2 min read

Alexandria Ocasio-Cortez, who just took her House seat to represent the Bronx, has sparked headlines by suggesting tax rates as high as 70 percent to finance a “Green New Deal.”

Alexandria Ocasio-Cortez, said in an interview with Anderson Cooper on Sunday’s 60 Minutes, “There’s an element where, yeah, people are going to have to start paying their fair share in taxes,” she said. “Once you get to the tippy-tops, on your 10-millionth dollar, sometimes you see tax rates as high as 60% or 70%. That doesn’t mean all $10 million are taxed at an extremely high rate. But it means that as you climb up this ladder, you should be contributing more.”

On Friday morning, Politico reported that “exasperated” Democratic leaders on the Hill were striving to control Alexandria Ocasio-Cortez, U.S. Congresswoman and Bronx-native.

Alexandria Ocasio-Cortez proposed higher tax rate

She proposed a higher tax on the super-wealthy as part of a plan to finance the Green New Deal program.

AOC is proposing to lift the top marginal tax rate to 70 percent on incomes starting at $10 million. This idea has drawn both praise and mockery from the whole the political spectrum.

The opponents’ argument is that high taxes can make people work less. For example, if a well-to-do person takes home only $5,000 per hour instead of $7,000, he might cut back on the number of hours he works. But in real life, the effect is minimal.

Truth is that higher taxes are unlikely to reduce incentives, as the incentives to work are governed by the marginal utility of lost or gained income. Simply put when the wage of someone earning $22.000 per year can go up or down by $1.000 that person is well incentivized to make a decision about cutting back work hours. But when a person earning $10 mill a year, $1.000 of lost or gained income makes no change of the standard of living.

In support of this thesis, the Nobel Prize-winning Paul Krugman speaks.

Paul Krugman, in full Paul Robin Krugman, (born February 28, 1953, Albany, New York, U.S.), American economist and journalist who received the 2008 Nobel Prize for Economics for his work in economic geography and in identifying international trade patterns.

A few days ago he asked one simple question in his column for the New York Times:

“What does Alexandria Ocasio-Cortez know about tax policy?’‘

And he gave the answer:

”A lot.”

Detractors try to discredit this young woman by publishing allegedly, compromising photos and videos. AOC was dancing in college. What?

That’s the right’s hysterics! Also, some of them try to show that her policy is insane.

Paul Krugman wrote:

”The controversy of the moment involves AOC’s advocacy of a tax rate of 70-80 percent on very high incomes, which is obviously crazy, right? I mean, who thinks that makes sense? Only ignorant people like … um, Peter Diamond, Nobel laureate in economics and arguably the world’s leading expert on public finance. (Although Republicans blocked him from an appointment to the Federal Reserve Board with claims that he was unqualified. Really.) And it’s a policy nobody has ever implemented, aside from … the United States, for 35 years after World War II — including the most successful period of economic growth in our history.”

And Krugman added:

“A policy that makes the rich a bit poorer will affect only a handful of people, and will barely affect their life satisfaction since they will still be able to buy whatever they want.”

and

“In other words, tax policy toward the rich should have nothing to do with the interests of the rich, per se, but should only be concerned with how incentive effects change the behavior of the rich, and how this affects the rest of the population.”

Alexandria Ocasio-Cortez belongs to millennials generation

Almost half of the millennials say they prefer socialism to capitalism. What do they mean?

“My policies most closely resemble what we see in the UK, in Norway, in Finland, in Sweden,” Alexandria Ocasio-Cortez told “60 Minutes.”

On the other side, critics of high taxes claim the policy stifles economic growth by reducing the incentive for people to work. But Sweden’s employment rate is 77.5%, beating the U.S.’s 71%. In terms of economic growth this decade, expanding 2.7% a year in Nordic countries, on average, compared with 2.2% for the U.S.

For a real-world example, critics and fans alike should look to Sweden. This Nordic country has a marginal tax rate of 69.7% on salaries above $79,000. That’s almost 30 percents higher than in the U.S.

It is fantastic how many people don’t understand progressive taxation and marginal rates.

YOU WOULD LIKE TO READ THIS: Embarrassingly algorithms make fails more often than you expect.

Most interesting, it shows how few people understand that without progressive tax, you don’t get the infrastructure which allows people and businesses to prosper.

On the other side, some do.

Soak the rich. They should be happy we are not moving for a wealth tax.

Indeed. High marginal tax rates or guillotines. Seems like an easy choice for me.

So, we can say that Ocasio-Cortez’s tax plan isn’t radical at all.

And it certainly won’t damage the economy in any significant way. But will the plan to yield a bounty of tax revenue for a Green New Deal or other major spending programs?

This question is more about maximizing revenues than about the marginal rates.

Krugman pointed:

“Or to put it a bit more succinctly, when taxing the rich, all we should care about is how much revenue we raise. The optimal tax rate on people with very high incomes is the rate that raises the maximum possible revenue.”

Wealthy people have eye-popping incomes. But there really aren’t that many of them.

The amount of money the tax would raise would yield roughly $72 billion a year. That would increase federal personal income tax revenue by about 3.9%. It would certainly not be nearly enough to pay for Ocasio-Cortez’s Green New Deal.

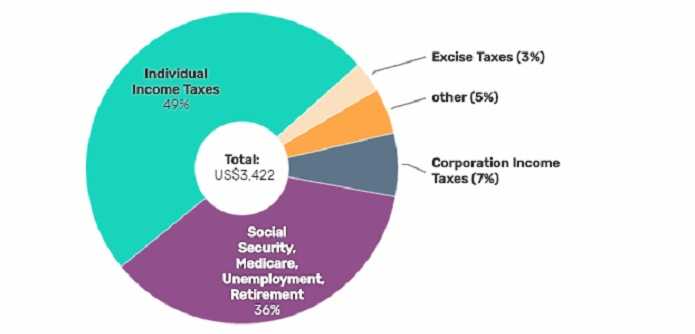

Chart: The Balance Source: The Office of Management and Budget

But the point is, why wealthy people don’t like to share or, more important, to invest in their country’s progress.

Survey shows

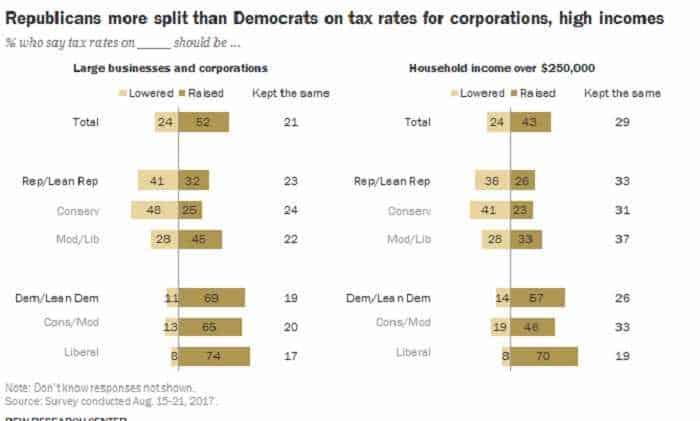

According to a Pew Research Center survey conducted Aug. 15-21 among 1,893 adults, more Americans say tax rates on corporations and higher-income households should be raised rather than lowered.

The result is: 24% say taxes on incomes over $250,000 should be reduced; 43% say they should be raised, while 29% favor keeping them the same as they are currently.

According to the same survey, majorities of Democrats and Democrat-leaning independents favor raising tax rates on both corporations (69%) and high incomes (57%), while Republicans are more divided.

But while 70% of liberal Democrats say tax rates on household incomes over $250,000 should be raised, fewer than half of conservative and moderate Democrats (46%) say the same.

The bottom line

Historically, America used to have very high tax rates on the rich, even higher than AOC is proposing. The highest growth rate period was when the top marginal tax rate was 90%. That was the golden era of the post-WWII U.S. economy.

Let’s conclude this article with Krugman’s quote:

“Well, on the tax issue she’s just saying what good economists say; and she definitely knows more economics than almost everyone in the G.O.P. caucus, not least because she doesn’t ‘know’ things that aren’t true.”

Risk Disclosure (read carefully!)

Leave a Reply