5 min read

Yes, we know. Lot of you would say Warren Buffet. Frankly, he isn’t even a stock trader, he’s a deal maker and a shark. Moving on.

What makes a trader ‘great’ in our eyes is intellect, knowledge, and experience, combined together to create a very real handle on the markets and the price movement therein. This means many years, and many, many trades.

Forget all stories about ‘great’ traders that hit it very big on one or two trades. Or about people that took advantage of a housing boom or tech bubble over the span of just a few years to make an absolute killing.

To us, this hints at a potential one-off situation, a case of good luck. Nothing more.

Anyone can hit it big on a single trade.

Often, this is even a result of taking too much risk, not understanding the basics of money management. Honestly, many traders are lauded as extraordinary, but a year or two later the opposite happened and they were back to square one.

You should differentiate a trader with a long track record with consistent returns from a trader with a small handful of trades yielding great riches.

We prefer, respect and seek to imitate are the individuals who have a significant track record, and consistency.

Trading on the exchange market is associated with big money, sometimes with fame and other pleasures of the modern world. However, we rarely have the opportunity to learn how to earn really big money in financial markets.

In our opinion, these are the greatest traders in the world, individuals who have all but proven definitively that they’re capable to play a real ‘edge’ in one of the most difficult games in the world.

Here is the list of the greatest stock traders of all time.

George Soros

Why as a first among all greatest stock traders?

Born in Hungary in 1930, he lived through the Nazi occupation of 1944–5, which resulted in the murder of over 500,000 Hungarian Jews. His own Jewish family survived by securing false identity papers, concealing their backgrounds, and helping others do the same. Soros later recalled that “instead of submitting to our fate, we resisted an evil force that was much stronger than we were, yet we prevailed. Not only did we survive, but we managed to help others.”

As the Communists consolidated power in Hungary after the war, Soros left Budapest in 1947 for London, working part-time as a railway porter and as a night-club waiter to support his studies at the London School of Economics. In 1956, he emigrated to the United States, entering the world of finance and investments, where he was to make his fortune.

Actually, Soros began his financial career at Singer and Friedlander in London at the age of 24. He graduated from the London School of Economics and after that became a legend of the financial industry. His most successful trade gave earned him a profit of $1 billion in a single day.

George Soros is the author of many books about investing and finances.

He actively works in the philanthropic area, he donated more than $7 billion for various organizations.

In 1970 he established the Soros Fund Management, which in the last few decades generated more than $40 billion in profits. Soros is currently one of the thirty wealthiest individuals in the world, as well as “the king of Forex trading”. To most of the financial trades, he is the biggest inspiration to follow. So, he is the ‘teacher’ to many traders. That’s why he is one of the greatest stock traders.

“My success in the financial markets has given me a greater degree of independence than most other people,” Soros once wrote. That independence has allowed him to forge his own path towards a world that’s more open, more just, and more equitable for all.

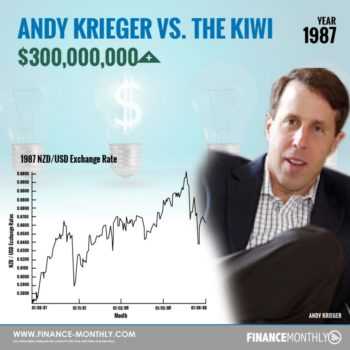

Andrew Krieger

This one of the greatest stock traders graduated from the famous Wharton Business School at the University of Pennsylvania, is a successful trader, known for his interest in New Zealand currency (NZD).

He left his position at Solomon Brothers and in 1986 joined Banker’s Trust. And immediately became a worthy employee, which rewarded him in higher capital limits ($700 million instead of standard $50 million!). His position allowed him to gain profit from the Black Monday crash in 1987. If you are old enough, you will never forget Black Monday.

On October 19th, 1987, the financial markets plummeted, with the Dow Jones falling almost 22%. Panic spread around the world, with most markets down by more than 20% by the end of October.

There was no reason for this.

In fact, the tumult in the markets became a self-fulfilling prophecy as investors ran for the doors. At the time of the crash, Andy Krieger was known as one of the most aggressive currency traders in the world.

He decided it was time to attack, and took a creative and unbelievably aggressive approach to take down the Kiwi dollar. He had access to huge leverage through currency options. With leverage as high as 400:1, he could bring unsustainable pressure to bear on New Zealand’s currency.

He created such a large short position that the Bank of New Zealand literally had no defense. After all, he claimed that his short position was so large that it was bigger than the entire New Zealand money supply. You have to have a strong nerve and complete confidence to do something like that. And Krieger had plenty of both and wot that bet.

After earning $300 million in selling the New Zealand currency, Andrew Krieger became famous in the trading field. In 1988 he started working for Soros Management Fund and later changed it to Northbridge Capital Management.

He is also known for his philanthropic work – after the tsunami in 2004, he donated $350,000 for the victims.

Stanley Druckenmiller

Stanley Freeman Druckenmiller was born on June 14, 1953, is another of the greatest stock traders. He is an American investor, hedge fund manager, and philanthropist. He is the former chairman and president of Duquesne Capital, which he founded in 1981. He closed the fund in August 2010 because he felt unable to deliver high returns to his clients. At the time of closing, Duquesne Capital had over $12 billion in assets.

From 1988 to 2000, he managed money for George Soros as the lead portfolio manager for Quantum Fund. He is reported to have made $260 million in 2008.

George Soros and Stanley Druckenmiller famously worked together on a trade to short the British pound in the 1990s, reaping a $1 billion. At the time, Druckenmiller ran Soros Quantum Fund and leveraged it by one and a half times to make the bet.

In one interview, a young Druckenmiller described Soros’ thinking when he made the enormous trade.

“If there’s one thing I’ve learned from him, it’s when you’re right and you know something, you really feel it, you can’t have enough,” Druckenmiller said. “And if I had to sum up his investing philosophy in one sentence, it’s that it’s not whether you’re right or wrong, you just have to have the maximum when you’re right, and that’s his unique and innate ability.”

Druckenmiller now runs the New York-based Duquesne Family Office.

He started there after closing his Duquesne Capital, which reportedly accumulated annual returns of 30%. Soros operates Soros Fund Management, with roughly $30 billion in family assets under management.

Bruce Kovner

Bruce Stanley Kovner was born in 1945. He is an American investor, hedge fund manager, and philanthropist. He is Chairman of CAM Capital, which he established in January 2012 to manage his investment, trading and business activities. From 1983 through 2011, Kovner was Founder and Chairman of Caxton Associates, LP, a diversified trading company

Kovner serves as Chairman of the Board of The Juilliard School and Vice Chairman of Lincoln Center for the Performing Arts. He also serves on the Boards of the Metropolitan Opera, and the American Enterprise Institute.

Kovner has reportedly attributed his money making success to “stupid governments”, implying that the policy mistakes of central banks and governments cause disequilibria in financial markets that can be exploited.

Kovner borrowed $3,000 on his MasterCard in early 1977 and began trading on his own. He made $1,000 on his first two trades copper and interest rate futures. Kovner says his earlier trading experience was the most memorable.

The first time he lost control of the trading process was in the soybean market. ‘’’It is seared into my memory. A shortage developed in soybeans, running his $4,000 position up to $45,000 in six weeks. In a moment of insanity, I discarded a hedge limiting losses if prices turned down, which they did. ’’In a panic, he liquidates his position, escaping with a loss of $23,000.’’

Yet he still had $22,000, five times what he started with. ‘’I had a huge gain but lost half before getting out? I lost half the profit in an hour. I closed out the trade and was physically sick for a week. In retrospect that was a very good thing, says Kovner. It helped me understand risk and create structures to control risk.”

A music lover!

He has best been known to treat friends to private performances at his New York City home by up-and-coming musicians, often from New York’s Juilliard School. Kovner grew up in the San Fernando Valley east of Los Angeles. When a bad case of writer’s block stymied his quest for a Harvard PhD., Kovner drove a cab to pay the rent, took harpsichord lessons at Juilliard and dabbled at a succession of pursuits while seeking this true calling. In 1976 he found it: currencies and futures speculating.

All the rest is the history of the greatest stock traders.

Jim Rogers

James Beeland Rogers Jr. was born on October 19, 1942. He is an American businessman, investor, traveler, financial commentator and author based in Singapore. Rogers is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund and creator of the Rogers International Commodities Index (RICI).

Rogers does not consider himself a member of any school of economic thought but has acknowledged that his views best fit the label of the Austrian School of economics.

He started to invest in the 1960s with just $ 600. In the 1970s he joined forces with another legendary investor, George Soros. They founded the hedge fund named Quantum Fund. In the 1980s, Jim Rogers left the fund and began investing in his account.

Jim Rogers is a typical representative of long-term trading.

He is a living legend among traders. Usually, he keeps his positions for several years. But he is looking for shares that are likely to turn out better than the market. In the 1980s, he estimated well that stock markets would be on the rise in that decade.

Rogers invested in German shares. The German market seemed to him the most prospective because the German economy was booming, and the local stock market still did not move up, after the collapse which it experienced in 1962.

Rogers thinks patience is the most important thing in trading. Jim Rogers usually analyzes the market for important fundamental factors. Although he admits that sometimes he looks at charts, which often show panic of the crowd. He happens to do exactly the opposite when he sees a panicky downward movement or euphoric upward movement.

Jim Rogers’ strategy is not easy to describe in a few words. It’s just trading on common sense, as he says.

He is a frequent speaker at universities and guest on television programs on investing and business affairs and one of the greatest stock traders.

Paul Tudor Jones

He is a typical speculator and a legend on Wall Street. His assets are estimated at over 4.5 billion dollars.

In the 80s, he became famous for the documentary film “Trader”, in which he discovered the secrets of his methods used on the stock market.

Jones banned the film’s release, in which often he was nervous. But the film got into a wider group and you can find it without a problem on the Internet.

Paul Jones is a classic speculator who bases his decisions mostly on technical analysis. He works on the futures market. And he believes that to succeed you have to go a bit against the flow. Jones tries to buy in bottoms and sell at the tops, which is a bit opposite to the rest of the market participants.

He started as a broker on the New York Cotton Exchange.

So he can brag of earning a large commission in the first year of operation, which amounted to 1 million dollars. Later he worked as an independent trader on NYCE. hen in 1984 he founded a hedge fund, the Tudor Futures Fund. The fund started with assets worth $ 1.5 million. At the end of 1988, it was already over USD 300 million.

He achieved a three-digit rate of return for five years in a row. In October 1987, when the indices suffered a severe breakdown, Paul achieved a rate of return of 62%.

His method gives you the opportunity to purchase a given item at an attractive price, but it can also be very dangerous. Jones found out about it in 1979, when he worked as a trader on NYCE.

On the cotton market, prices fell to new minima and slightly rebounded. And Paul decided that this was the effect of activating stop-loss orders and open a large long position. The market after a shortstop continued to go down.

However, Jones increased his position, although he felt that he could make a mistake. He managed to close the position after a few days. And the loss incurred only on this transaction amounted to 60-70% of the total capital. Jones was so depressed about the situation that he almost gave up his membership in the NYCE. But, he did not give up.

Jones’s approach seems right to buy in holes and sell at the tops, not vice versa.

The most important matter in speculation is proper capital and risk management. Jones was convinced how important these elements were in a really painful way.

He showed a strong character when he decided to continue and it was a huge success.

Most of the financial traders are building their careers in silence, but there are a few that have become popular because of their great trades. But remember, their stories are full of hard work, dedication, and patience. They are people with the power of influence, whose moves had an impact on the whole industry.

What else we may conclude?

There is no only one, the best way to play in financial markets. Everyone has to find their own. However, regardless of which strategy we choose, we must have strict rules of conduct, which we stick to, which is the best in this profession. And maybe one day, become one of the greatest stock traders and deserve our names in the list the best of the best.

Risk Disclosure (read carefully!)

Leave a Reply