Most recent news about the financial markets

- Find out when the U.S. stock market is open, close, and when it will close.

The U.S. market’s daily return is produced between the closing and opening bell. You’ll make the most money in the stock market during these specific hours. The most profitable time to invest is between the hours of the closing bell and the start of trading.

- S&P 500 shows stronger support at 3970, says McMillan.

The stock market is pushing back as investors look for a confidence boost. S&P 500 shows stronger support at 3970. A close below 3950 would be bearish for the market, writes Lawrence McMillan. The market is up 1.5% today.

- This ETF could take you from $5,000 to $87,000.

This Warren Buffett ETF could take you from $5,000 to $87,000 with next to no effort. Warren Buffett highly recommends this investment. It’s a good reason why he highly recommends it. It can be done with next-to-no effort.

- S&P 500 ETF Trust snaps three-week winning streak. U.S. economy added 236,000 new jobs in March

U.S. economy added 236,000 new jobs in March. Wages grew 4.2% year-over-year and the unemployment rate ticked lower from 3.6% to 3.5%. World Wrestling Entertainment, Inc. (NYSE: WWE) announced it will be merging with UFC to form a new public company.

- The S&P 500 ETF Trust traded lower for the first time in four weeks.

The U.S. added 236,000 jobs in March, missing economist estimates of 240,000. The unemployment rate fell 0.1% to 3.5%. Wages were up 4.2% year-over-year and increased 0.3% from February.

- U.S. adds 236,000 jobs in March, missing expectations. Unemployment rate remains at 3.5%, unchanged from February

The U.S. added 236,000 jobs last month, below the average economist estimate of 240,000. The unemployment rate is at 3.5%, below economist estimates of 3.6%. The labor participation rate continued to rise to 62.6%, compared to the 63.4% pre-COVID-19 pandemic rate in February 2020. Wages were up 4.2% year-over-year and increased 0.3% from February.

- Bond funds saw record inflows in first quarter. Investors showed ‘a lot of restraint’ in the first quarter

Bonds have been the hot spot for money flowing into exchange-traded funds this year. In the first quarter, investors showed restraint and chose bonds over other investment options. iReport.com will let you know if you want to invest in bonds.

- Report on Invesco Dow Jones Industrial Average Dividend ETF (DJD).

Dow Jones Industrial Average Dividend ETF (DJD) should be on your investing radar. Invesco Style Box ETF report for DJD has a report for the DJD as well. for more information on DJD, click here.

- CIO survey suggests stable IT spending, fundamentals.

Morgan Stanley reiterates an Overweight rating on Microsoft Corp (NASDAQ: MSFT) with a $307 price target. The MS AlphaWise CIO Survey suggests stable IT spending and favorable Microsoft-specific fundamentals. The stabilization in 2023 spending expectations is encouraging.

- Analyst Joe Goodwin highlights Superiority, Market Potential, Cash Flow Upside.

Asana Inc. (NYSE: ASAN) has a Market Outperform and a $28 price target. The stock has risen 42% YTD versus the Nasdaq’s 15%. The analyst re-rated ahead of hosting several investor meetings with CFO Tim Wan and Head of IR Catherine Buan. They will discuss the tone of business, Asana’s path to profitability and CEO Dustin Moskovitz’s insider buying.

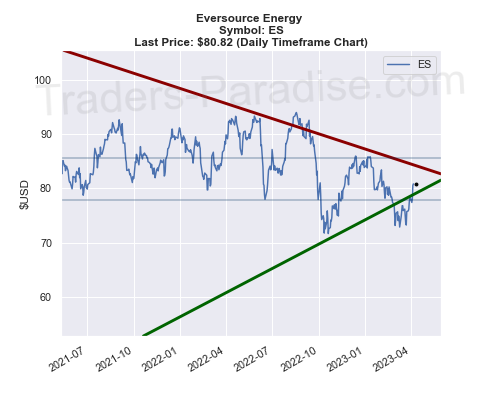

#1 Trading idea on AKAM

Company Name: Akamai Technologies, Inc.

Symbol: AKAM

Sector: Technology

Company Description: Akamai Technologies, Inc. is a global content delivery network (CDN), cybersecurity, and cloud service company. It provides web and Internet security services. It’s a provider of CDN, Cybersecurity, and Cloud Service. It is headquartered in San Francisco.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for AKAM — Akamai Security Service to Boost Cyber Defense.

Akamai (AKAM) unveils new security service updates and premium features to enhance protection against sophisticated cyberattacks. for Akamai’s Security Service to Boost Cyber Defense. For confidential support call the Samaritans on 08457 90 90 90, visit a local Samaritans branch or click here.

- News story for AKAM — QSnatch is one of the significant threats to corporate network infrastructure.

Akamai (AKAM) research indicates the rising cyber security threats in the Asia-Pacific region. QSnatch malware is one of the most significant threats to corporate network infrastructure, according to the report by Akamai. The report is available on AkamaI’s website.

- News story for AKAM — Akamai Technologies, Enovix, Radius Health among big gainers on insider buying.

Insiders bought shares of Akamai Technologies and Enovix Corporation recently. US stocks closed lower on Wednesday, but there were a few notable insider trades. Insider purchases should not be taken as the only indicator for making an investment or trading decision, but it can lend conviction to a buying decision.

TECHNICAL ANALYSIS

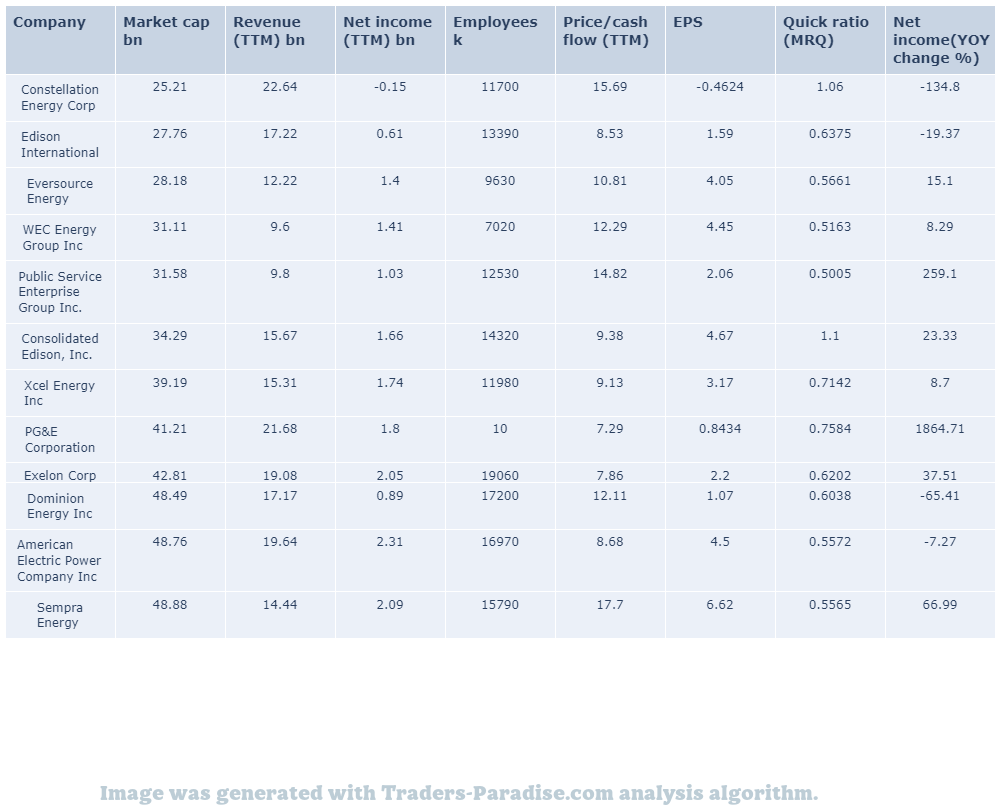

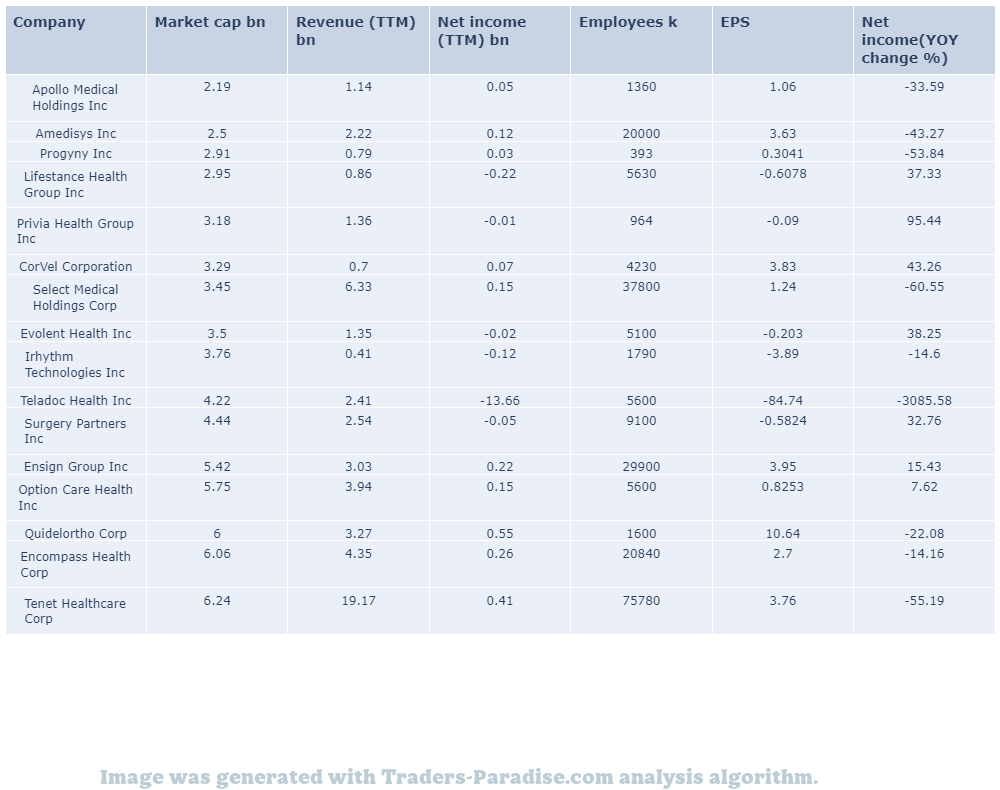

PEERS AND FUNDAMENTALS

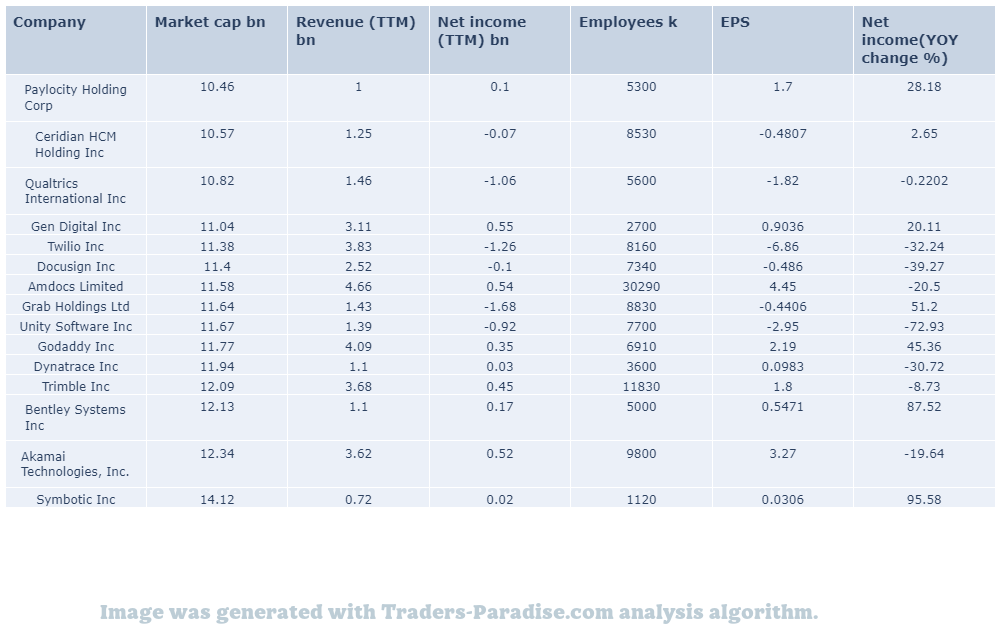

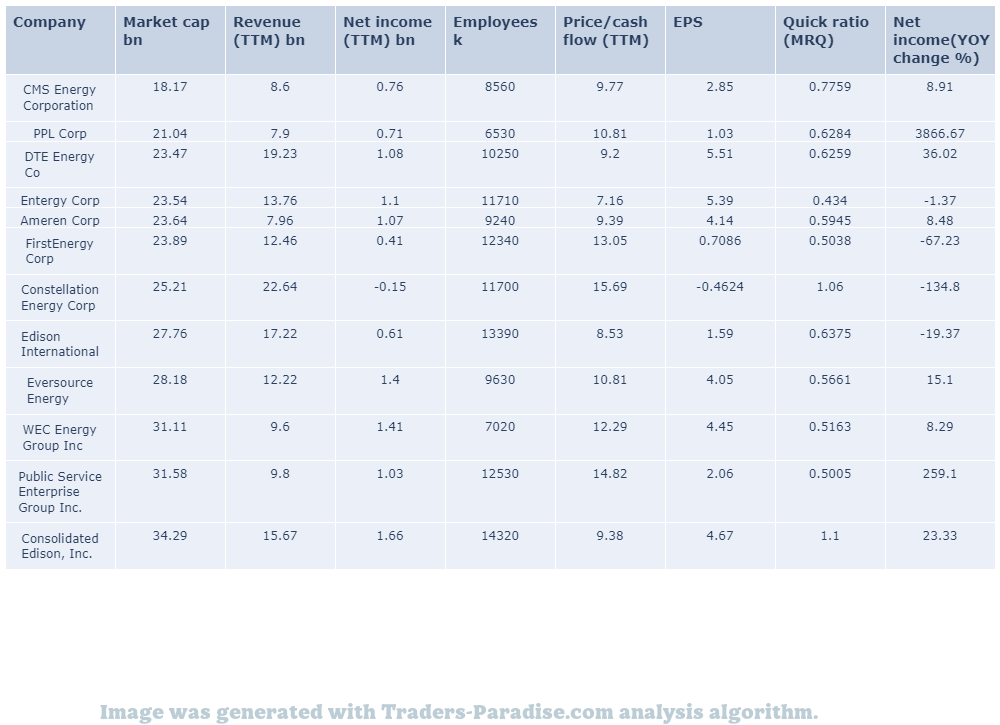

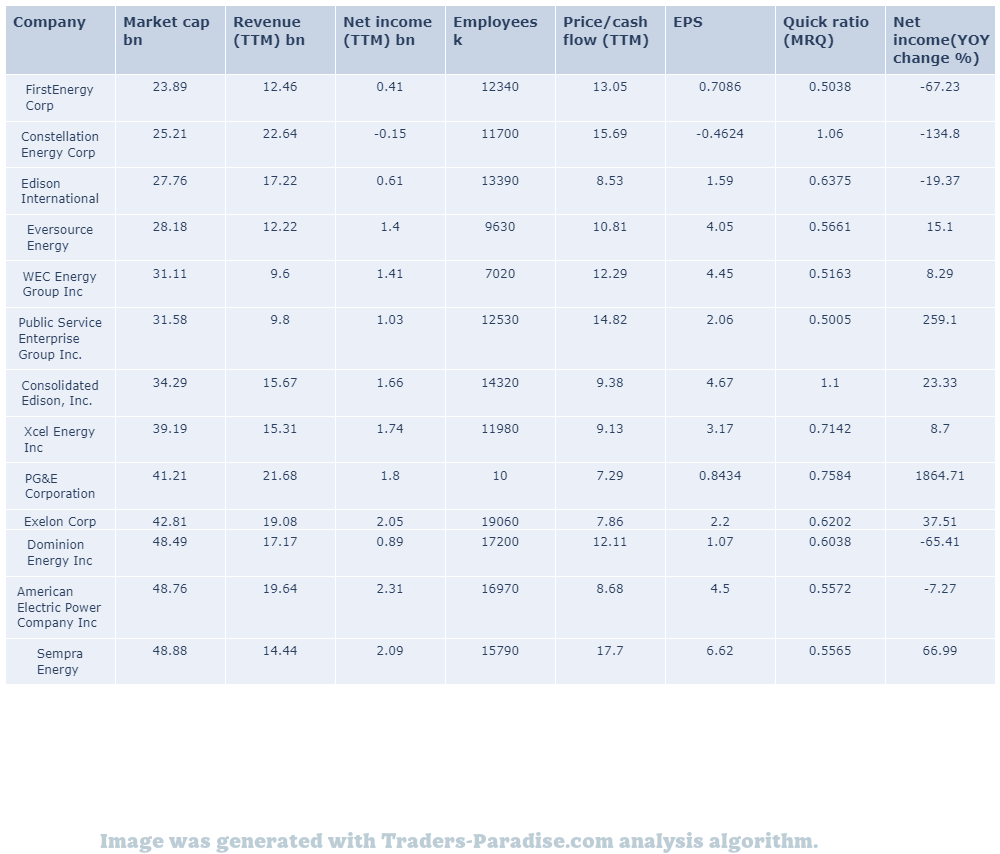

#2 Trading idea on ES

Company Name: Eversource Energy

Symbol: ES

Sector: Energy & Transportation

Company Description: Eversource Energy is a publicly traded, Fortune 500 energy company. It is headquartered in Hartford, Connecticut and Boston, Massachusetts, and has a Fortune 500 stock market value of $1.5 billion. It’s a major energy provider in the U.S.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ES — La raffinerie Esso de Gravenchon contrainte d’arrter sa production de carburants par manque d’ali

Esso de Gravenchon can’t produce carburants par manque d’alimentation en matières première, because it’s not in line with the standards of the manque. For confidential support call the Samaritans on 08457 90 90 90, visit a local Samaritans branch or click here.

- News story for ES — Lors de nouveaux villes de Nanterre, Esso a déj un nouveaux villes.

Esso S.A. will announce its results on 22 mars 2023 in Nanterre, le 22 mars 2022. Esso will consolidate its operations with Esso F.F. in 2022 Nanterrre and consolidate its shares with Es SO.F in 2022.

- News story for ES — Eversource Energy (ES) has been given a average price target of $88.14 by analysts.

In the last 3 months, 7 analysts have offered 12-month price targets for Eversource Energy. The company has an average price target of $88.14 with a high of $94.00 and a low of $82.00. The greater the number of bullish ratings, the more positive analysts.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#3 Trading idea on D

Company Name: Dominion Resources, Inc.

Symbol: D

Sector: Utilities

Company Description: Dominion Energy supplies electricity in Virginia, North Carolina, and South Carolina and natural gas to parts of Utah, West Virginia, Ohio, Pennsylvania and North Carolina. Dominion also has generation facilities in Indiana, Illinois, Connecticut and Rhode Island. Dominion Energy is headquartered in Richmond, Virginia.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for D — Dominion Energy (D) stock

of Dominion Energy (D) closed the most recent trading day at $55.57, moving -0.61% from the previous trading session. D’s stock price is down 0.61%. D’s share price is up 0.60%. D.

- News story for D — Shares of Dominion Energy moved +1.09% in Friday trading session.

Dominion Energy (D) closed the most recent trading day at $54.72, moving +1.09% from the previous trading session. D.E. made gains as the market dipped. D-E’s stock is up 1.09%.

- News story for D — Stocks to buy with dividend yields over 4%.

There is a bull market coming. Three stocks with dividend yields over 4% are worth buying even if they keep falling. They are: “A Bull Market is Coming: 3 Stocks to Buy With Dividend Yields Over 4%”, “The S&P 500 Index”, and “The Nasdaq”.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#4 Trading idea on MPC

Company Name: Marathon Petroleum Corporation

Symbol: MPC

Sector: Basic Materials

Company Description: Marathon Petroleum Corporation is an American petroleum refining, marketing, and transportation company headquartered in Findlay, Ohio. It is a subsidiary of Exxon-Mobil Corporation. It’s a publicly traded company with a market value of more than $50 billion. It has operations in the following areas:

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MPC — Analysts see ‘golden age of refining’ ahead of peak summer season.

U.S. oil refiners are slated to report “record” quarterly profits during a traditionally weak season. BofA Securities calls it a “golden age” of refining. The peak summer season is during this time. in the summer.

- News story for MPC — Oil giant plans to use the money to develop cleaner fuels.

ExxonMobil plans to spend $7 billion through 2027 in its Low Carbon Solutions business unit to help others lower emissions. ExxonMobil expects its Low-Carbon Business to surpass Oil in the near future, as it expects to save more than $10 billion by 2027.

- News story for MPC — Valero is on track to reduce greenhouse gas emissions by 63% by 2025.

Valero (VLO) is on track to reduce and displace Refinery GHG emissions by 63% through investments in board-approved projects by 2025. Here’s why it’s worth buying Valero stock right away. – Valero is a refiner.

TECHNICAL ANALYSIS

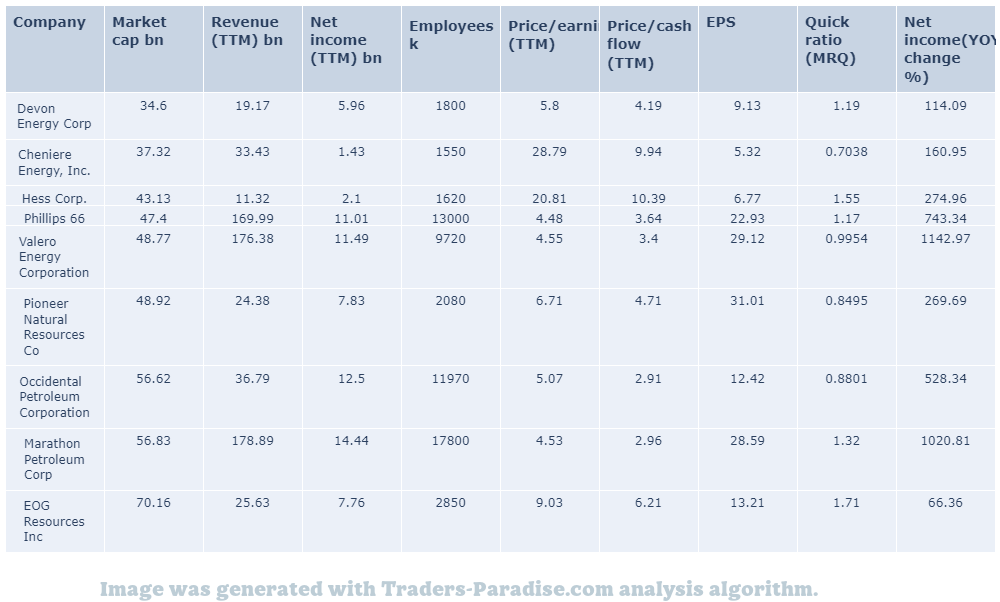

PEERS AND FUNDAMENTALS

#5 Trading idea on CLX

Company Name: The Clorox Company

Symbol: CLX

Sector: Consumer Goods

Company Description: The Clorox Company is an American global manufacturer and marketer of consumer and professional products. It is based in Oakland, California. It’s a global manufacturer of consumer products and a marketer in the field of professional products, including cleaners and disinfectants.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CLX — Wall Street analysts have a negative outlook for Clorox.

Clorox (NYSE:CLX) has observed the following analyst ratings: Bullish, Somewhat Bullish and Bearish. 7 analysts have an average price target of $141.86. The current price of Clorox is $157.69. The greater the number of bullish ratings, the more positive analysts are.

- News story for CLX — Pricing actions, revenue management initiatives, brand strength and digital growth position Colgate for growth

Pricing actions, revenue management initiatives, innovation, brand strength and digital growth position Colgate (CL) for growth amid higher costs and currency headwinds. Here’s why investors should hold Colgate stock for now. – Colgate’s stock is up 2% this morning.

- News story for CLX — Clorox is a top-rated Momentum stock.

Clorox (CLX) is a Top-ranked Momentum Stock according to the Zacks Style Scores. Clorox is one of the top-rated Momentum Stocks according to Zacks’ Style Scores, which offers investors a way to easily find top-ranked stocks based on their investing style.

TECHNICAL ANALYSIS

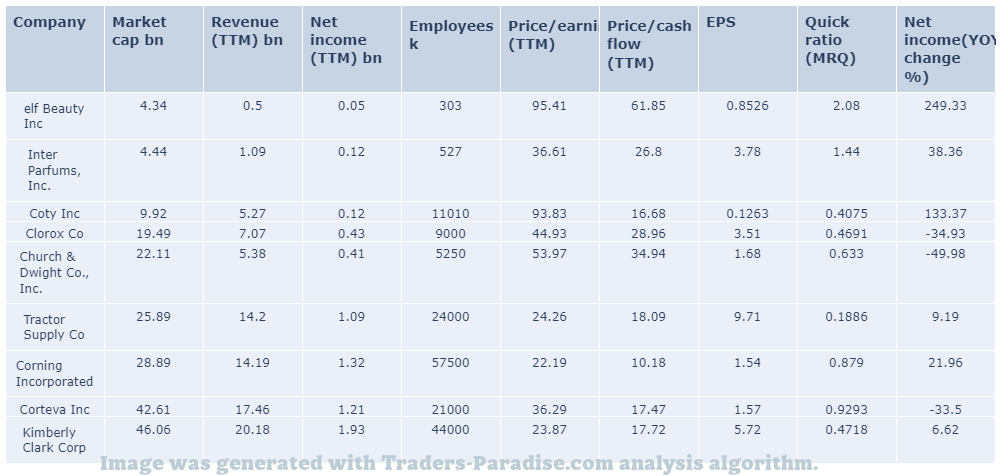

PEERS AND FUNDAMENTALS

#6 Trading idea on WBD

Company Name: Warner Bros Discovery Inc

Symbol: WBD

Sector: Technology

Company Description: Warner Bros. is headquartered in New York, New York and is owned by Warner Bros. Pictures. The company is a division of Warner Bros., which is based in Los Angeles. It’s worth $2.5 billion in annual revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WBD — Four Democrats ask DOJ to investigate merger. They say the deal is responsible for job cuts

Representatives Joaquin Castro, David Cicilline, Pramila Jayapal, and Elizabeth Warren have asked the DOJ to review the Warner Bros. Discovery merger. They say the merger is responsible for “hollowing out an iconic American studio” and for job cuts at the studio.

- News story for WBD — Streaming giants teaming up to lead the conversation.

Roku and Warner Bros. Discovery are teaming up to lead the conversation about streaming video services like Roku and Warner Discovery. They say, “Choose Any 3” for streaming, live TV, and great content. iReport.com will let you know more about it.

- News story for WBD — Stocks that are no-brainers to buy in April.

Growth-focused Nasdaq 100 is home to three amazing deals hiding in plain sight. They are no-brainer buys in April, according to Barron’s. . for the growth-focused NASDAQ 100 are three stocks.

TECHNICAL ANALYSIS

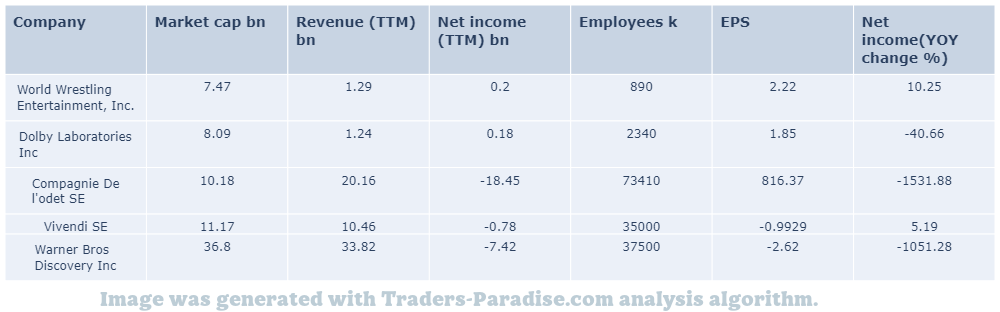

PEERS AND FUNDAMENTALS

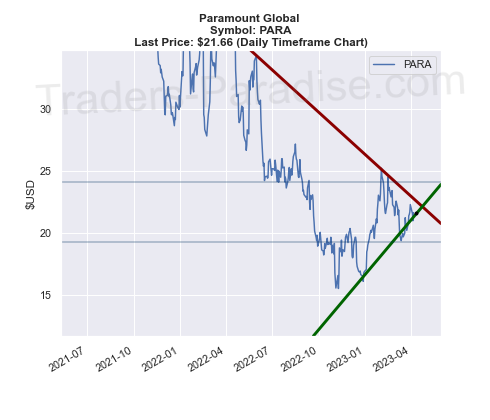

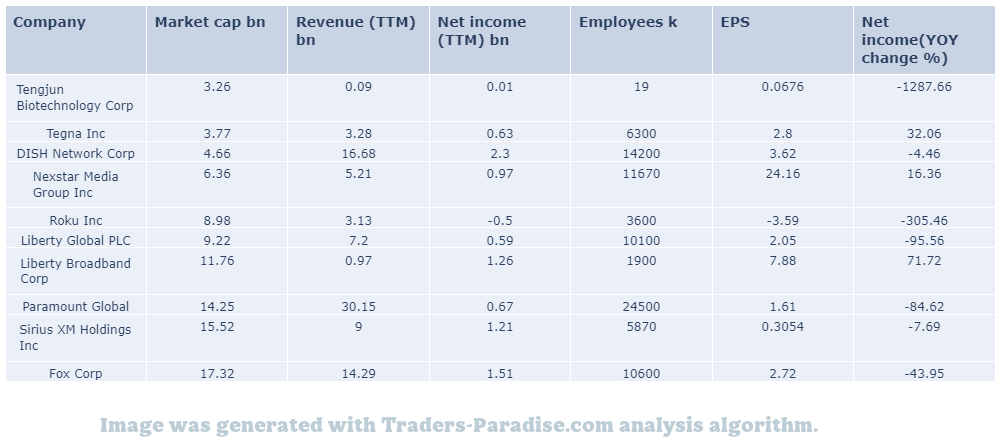

#7 Trading idea on PARA

Company Name: Paramount Global

Symbol: PARA

Sector: Technology

Company Description: Paramount Global is a global media and entertainment company. It is headquartered in New York, New York and has a global network of offices. It has more than 100,000 employees. It’s one of the world’s biggest media companies, with a turnover of over $20 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PARA — You don’t have to sell stocks to get rich.

You don’t have to increase your investment risk to generate substantial returns on Wall Street. 4 Time-Tested Stocks That Can Safely Double Your Money by 2028 are time-tested and reliable investments that can double your money in a reasonable amount of time.

- News story for PARA — Top dividend stocks have slumped in recent months.

The top dividend-paying stocks are down 21% to 78%. They pay generous yields and trade at cheap valuations. You’ll regret not buying them on the dip. They are the 3 Top Dividend Stocks That You’ll Regret Not Buying on the Dip.

- News story for PARA — Study finds ad-supported TV is free, easy to use.

Paramount Global (PARA) shares findings of Free, Easy, Fast research on free ad-supported streaming television with Free, easy and fast study. “Free, easy, fast” is a term used to refer to ad-free streaming television.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

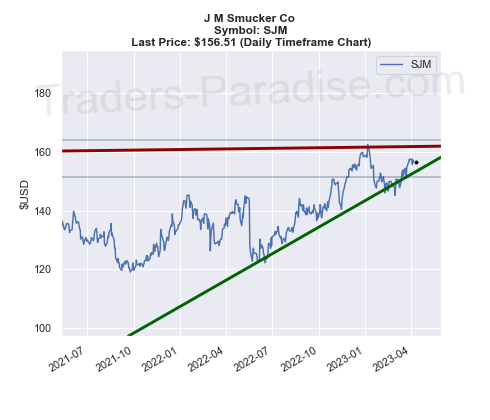

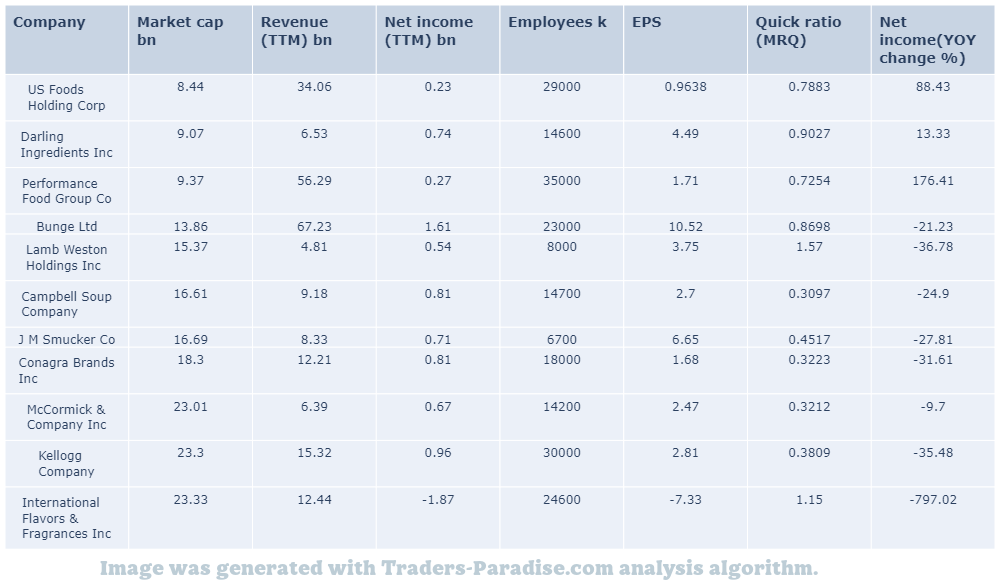

#8 Trading idea on SJM

Company Name: J M Smucker Co

Symbol: SJM

Sector: Industrial Goods

Company Description: The J. M. Smucker Company is an American manufacturer of jam, peanut butter, jelly, fruit syrups, beverages, shortening, ice cream toppings, and other products in North America. Its headquarters are located in Orrville, Ohio.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SJM — Goals, current holdings, allocation, sales, and buys of Q1 2023.

Q1 2023 saw S&P 500 up 4% and gave investors a decent start for the year. Click here to read the goals, current holdings, allocation, sales, and buys of my Dividend Growth Portfolio for Q1 202023.

- News story for SJM — McCormick’s P/E ratio is higher than most of its peers

stock soared on Tuesday. McCormick stock doesn’t have a high P/E ratio, but it’s not a reason to avoid the stock either. i in the share price on Tuesday soared by 10% to $8.50.

- News story for SJM — JM Smucker has an average price target of $160.5, with a high of $170.00 and a low of $155.00.

According to 4 analysts offering 12-month price targets in the last 3 months, JM Smucker has an average price target of $160.5 with a high of $170.00 and a low of $155.00. The analysts are typically employed by large Wall Street banks and tasked with understanding a company’s business.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

#9 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — How much do you want to invest in stocks?

Even another bear market doesn’t deter investors with the appropriate buy-and-hold horizon. Where to invest $2,500 right now is where to find the best place to do it. . for more information visit: http://www.cnn.com/investing/

- News story for TDOC — Top 5 growth stocks to buy before the next bull market.

It’s the time to prepare your portfolio for better days ahead. 5 Top Growth Stocks to Buy Before the Next Bull Market are listed below. – for more information on these stocks, visit: http://www.cnn.com/investor/top-growth-stocks-to-buy/

- News story for TDOC — Shares of Teladoc closed at $25.61 in recent trading session

oc (TDOC) closed at $25.61, marking a -1.12% move from the previous day. Teladoc stock (TDoc) is down 1.12%. It’s up 1.3% from previous day, down 1%.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

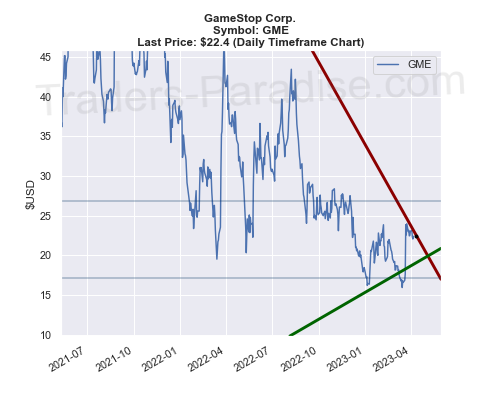

#10 Trading idea on GME, might be reaching some kind of top

Company Name: GameStop Corp.

Symbol: GME

Sector: Services

Company Description: GameStop Corp. is headquartered in Grapevine, Texas, and the company is a subsidiary of GameStop Inc., which is based in New York City. The company is valued at more than $20 billion, according to the company’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GME — SEC chief wants retail orders to be auctioned off. Questions remain on ultimate impact of reforms

Gensler’s meme-stock reforms are meant to help retail traders, but some investor protection advocates aren’t so sure. SEC chief wants retail stock orders to be auctioned off to market makers and exchanges, but questions remain as to the ultimate impact of these reforms.

- News story for GME — How to buy them and day trading Basics for 2023.

Penny Stocks to Buy, Picks, News and Information are for beginners and how to make money trading cheap stocks in 2023. The post Penny Stocks, How To Buy Them & Day Trading Basics For 2023 appeared first on PennyStocks.com.

- News story for GME — Strategist sees three reasons for Bitcoin’s gains.

JPMorgan strategist pins bitcoin’s gains this year to three reasons: the bank system turmoil, the banking crisis, and other factors. Bitcoin has been boosted by all three factors, according to the strategist. Bitcoin’s value has increased by about 50% this year.

TECHNICAL ANALYSIS

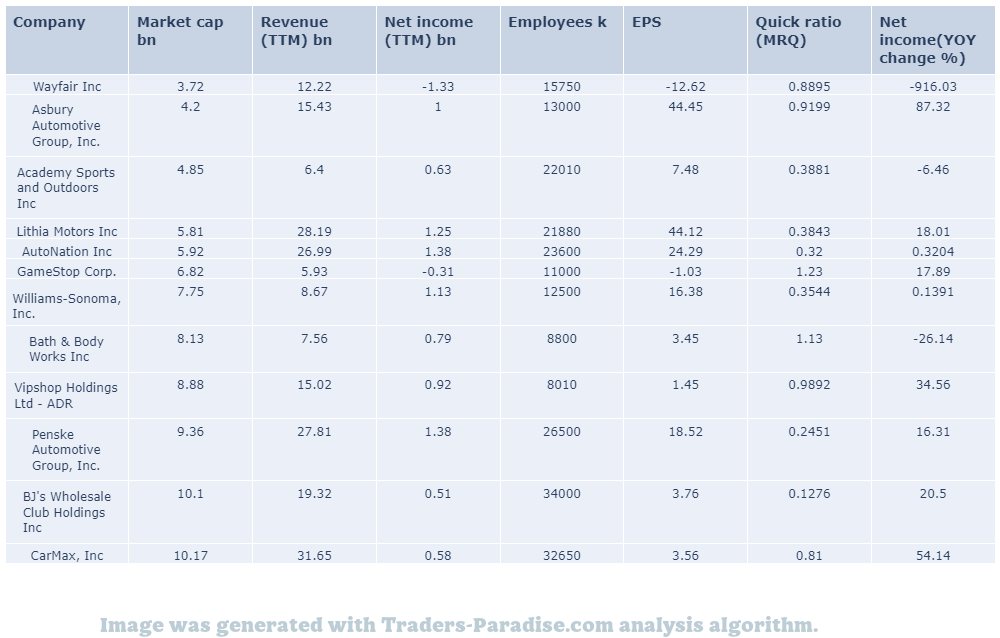

PEERS AND FUNDAMENTALS

#11 Trading idea on BIIB, might be reaching some kind of top

Company Name: Biogen Idec Inc.

Symbol: BIIB

Sector: Healthcare

Company Description: Biogen Inc. is a biotechnology company based in Cambridge, Massachusetts. It specializes in the discovery, development, and delivery of therapies for the treatment of neurological diseases to patients worldwide. Its products are developed to treat neurological diseases.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for BIIB — Shares of the company are up 29% in the past year.

Prothena (PRTA) has gained 29% in the past year as investors are optimistic on its promising Alzheimer’s Disease pipeline. PRTA is expected to continue to grow its market share in the coming years. Â

- News story for BIIB — Price-to-Sales (P/S) ratio is a misleading indicator.

U.S. Wide-Moat Stocks On Sale – The April 2023 Heat Map. We believe that the most widely used valuation multiples are terribly flawed. Click here to read a complete analysis of the heat map and the analysis of U.S wide-moat stocks on sale.

- News story for BIIB — Biogen Inc. (BIIB) closed at $275.25, marking a -0.75% move from the previous day

Biogen Inc. (BIIB) closed at $275.25 in the latest trading session, marking a -0.75% move from the previous day. Broader markets were up by 0.75%. for the whole day.

TECHNICAL ANALYSIS

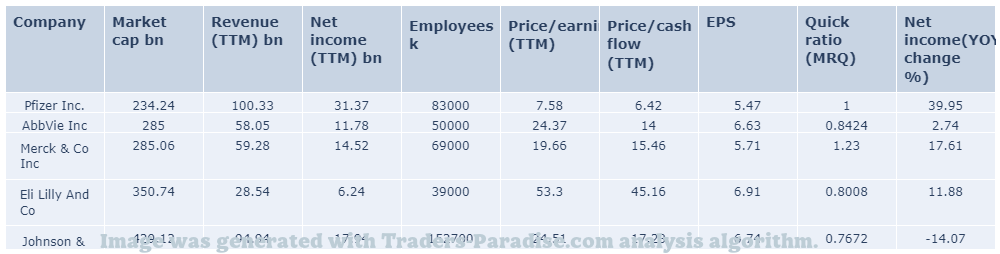

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

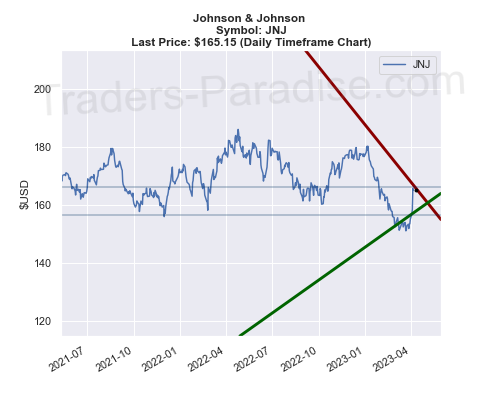

#12 Trading idea on JNJ, might be reaching some kind of top

Company Name: Johnson & Johnson

Symbol: JNJ

Sector: Healthcare

Company Description: Johnson & Johnson was founded in 1886. Its common stock is a component of the Dow Jones Industrial Average. The company is ranked No. 36 on the 2021 Fortune 500 list of the largest U.S. corporations by total revenue. J&J has a prime credit rating of AAA.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JNJ — Warren Buffett to Buy on the Dip: Report.

Warren Buffett recommends two Warren Buffett’s favorite stocks to buy on the dip. These stocks have what it takes to perform well over the long term, according to Warren Buffett. They are: “Berkshire Hathaway Inc.” and “American International Group Inc.”

- News story for JNJ — Some of the best-known names in the world of finance are on this list.

This article is part of our monthly series where we highlight five companies that are large-cap, relatively safe and dividend-paying. Read more here: 5 Relatively Safe And Cheap Dividend Stocks To Invest In – April 2023.

- News story for JNJ — S&P 500 ETF Trust snaps three-week winning streak. U.S. economy added 236,000 new jobs in March

U.S. economy added 236,000 new jobs in March. Wages grew 4.2% year-over-year and the unemployment rate ticked lower from 3.6% to 3.5%. World Wrestling Entertainment, Inc. (NYSE: WWE) announced it will be merging with UFC to form a new public company.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

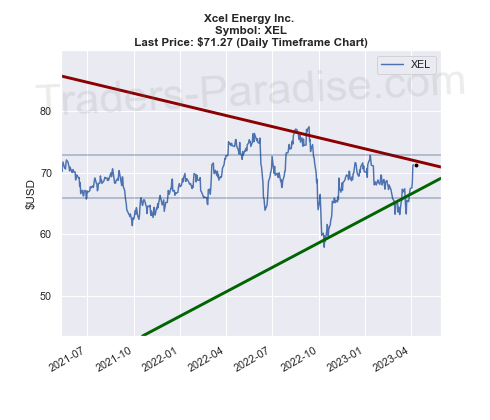

#13 Trading idea on XEL, might be reaching some kind of top

Company Name: Xcel Energy Inc.

Symbol: XEL

Sector: Utilities

Company Description: Xcel Energy Inc. is a utility holding company based in Minneapolis, Minnesota. It serves more than 3.7 million electric customers and 2.1 million natural gas customers in Minnesota, Michigan, Wisconsin, North Dakota, South Dakota, Colorado, Texas, and New Mexico.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for XEL — Rising earnings estimates, expansion and strong return on equity make GWRS a solid pick.

Global Water Resources (GWRS) is a solid pick from the water industry, given its rising earnings estimates, expansion through strategic acquisitions and strong return on equity. Here’s why GWRS is a good investment for you. – Global Water Resources’ website.

- News story for XEL — Check out our latest analysis for Spire

Spire (SR) makes a strong case for investment given its earnings growth, strong ROE and capability to increase shareholders’ value. Here’s why you should add Spire to your portfolio now. . – Spire’s share price is up 2% today.

- News story for XEL — 5 analyst offering 12-month price targets for Bear Energy.

According to 5 analyst offering 12-month price targets in the last 3 months, Xcel Energy has an average price target of $70.8 with a high of $75.00 and a low of $66.00. The greater the number of bullish ratings, the more positive analysts are on the company.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply