Investing or trading is the right question.

Let us explain the differences between traders and investors, at first.

Stock traders are individuals (or entities) engaged in the trading of equity securities, or the transfer of other financial assets.

They work either for themselves or on behalf of someone else. Hence, they may operate as agents, hedgers, arbitrageurs, speculators, or investors.

Stock investors are individuals (or entities) who use their own money to buy equity securities. The goal of the stock investor is to gain returns, which come in the form of income, interest, or appreciation in value also known as capital gains.

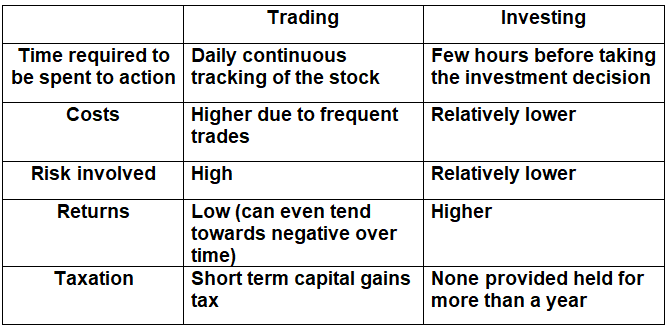

Differences between trading and investing:

Investing and trading may often be classified together.

But, they are both different ways of attempting to profit from the financial markets.

The goal of making investments is to progressively increase wealth over a long period of time by using the buying and holding of a portfolio of stocks, mutual funds, bonds and other methods of investment.

Trading involves short-term buying and selling of stock and commodities such as currency pairs and other instruments with the goal of earning profitable returns which outperform traditional buy and hold investing.

For example, while most investors may be satisfied with a 10% annual return, traders may seek to achieve this per month.

Period of acting

Return on investment and payback period seem to be the two most commonly used financial metrics for making sustainability investment.

Trading is a method of holding stocks for a short period of time. It could be for a week or more often a day! The trader holds stocks till the short term high performance.

On the other hand, investing is an approach that works on buy and hold principle.

Investors invest their money for some years, decades or for the even longer period.

Short-term market fluctuations are irrelevant in the long-running investing.

Growth of capital

Traders look at the price movement of stocks in the market. If the price goes higher, traders may sell the stocks.

So we can say, trading is the skill of timing the market.

But investing is an art of creating wealth by compounding interest and dividend over the years by holding quality stocks in the market.

Risk of both fields

Both, trading and investing, include risk to your capital.

But trading involves higher risk and higher potential returns. The price might go high or low in a short while.

Investing takes a while to develop (and there’s a whole course we created to explain how to do it). It involves comparatively lower risk and lower returns in a short run but might deliver higher returns by putting together interests and dividends if held for a longer period of time.

Daily market cycles do not affect much on quality stock investments for a longer time.

Essential Differences

Trading is a one day match while investing is a championship.

Similarly, traders are skilled, technical individuals, they learn market trends to hit higher profits in the stipulated time.

It is related to the psychology of the market.

Investors, on the other hand, analyze the stocks they want to invest in. Investing also includes learning business fundamentals and commitment to stay invested for a longer term.

It is related to the philosophy that runs the business.

For example: If in the company’s balance sheet you see the inventory cell is too high, that might indicate problems with selling and marketing. This also may suggest higher and unnecessary payments for containing the inventory. This usually leads to some drops in stock price.

Traders put money in stock for a short-term, buy and sell fast to hit higher profits in the market. They seek a smaller and shorter opportunity.

Missing the right time may lead to a loss.

They look at the present performance to hit the higher price and book profits in very short term.

Investors keep themselves away from trends and invest in value.

They invest for a longer period of time keeping the attention of the stocks they hold. They wait till the stock reaches its potential.

You are the one to decide if your goal trading at a higher price making a smaller profit in a short time. Or holding on and sell at the much higher price, in the long run, is what you aim for.

A key rule of trading is to only do so when you are certain that there is an upcoming future event which is predicted to drive the stock value of an organization or entity higher, yet it is obviously not an easy task. If you think an asset’s price will go up – it’s clear that many other traders also know what you know. So it’s important to be one of the first who starts their position. If an asset has already made its rise – it’s not the best time to buy!

When trading, there are certain strategies which must be put in place.

Traders should take note of the news and use it to make an educated decision which will hopefully enable them to make a profit afterward.

This shows the difference between trading as a short-term investment and investing as a long-term method of gaining wealth.

When investing, the goal is to bank profits over the long term, with dips in value simply providing the opportunity to buy more of the commodity in question.

Investing means sitting it out when the commodity rises in value as there will likely be more good news ahead for the company and more profits to be made.

If you are new to the world of investing and trading, it’s important to know which you are going to choose.

The imperative to increase your financial gain is what defines it.

Knowledge is the key.

If you are knowledgeable about the stock market but have little idea about how to trade Forex, for example, you will naturally head over to the stock market for your first investment.

General advice: Don’t get investing and trading confused – it could seriously hurt your portfolio!

Leave a Reply