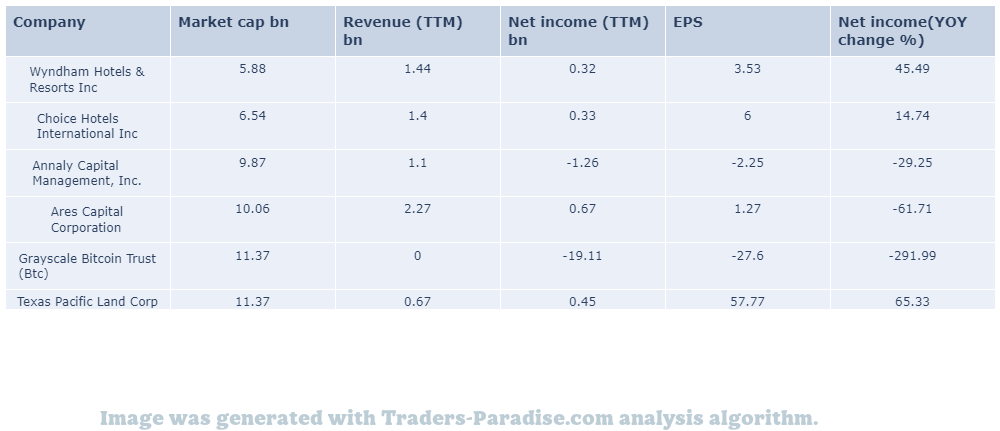

#13 Trading idea on TPL, might be reaching some kind of top

Company Name: Texas Pacific Land Trust

Symbol: TPL

Sector: Financial

Company Description: Texas Pacific Land Corporation is engaged in land and resource management and water operations and services businesses. The company is headquartered in Dallas, Texas. The firm has a total annual revenue of $1.2 billion. Â y

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TPL — Clearway Energy is set to report first-quarter earnings on May 2.

Clearway Energy (CWEN) is expected to beat earnings estimates. The company has the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for the company’s upcoming report and follow the link for more information.

- News story for TPL — Four growth stocks are perfect candidates for buy-and-hold forever investors.

The four growth stocks are perfect candidates for buy-and-hold forever investors. They have their own unique operating niches and are good candidates for long-term investors’ investment. They are: “Growth Stocks to Buy and Hold Forever”

- News story for TPL — Earnings surprise was 4.76% while revenue came in at 61.11%.

Enovix Corporation (ENVX) delivered earnings and revenue surprises of 4.76% and 61.11% for the quarter ended March 2023. The company also reported a loss for the first quarter of the year, which lags revenue estimates.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

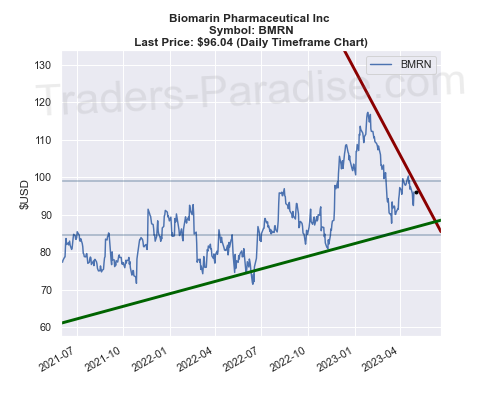

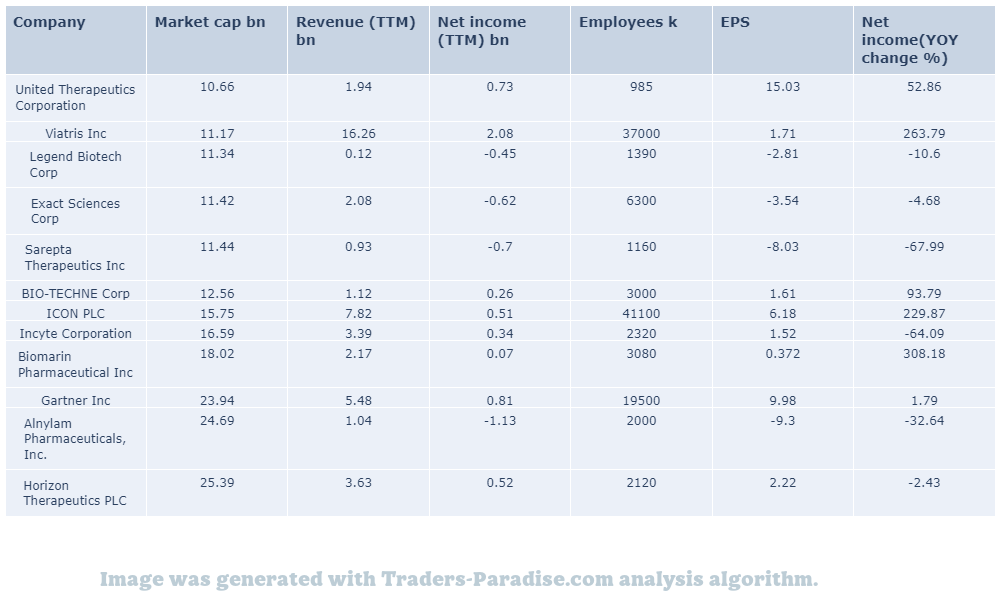

#14 Trading idea on BMRN, might be reaching some kind of top

Company Name: Biomarin Pharmaceutical Inc

Symbol: BMRN

Sector: Healthcare

Company Description: BioMarin Pharmaceutical Inc. develops and markets therapies for people with rare diseases and serious and life-threatening medical conditions. The company is headquartered in San Rafael, California and has a research and development center in San Francisco. Â

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for BMRN — Earnings top, Voxzogo sales beat estimates. rapid uptake of the drug boosts revenues

BioMarin’s first-quarter earnings and sales beat estimates. The rapid uptake of Voxzogo boosts revenues for BioMarin, which reports encouraging results for the first quarter of the year. – BMRN’s stock is up 1.5%.

- News story for BMRN — Bullish analysts have rated Biomarin Pharmaceutical 3 times in the past 3 months.

17 analysts have given Biomarin Pharmaceutical (NASDAQ:BMRN) different ratings within the last quarter. They have an average price target of $110.82. The current price of the stock is $89.65. The greater the number of bullish ratings, the more positive analysts are on the stock.

- News story for BMRN — Key metrics include sales, free cash flow, working capital.

BioMarin (BMRN) reports Q1 earnings for the quarter ended March 2023. Some of the key metrics of the company’s business compare to Wall Street estimates and year-ago values, as seen in the table below.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

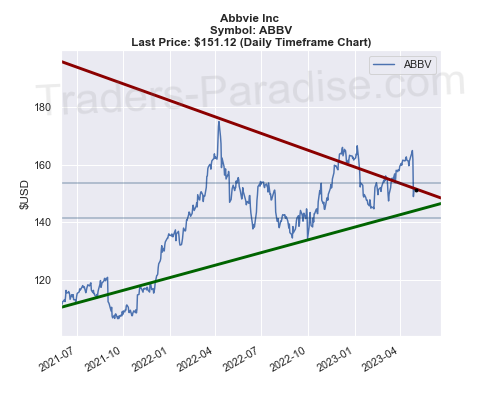

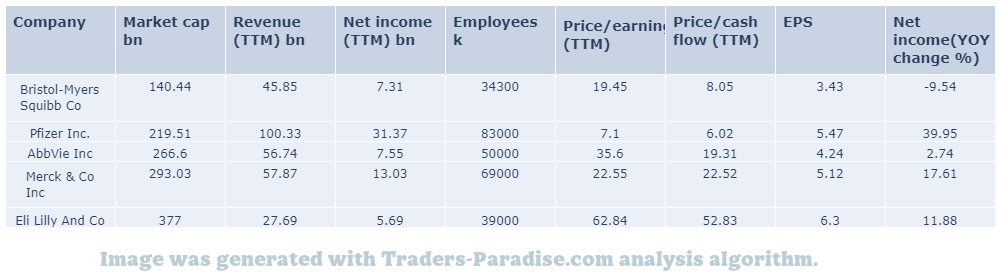

#15 Trading idea on ABBV, might be reaching some kind of top

Company Name: Abbvie Inc

Symbol: ABBV

Sector: Healthcare

Company Description: AbbVie is an American publicly traded biopharmaceutical company. It originated as a spin-off of Abbott Laboratories. It was founded in 2013. It’s a publicly traded company that was created as a result of a merger between Abbott and Abbvie.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ABBV — Shares of the drugmaker are down more than 20% this year. Rapidly declining Humira sales weren’t the only disappointment

AbbVie’s Humira sales are declining fast. The company’s first-quarter earnings report disappointed investors. in its first- quarter earnings report. It’s time to sell? for Abbvie to consider that.

- News story for ABBV — Two of the stocks in the spotlight are tech giants.

There are temporary headwinds for two of these stocks, but they are unstoppable stocks to buy right now, so don’t let them fool you. They are the 3 Unstoppable Stocks to Buy Right Now. They’re the first two stocks to be mentioned.

- News story for ABBV — Earnings call for the quarter ending March 31, 2023.

AbbVie will hold an earnings call for the period ending March 31, 2023. The conference call will be held at 10:30 a.m. (GMT) on Wednesday, March 30th, 2018. For more information, go to abbvie.com.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#16 Trading idea on CDW, might be reaching some kind of top

Company Name: CDW Corp

Symbol: CDW

Sector: Consumer Discretionary

Company Description: CDW Corporation is a provider of technology products and services for business, government and education. CDW is headquartered in Lincolnshire, Illinois. CDW is a company with more than 100,000 employees. It is a subsidiary of CDW Corporation.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CDW — Expected earnings decline on lower stem cell sales.

Stem, Inc. (STEM) doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Stem’s Q1 earnings are expected to decline, but the company has a good chance of beating the expectations.

- News story for CDW — Analysts are expecting a decline in earnings in the fourth quarter.

CDW (CDW) doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for CDW’s upcoming report and stay on top of the key developments.

- News story for CDW — Palo Alto, ServiceNow and Cloudflare all fell on Tuesday.

Palo Alto Networks, ServiceNow and Cloudflare fell today. Tenable’s guidance disappointed and they didn’t meet expectations. – Tenable is a peer of Palo Alto Networks and ServiceNow. – ServiceNow is a provider of cloud services.

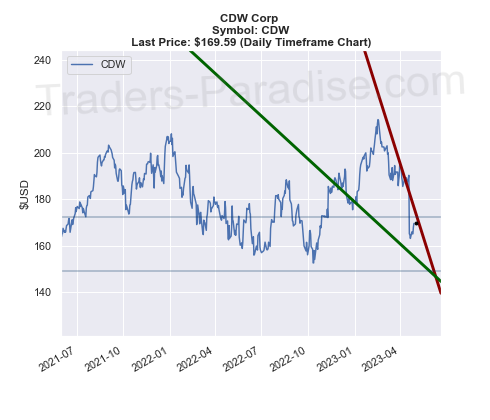

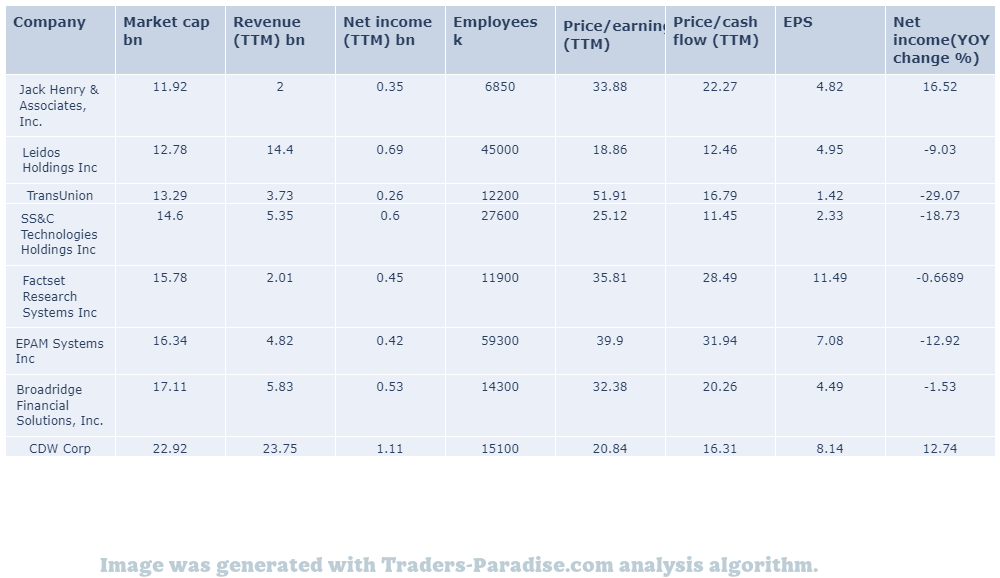

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#17 Trading idea on PXD, might be reaching some kind of top

Company Name: Pioneer Natural Resources Co.

Symbol: PXD

Sector: Basic Materials

Company Description: Pioneer Natural Resources Company is a company engaged in hydrocarbon exploration headquartered in Irving, Texas. It operates in the Cline Shale, which is part of the Spraberry Trend of the Permian Basin. The company is the largest acreage holder in the area.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PXD — Earnings beat expectations despite lower oil prices.

Exxon stock rose more than 2% on Friday after the energy giant reported a record first-quarter earnings, handily beating expectations. Exxon Mobil posts best-ever first quarter, sidestepping lower oil prices, which hurt the company’s stock performance.

- News story for PXD — Top- and bottom-line numbers 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299 888-353-1299

Pioneer Natural Resources (PXD) reported its first quarter results for the quarter ended March 2023. Some of its key metrics are compared to Wall Street estimates and the year-ago values. The company performed well compared to the estimates and year ago values.

- News story for PXD — High dividend stocks to watch in the coming months.

There are four high-dividend stocks with impressive cash flow that are worth a look for now. For more information, visit: http://www.jpmc.com/news/investor-gives/top-ten-stocks-with-impressive-cash-flow.

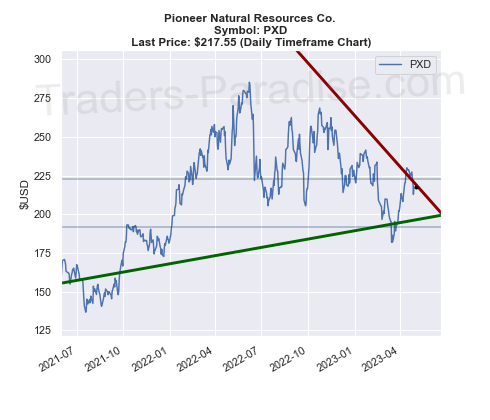

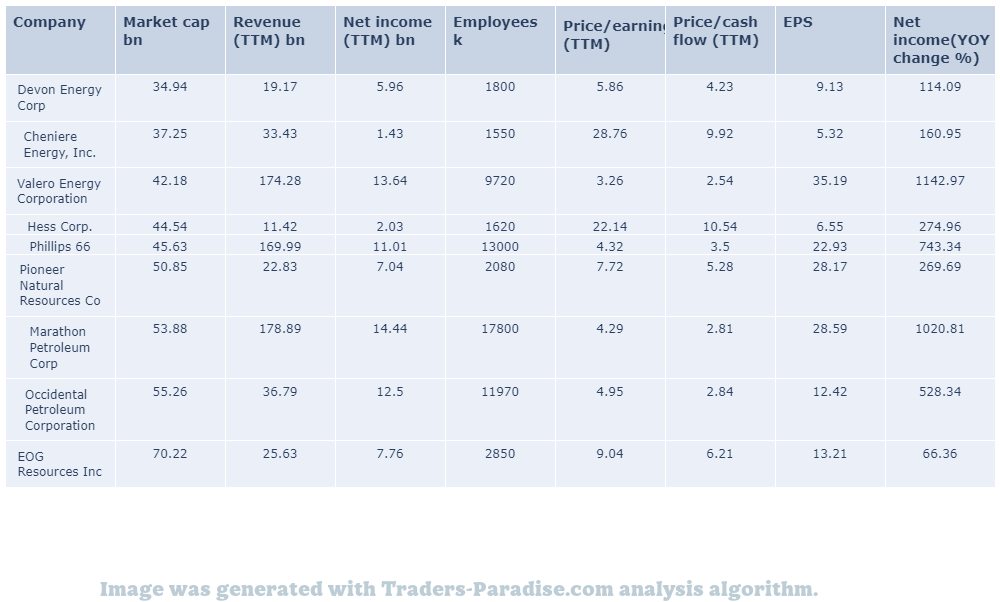

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#18 Trading idea on WCN, might be reaching some kind of top

Company Name: Waste Connections Inc.

Symbol: WCN

Sector: Industrial Goods

Company Description: Waste Connections, Inc. provides waste collection, transfer, disposal and recycling services in the United States and Canada. The company is headquartered in Vaughan, Canada and provides services in both the U.S. and Canada, including recycling and waste collection.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WCN — Is it a good thing to have a monopoly?

The Fundamentals of Investing in Monopolies explains how a monopoly can be good for investors and how it might be bad for the economy as a whole, but not bad for investors. . for more information on this topic visit:

- News story for WCN — Earnings and revenue missed estimates by a whisker.

Waste Connections (WCN) beat Q1 earnings and revenue estimates by 1.14% and 0.18%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock? Shareholders should keep an eye on the news.

- News story for WCN — First-quarter 2023 earnings and revenues are expected to have increased year over year.

FTI Consulting’s first-quarter 2023 earnings and revenues are expected to have increased year over year. FTI Consulting is expected to report earnings on March 31, 2023. The company’s revenues are also expected to be higher year-over-year.

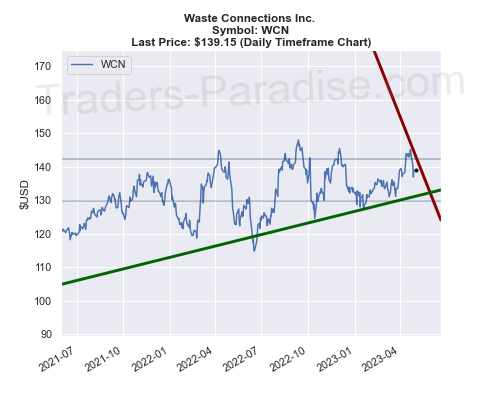

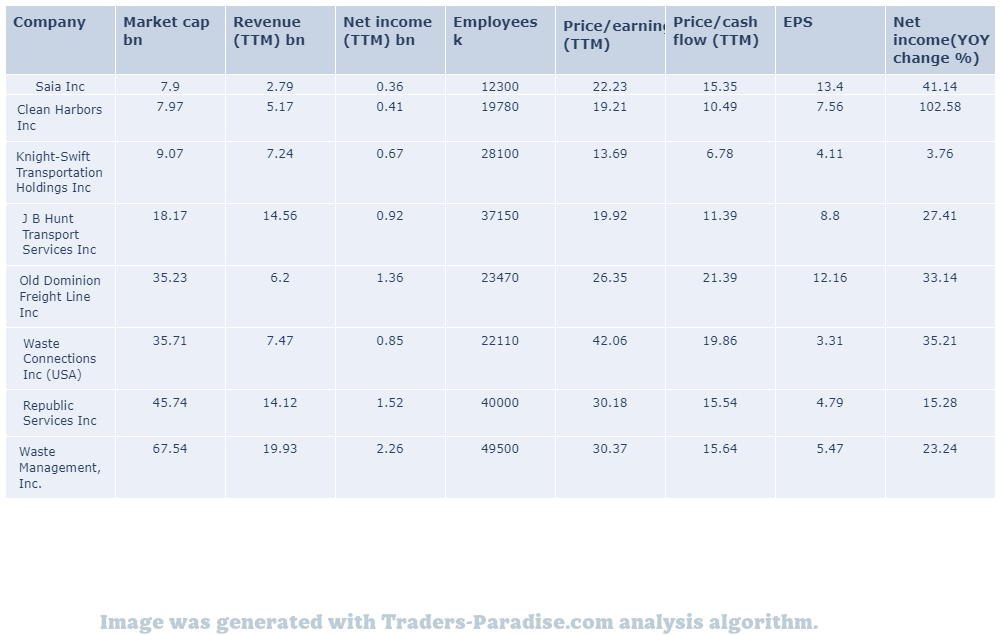

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#19 Trading idea on XPO, might be reaching some kind of top

Company Name: XPO Logistics, Inc.

Symbol: XPO

Sector: Services

Company Description: XPO Logistics, Inc. provides supply chain solutions in the United States, the rest of North America, France, the United Kingdom, and rest of Europe. The company is headquartered in Greenwich, Connecticut and provides services in the U.S., France, UK and internationally.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for XPO — Earnings and revenue missed estimates by -11.24% and 9.97%, respectively.

ArcBest (ARCB) delivered earnings and revenue surprises of -11.24% and 9.97%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock? Shareholders should keep an eye on the news.

- News story for XPO — Heartland Express reported lower-than-expected earnings and revenues.

Heartland Express (HTLDL) delivered earnings and revenue surprises of -15.79% and 3.72% for the quarter ended March 2023, compared to the expected -3.72%. The company’s stock has lagged Q1 earnings estimates.

- News story for XPO — Shares in XPO tumble as rivals step up hiring.

from Old Dominion boosted XPO stock this week. Old Dominion has a new hire from XPO this week, which boosted the stock. . in this week’s trading. in the past week, the stock has risen by about 10%.

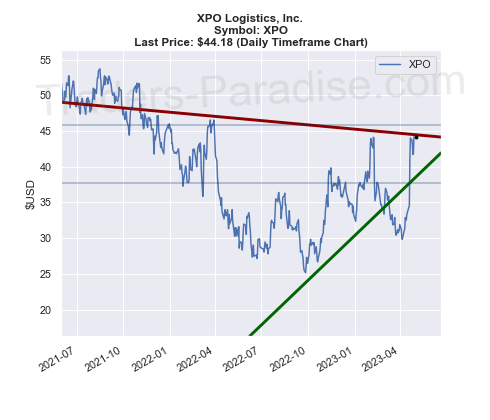

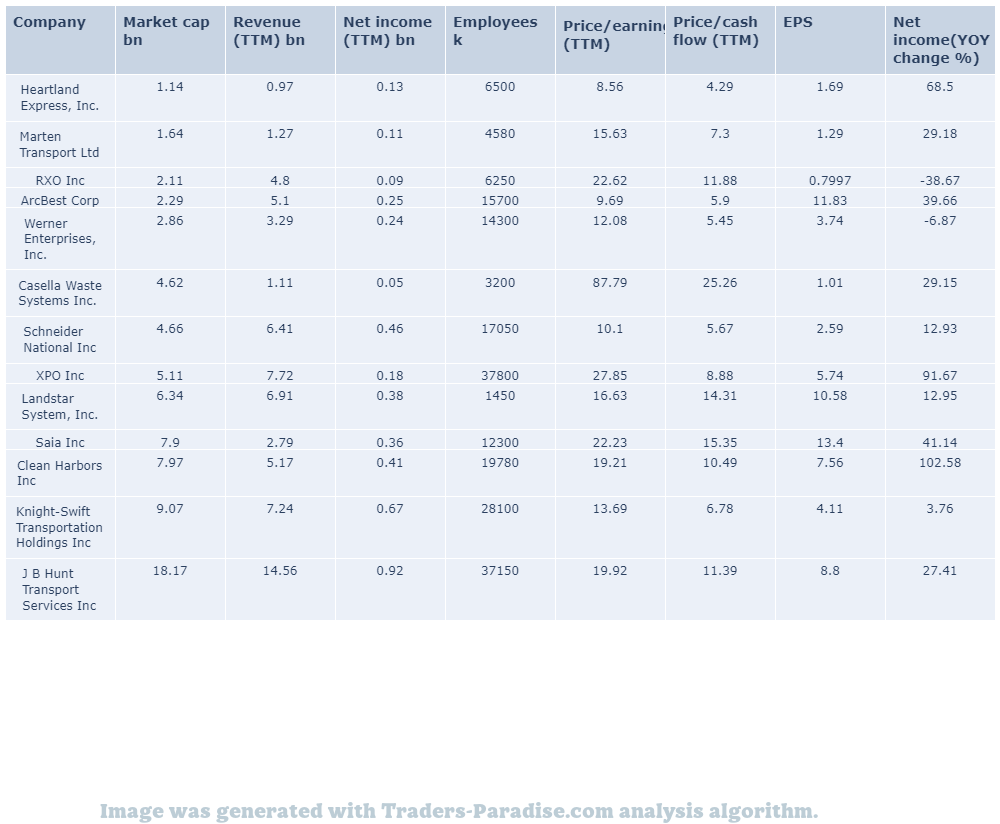

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply