Most recent news about the financial markets

- Stock markets have been volatile in recent weeks.

Are we in the early stages of recessionary conditions? This is the question that seems to be halting markets at the moment. – The Economist. The Economist’s opinion is that the economy is on the verge of a recessionary decline, but it’s just cooling down.

- How much do you know about the stock market?

You’ll make the most money in the stock market during these specific hours. Much of the U.S. market’s daily return is produced between the closing and opening bell, which is when most of the market’s returns are produced.

- ‘Black swan’ fund took a 25% loss from stock and bond market storm.

The fund set up to protect investors from market volatility has plunged from its peak in late 2021. It took a 25% loss from a stock- and bond market storm you’ll rarely see, as a swan of a different color upended predictions.

- Private-sector jobs fell 145K in March. Services sector continues to struggle

ADP reports 145,000 fewer private-sector jobs than expected. February’s figure was 261,000, which was upwardly revised from 210,000 expected. There was a decline in the Services Sector. for February.

- Market may be near a high, but it may be too soon to call a bottom

The U.S. Market May Be Near a High, according to some market watchers. It’s possible that the market will reach a new high soon. It may be near the current high. . Â y

- Private employers added 145,000 jobs in March, down from 261,000 in February.

Automatic Data Processing, Inc. (ADP) reported 145,000 jobs added by private companies in March 2023, down from 261,000 in February. According to ADP Chief Economist Nela Richardson, “March payroll data is one of several signals that the economy is slowing”

- S&P 500 ETF gives investors access to the alternative index.

The S&P 500 Index Exchange-Traded Fund gives every member of the index an equal opportunity to grow their investment. It’s an alternative to the most popular and popular exchange-traded funds. It gives investors an equal chance to make more money.

- Equities still priced for rich valuations, Browne says.

Pimco’s Erin Browne thinks rates and equities are singing from different hymn books currently. The former is pricing-in accelerated rate cuts during the second half of this year and into 2024, while the latter is priced for rich valuations. This indicates the rates market is starting to price-in the economy and heading towards a recession.

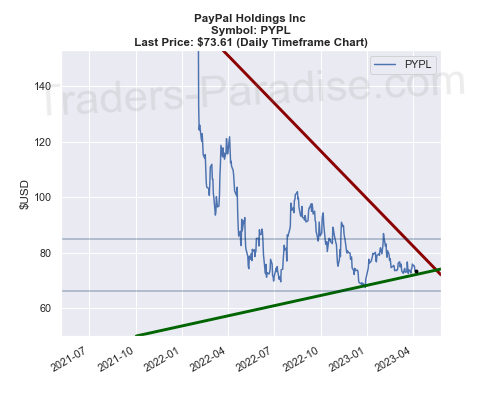

#1 Trading idea on PYPL

Company Name: PayPal Holdings Inc

Symbol: PYPL

Sector: Consumer Discretionary

PayPal Holdings, Inc. operates an online payments system in the majority of countries that support online money transfers. The company operates as a payment processor for online vendors, auction sites, and many other commercial users, for which it charges a fee. It serves as an electronic alternative to traditional paper methods like checks and money orders.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PYPL — Supercharged growth stock to buy hand over Fist before it Soars.

This stock has been beaten down by macroeconomic conditions but could rebound big-time if analysts are right. According to Wall Street, this stock is a growth stock to buy before it soars 113% according to Wall St. analysts say a bull market is coming.

- News story for PYPL — These are 3 of the best growth stocks to buy in April

The longer you hold on to these stocks, the better your returns will likely be. These are 3 of the Best Growth Stocks to Buy in April. The longer you keep on to them, the more you’ll make on your investments.

- News story for PYPL — No-Brainer Stocks to Buy With $200 Right Now.

You don’t need a lot of money to start building wealth on Wall Street. 3 stocks to buy with $200 right now are no-brainer stocks you can buy with that amount of money right now. They are all good investments.

TECHNICAL ANALYSIS

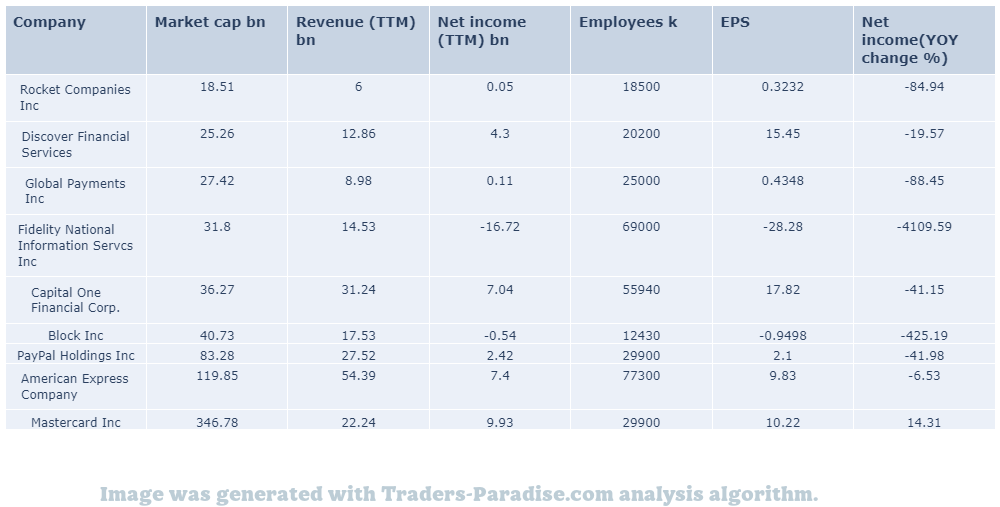

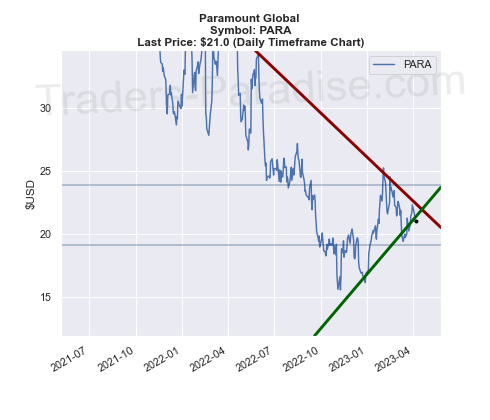

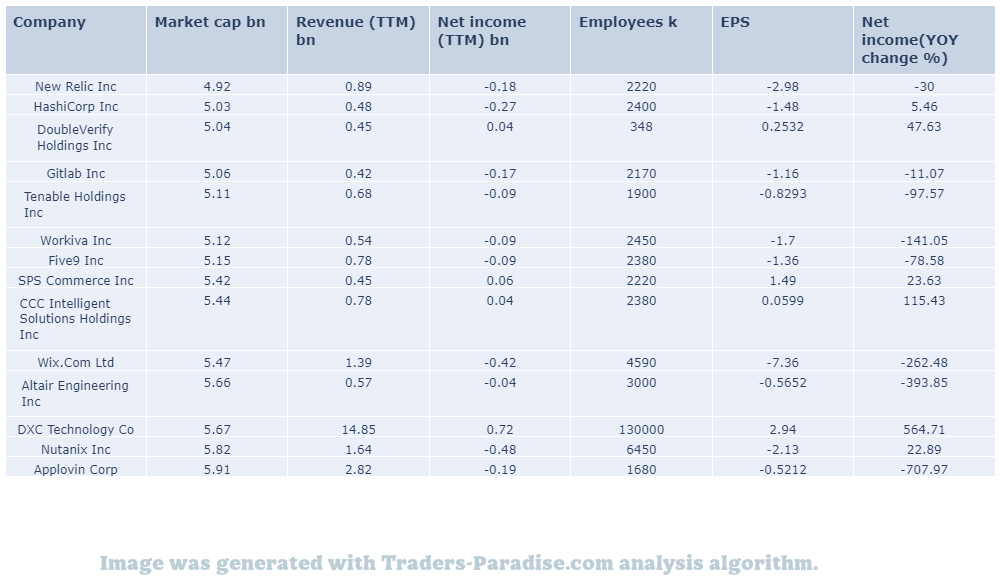

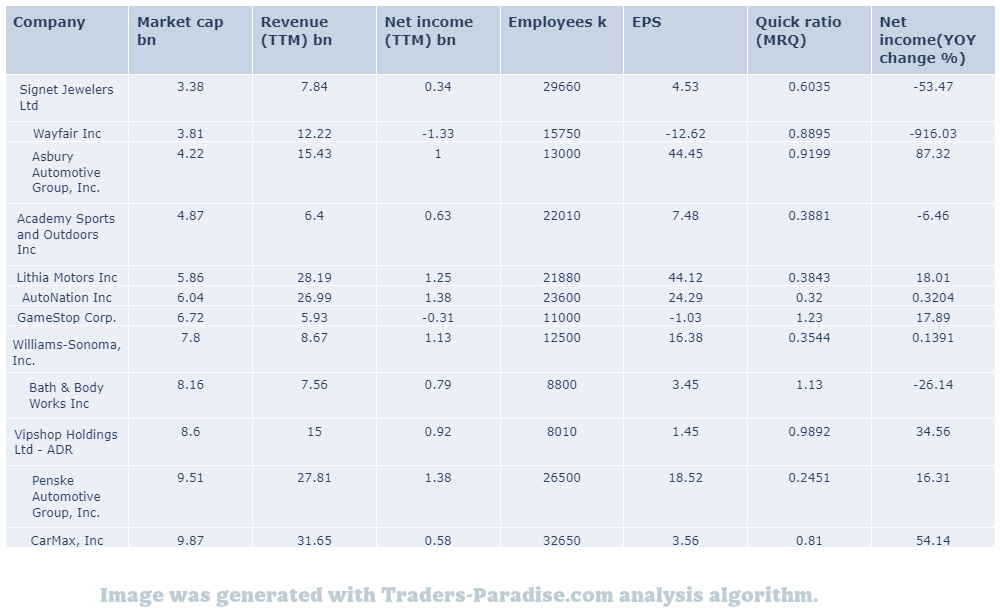

PEERS AND FUNDAMENTALS

#2 Trading idea on URI

Company Name: United Rentals, Inc.

Symbol: URI

Sector: Services

Description: Shares of the world’s largest equipment rental company are down more than 20% this year.

United Rentals, Inc. is the world’s largest equipment rental company. It has about 13 percent of the North American market share as of 2019, according to the company’s market share report. The company is based in New York, but has a global headquarters in California.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for URI — KBR boosts backlog with new contract from Avina Clean Hydrogen.

KBR’s K-Green Technology has been selected for a Grassroots Project. KBR has won a contract from Avina Clean Hydrogen for the green ammonia project in the United States. K- green technology has been chosen for a grassroots project.

- News story for URI — United Rentals has beaten estimates in three of the past four quarters.

Zacks’ focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks at Zacks’ disposal.

- News story for URI — Caterpillar, United Rentals, Fortinet, ExlService Holdings have impressive interest coverage ratios.

Caterpillar, United Rentals, Fortinet and ExlService Holdings are sound enough to meet financial obligations. They generate earnings well above their interest expenses and have a good interest coverage ratio. They are good investments for investors with strong financial foundations.

TECHNICAL ANALYSIS

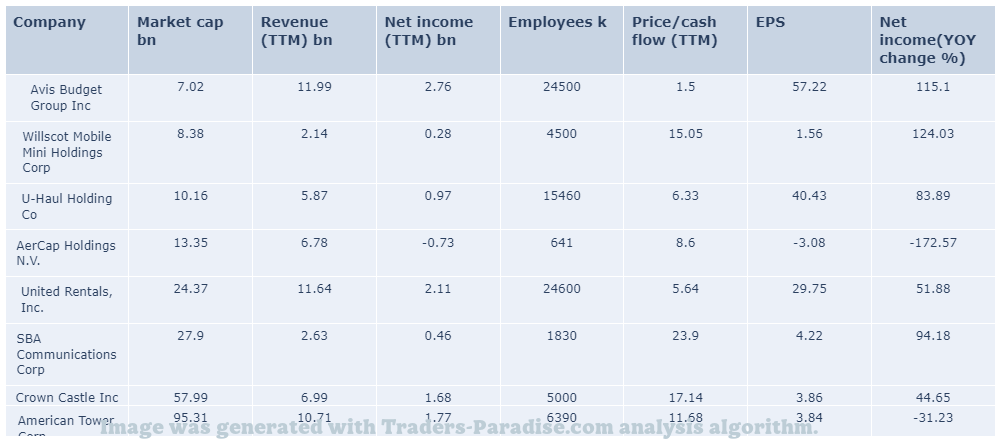

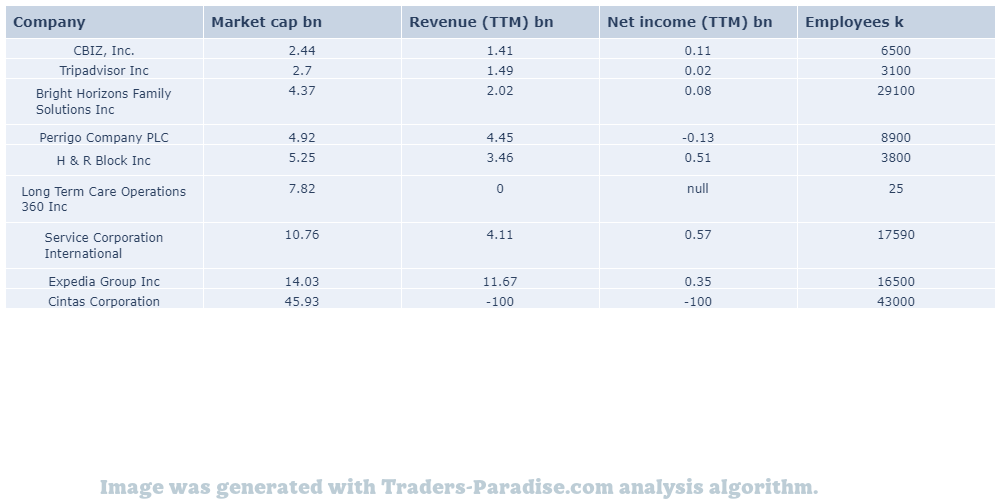

PEERS AND FUNDAMENTALS

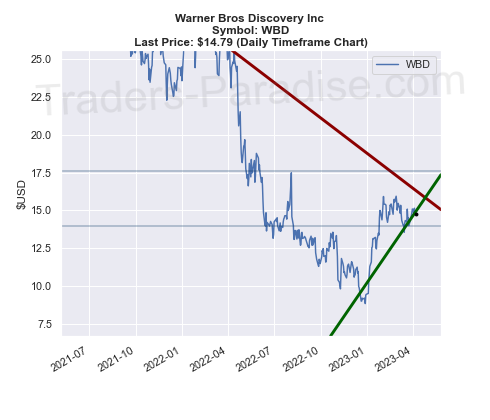

#3 Trading idea on WBD

Company Name: Warner Bros Discovery Inc

Symbol: WBD

Sector: Technology

Description: Company is owned by Time Warner.

Warner Bros. is headquartered in New York, New York and is owned by Warner Bros. Pictures. The company is a division of Warner Bros., which is based in Los Angeles. It’s worth $2.5 billion in annual revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WBD — Check out the full list of TV shows and shows to watch this month.

Emmy season is in full swing. HBO’s “Barry,” Netflix’s “Beef,” Amazon’s “Citadel,” Apple’s “Schmigadoon” and much more are available to watch. What’s worth streaming in April 2023?

- News story for WBD — HBO has announced dates for new series, renewals.

HBO Max will return in April 2023. Barry is back for its final season, while “Somebody Somewhere,” “100 Foot Wave” and “A Black Lady Sketch Show” are returning for new seasons. “Barry” is the only show leaving.

- News story for WBD — Earnings estimate revisions are a key driver of share price.

Wall Street analysts think Warner Bros. Discovery (WBD) has 30% upside potential. The consensus price target hints at a 30.3% upside for the stock. An upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term.

TECHNICAL ANALYSIS

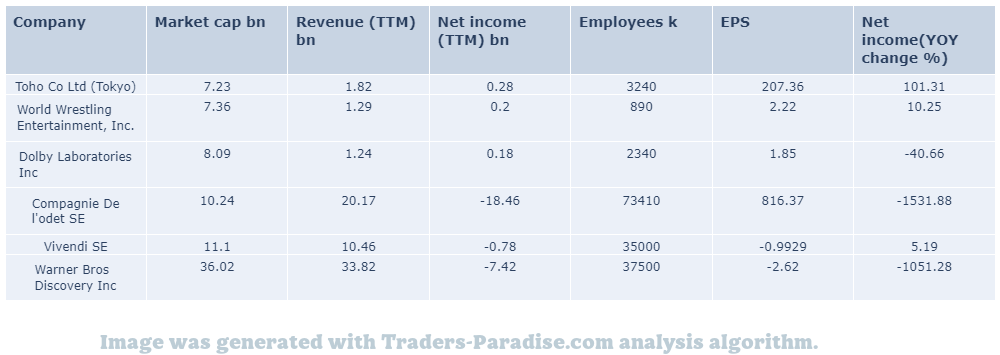

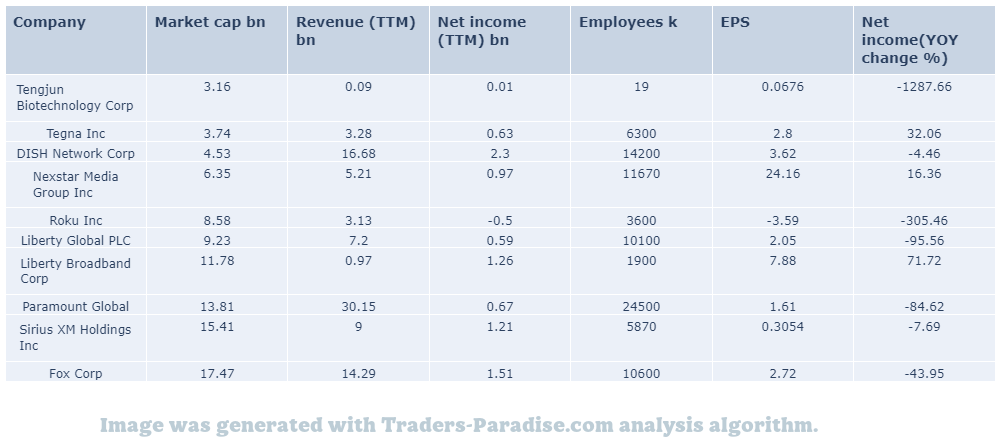

PEERS AND FUNDAMENTALS

#4 Trading idea on MKTX

Company Name: MarketAxess Holdings Inc.

Symbol: MKTX

Sector: Financial

Description: MarketAxess operates an electronic trading platform for fixed-income markets.

MarketAxess Holdings Inc. operates an electronic trading platform for the institutional credit markets. It also provides market data and post-trade services. MarketAxess is an international financial technology company that operates an e-trading platform for institutional credit market.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

TECHNICAL ANALYSIS

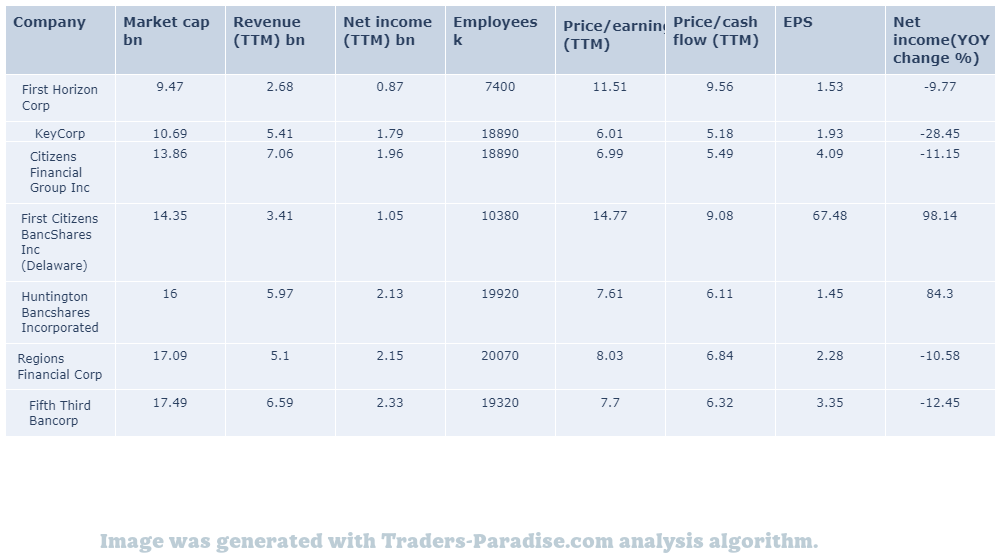

PEERS AND FUNDAMENTALS

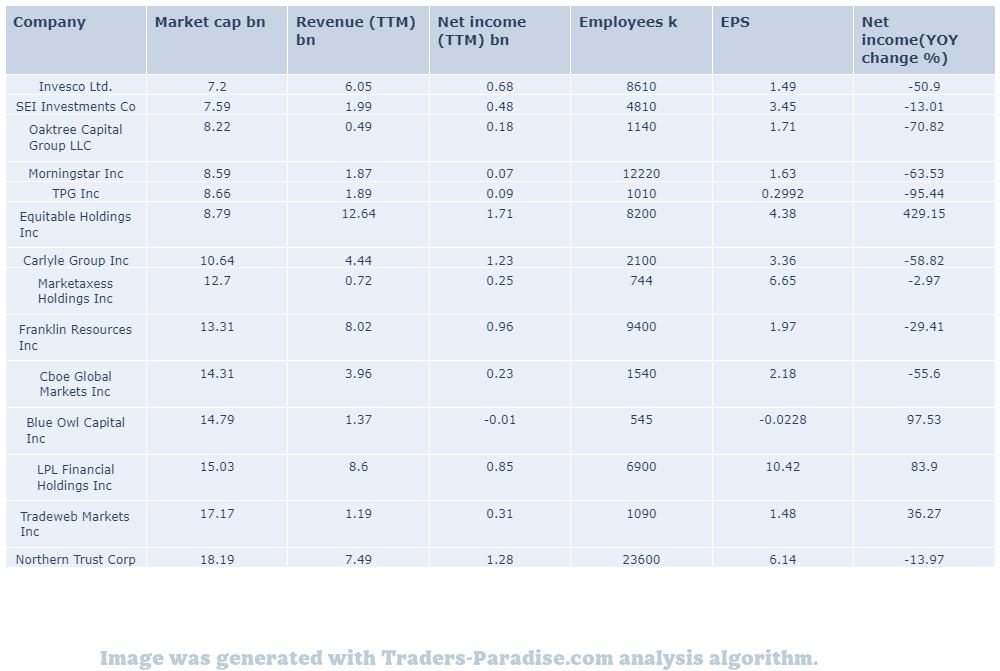

#5 Trading idea on PARA

Company Name: Paramount Global

Symbol: PARA

Sector: Technology

Description: Paramount Global is a global media and entertainment company. It is headquartered in New York, New York and has a global network of offices. It has more than 100,000 employees. It’s one of the world’s biggest media companies, with a turnover of over $20 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PARA — Check out the full list of TV shows and shows to watch this month.

Emmy season is in full swing. HBO’s “Barry,” Netflix’s “Beef,” Amazon’s “Citadel,” Apple’s “Schmigadoon” and much more are available to watch. What’s worth streaming in April 2023?

- News story for PARA — A Really Haunted Loud House will be released on Nickelodeon on Halloween.

Paramount Global’s Nickelodeon announces a new original Halloween movie, A Really Haunted Loud House, from Paramount Global’s (PARA) Nickelodeons and Paramount Global. Paramount Global (Para) Announces an Original Halloween Movie, A really haunted house.

- News story for PARA — Paramount Global-B (PARA)

Paramount Global-B (PARA) closed at $21.61 in the latest trading session, marking a -0.83% move from the prior day. Para shares are down more than Broader Markets (Para) by 0.83%.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

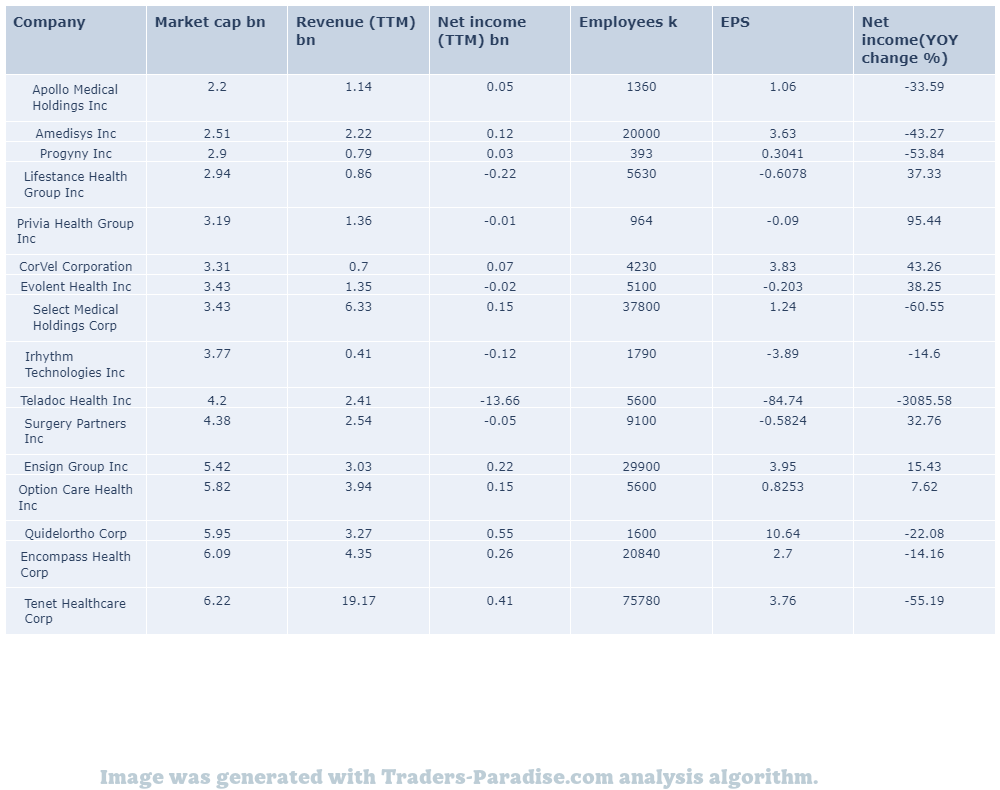

#6 Trading idea on TDOC

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Description: Company Description: Teladoc Health, Inc.

Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — Top 5 growth stocks to buy before the next bull market.

It’s the time to prepare your portfolio for better days ahead. 5 Top Growth Stocks to Buy Before the Next Bull Market are listed below. – for more information on these stocks, visit: http://www.cnn.com/investor/top-growth-stocks-to-buy/

- News story for TDOC — Shares of Teladoc closed at $25.61 in recent trading session

oc (TDOC) closed at $25.61, marking a -1.12% move from the previous day. Teladoc stock (TDoc) is down 1.12%. It’s up 1.3% from previous day, down 1%.

- News story for TDOC — Shares of the health care company have been on the rise recently.

Teladoc Health, Inc. (TDOC) has been one of the most watched stocks by Zacks users lately. It’s worth exploring what lies ahead for the stock now. for the Zacks.com users. For more information, go to Zacks’ website.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

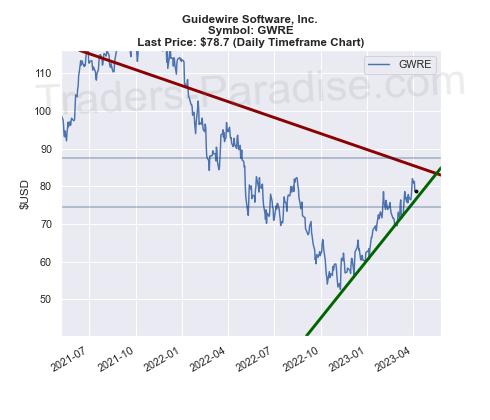

#7 Trading idea on GWRE

Company Name: Guidewire Software, Inc.

Symbol: GWRE

Sector: Technology

Description: Company offers software products for property and casualty (P&C) insurers.

Guidewire Software, Inc. provides software products for property and casualty insurers around the world. The company is headquartered in San Mateo, California, and provides products for insurance companies around the globe. For more information, visit the company’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GWRE — Analysts are expecting better-than-expected earnings.

Guidewire Software (GWRE) reported earnings 30 days ago. The stock is up 8.2% since the last earnings report. The company is expected to report earnings next week. The analyst’s estimate for the company’s earnings is $1.50 per share.

- News story for GWRE — Garmisch offers new capabilities and enhancements to drive growth and efficiency.

Guidewire launches Garmisch with new capabilities and enhancements to drive growth and efficiency across the insurance lifecycle. Guidewire’s (GWRE) Garmish Enhances Insurance Lifecycle is a product of its Garmich division.

- News story for GWRE — Revenues up Y/Y on strength in subscription and support revenues.

Guidewire’s (GWRE) Q2 loss was wider than expected. Revenues were up Y/Y thanks to growth in subscription and support revenues. The company’s Q2 results were stronger than expected due to the strength of its subscription revenues.

TECHNICAL ANALYSIS

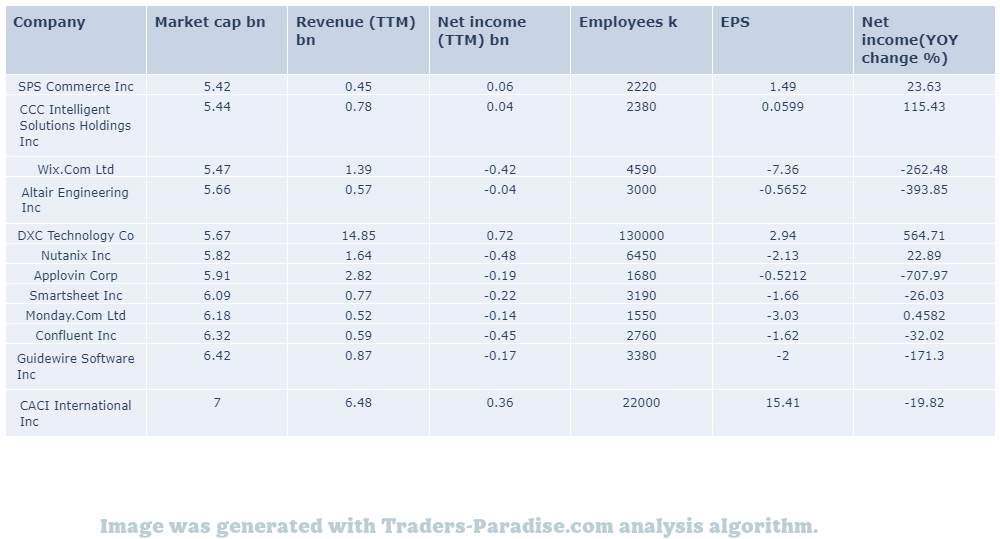

PEERS AND FUNDAMENTALS

#8 Trading idea on WIX

Company Name: Wix.Com Ltd

Symbol: WIX

Sector: Technology

Description: Company Description: Wix.com Ltd.

Wix.com Ltd develops and markets a cloud-based platform that enables anyone to create a website or web application in North America, Europe, Latin America, Asia, and internationally. The company is headquartered in Tel Aviv, Israel and is available in English and Spanish.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WIX — Tyler (TYL) has completed its second integration of its CAVU e system.

Tyler completed the second integration of Tyler’s CAVU eLicense system between OSBC and NMLS. It saves several hours of manual work and reduces tedious data entry for OSBC staff. Tyler (TYL) Completes eLicense Integration Between OSBC & NMLs.

- News story for WIX — Virgin Atlantic to offer its enhanced content through GDS.

GDS Sabre (SABR) will offer Virgin Atlantic’s content via its Global Distribution System marketplace (GDS SABR) GDS will make available Virgin’s enhanced content via GDS SBR’s marketplace. SBR will be able to offer Virgin’s content through its marketplace.

- News story for WIX — Software giant releases free version of its database.

Oracle (ORCL) gives developers free access to Oracle Database 23c. It has breakthrough features such as the JSON Relational Duality. It’s a free version for developers to level up their skills and start building new apps using breakthrough features like the JEDI.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

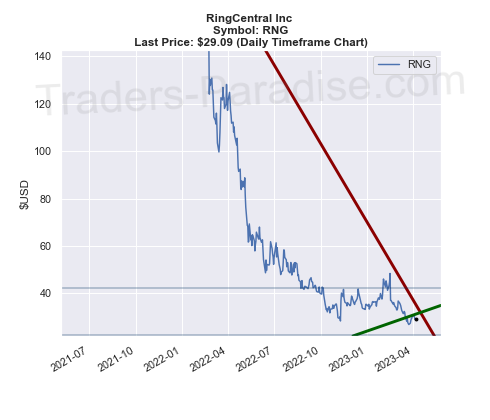

#9 Trading idea on RNG

Company Name: RingCentral Inc

Symbol: RNG

Sector: Technology

Description: Software-as-a-service company was acquired by Microsoft in June 2017.

RingCentral, Inc. offers software-as-a-service solutions that enable businesses to communicate, collaborate and connect in North America. The company is headquartered in Belmont, California and offers its services in English and in Spanish. for more information, visit ringcentral.com.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for RNG — Some of the biggest tech companies in the world are cutting jobs.

Videogame publisher Electronic Arts is the latest tech company to announce job cuts. Here’s a list of other companies that have announced job cuts recently: Apple, Facebook, Google, Microsoft, Amazon, Facebook and others. Â

- News story for RNG — intuitiveintuitiveintuitive Approach to Earnings ESP.

Zacks Earnings ESP gives investors a good idea of which stocks are likely to beat quarterly earnings estimates. Investors looking for computer and technology stocks with positive earnings momentum should check out these two names: Dell and Hewlett-Packard. Zacks has a useful tool to help investors find stocks that are expected to do so.

- News story for RNG — Machine learning and artificial intelligence (AI) capabilities are being rolled out by RingSense and Next-gen.

RingCentral launches new AI-powered capabilities, RingSense and Next-gen frontline workforce solutions. RingCentral has expanding clientele and a strong partner base. . – RingCentral (RNG) is a cloud-based business.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

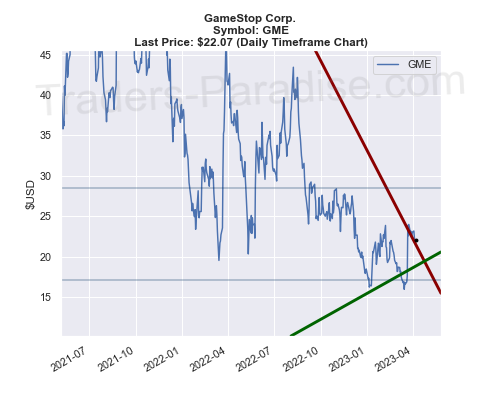

#10 Trading idea on GME, might be reaching some kind of top

Company Name: GameStop Corp.

Symbol: GME

Sector: Services

Description: Company sells video games for sale in the United States and Canada.

GameStop Corp. is headquartered in Grapevine, Texas, and the company is a subsidiary of GameStop Inc., which is based in New York City. The company is valued at more than $20 billion, according to the company’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GME — Video game retailer reported better-than-expected fourth-quarter results.

GameStop (GME) has been upgraded to a Zacks Rank #2 (Buy). This might drive the stock higher in the near term. GameStop has growing optimism about the company’s earnings prospects and is expected to perform well in the long term.

- News story for GME — Strategists at Wells Fargo argue it’s year three of a commodity supercycle.

Wells Fargo investment Institute strategists say the commodity supercycle is still young and has plenty of room to run. They argue it’s year three of the commodities supercycle and it has plenty more room to grow. for more information, visit Wells Fargo investment institute’s website.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

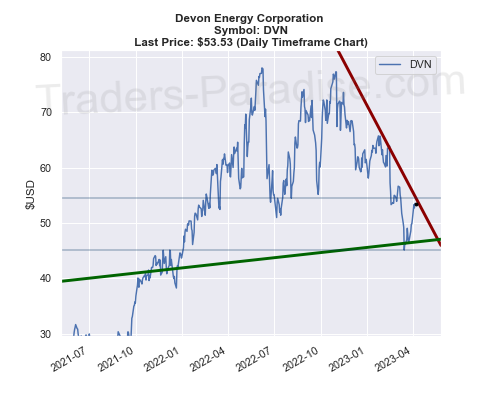

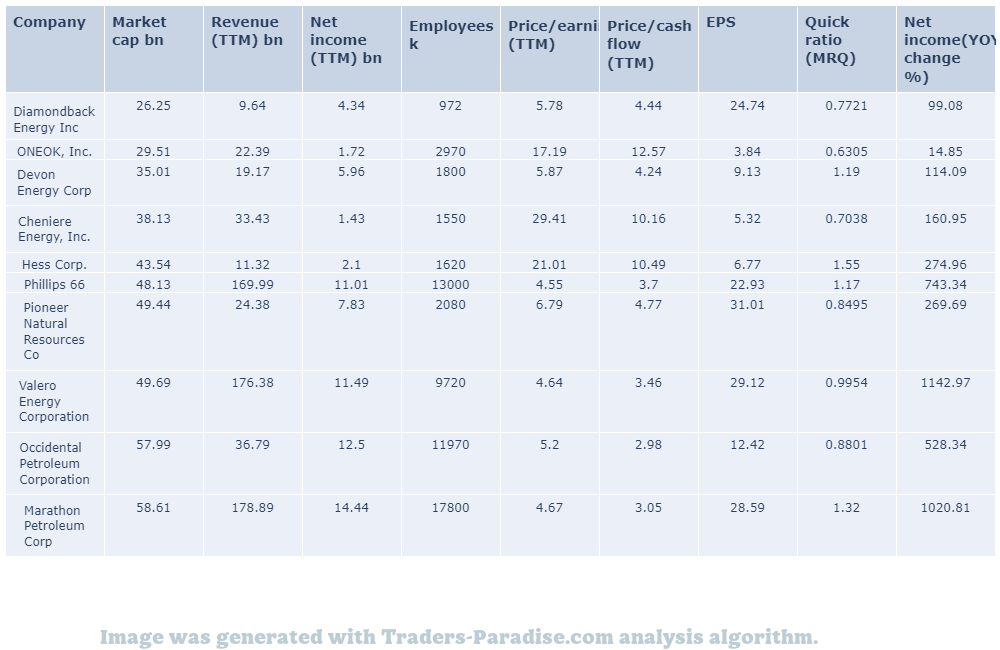

#11 Trading idea on DVN, might be reaching some kind of top

Company Name: Devon Energy Corporation

Symbol: DVN

Sector: Basic Materials

Description: Oil and gas exploration and production company based in Oklahoma City.

Devon Energy Corporation is an American energy company engaged in hydrocarbon exploration in the American market. The company is based in New York City, New Jersey and has operations in the Midwest and the East Coast of the U.S. It is a subsidiary of Devon Energy Inc.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for DVN — OPEC+ decided to cut oil production by 1.16 million barrels per day.

OPEC+ decided to cut oil production by 1.16 million barrels per day starting in May. Click here to see what this means for the investment community and read what I think it means for oil investors. i.e. OPEC+ Production Cut: A Massive Gift To The Oil Sector.

- News story for DVN — Shares of Devon Energy closed at $52.74 in recent trading session

Devon Energy (DVN) closed the most recent trading day at $52.74, moving -1.07% from the previous trading session. Devon Energy Dips More Than Broader Markets (DG) and is trading at lower levels than the market.

- News story for DVN — Saudi Arabia is cutting production to boost crude prices.

Saudi Arabia and its allies are cutting production to push crude prices higher. There are 3 oil stocks to buy to cash in on Saudi Arabia’s bid to boost crude prices, according to CNN.com’s Tom Foreman. He recommends buying shares in the following stocks.

TECHNICAL ANALYSIS

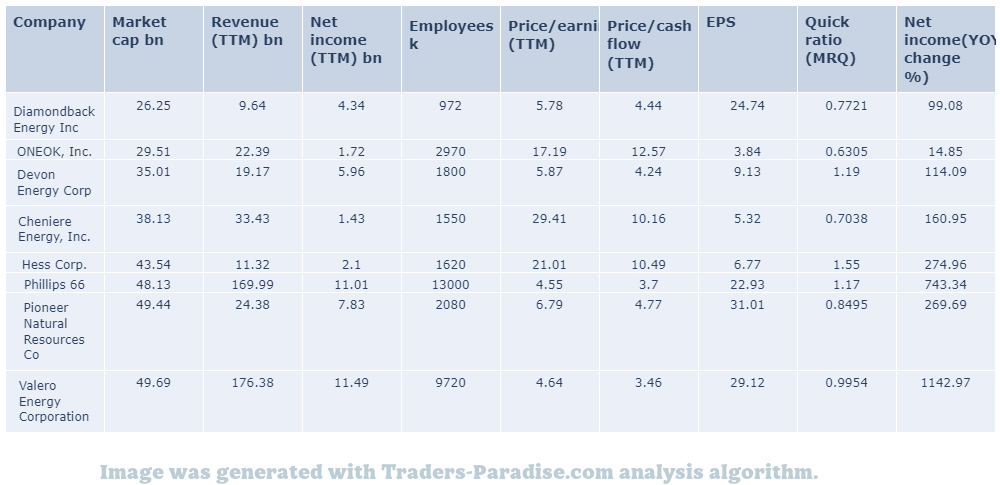

PEERS AND FUNDAMENTALS

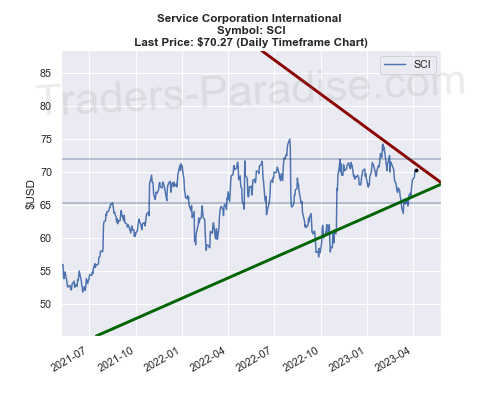

#12 Trading idea on SCI, might be reaching some kind of top

Company Name: Service Corporation International

Symbol: SCI

Sector: Services

Description: Service Corporation International – company profile

Service Corporation International offers death care products and services in the U.S. and Canada. The company is headquartered in Houston, Texas, and offers services in both the United States and Canada, including funeral home services and funeral home supplies.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SCI — Service Corporation has been benefiting from its focus on expansion.

Service Corporation (SCI) has been benefiting from its focus on expansion and greater-than-expected funeral services performed, according to the company’s CEO. SCI is focusing on expanding its business and increasing its profits. for more information, visit servicecorporation.com.

- News story for SCI — Service Corporation reports fourth-quarter 2022 earnings and sales decline.

‘s fourth-quarter 2022 earnings and sales decline from the year-ago period’s levels, which was significantly impacted by the pandemic. Service Corporation (SCI) Q4 Earnings Top Estimates, Sales Down from the previous quarter’s levels of levels.

- News story for SCI — Wall Street had expected the company to report earnings of $1.39 per share.

Service Corp. (SCI) delivered earnings and revenue surprises of 15% and 6.44%, respectively, for the quarter ended December 2022. The company surpassed the estimates by 15%. The company is expected to report earnings of $0.50 per share.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

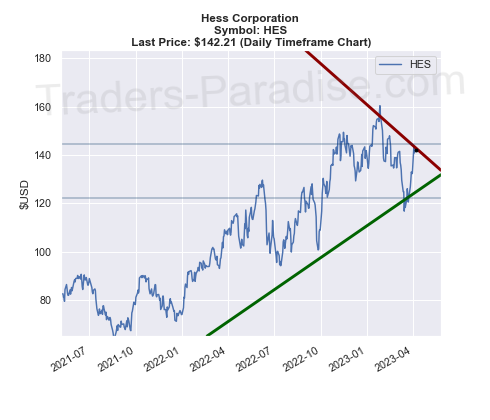

#13 Trading idea on HES, might be reaching some kind of top

Company Name: Hess Corporation

Symbol: HES

Sector: Basic Materials

Description: Hess Corporation is an American independent energy company.

Hess Corporation is an American global independent energy company. It is involved in the exploration and production of crude oil and natural gas. It was formerly known as Amerada Hess Corporation. It’s a subsidiary of Hess Oil Company, which is based in Houston, Texas.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HES — Bank of America names top oil and gas exploration and production stock picks.

OPEC announced a surprise production cut on Monday. WTI crude oil prices jumped 6.1% to above $80 per barrel. The United States Oil ETF traded higher by 5.3%. Bank of America analyst Doug Leggate named his five top oil and gas exploration & production stock picks for a tighter oil market.

- News story for HES — Shares of Hess closed at $132.34 on Friday

of Hess (HES) closed at $132.34, marking a -0.1% move from the previous day. Hess stock is down 0.1%. HES stock is up 0.3% from previous day to $132:00.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

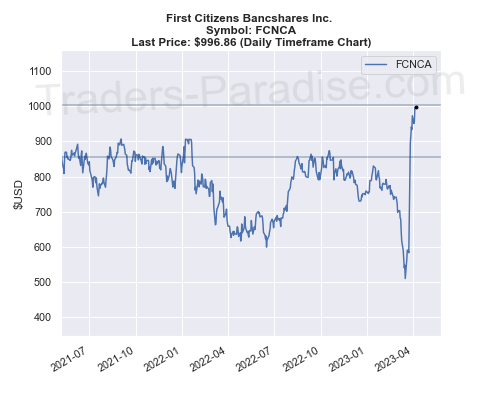

#14 Trading idea on FCNCA, might be reaching some kind of top

Company Name: First Citizens Bancshares Inc.

Symbol: FCNCA

Sector: Financial

Description: First Citizens BancShares, Inc. is the parent company of First-Citizens Bank & Trust Company.

First Citizens BancShares, Inc. is the parent company of First-Citizens Bank & Trust Company providing retail and business banking services to individuals, businesses and professionals. The company is headquartered in Raleigh, North Carolina and provides services to people and businesses.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FCNCA — Half-empty office buildings are a deepening source of angst for landlords and investors.

Half-empty office buildings are a source of angst for landlords and debt investors. Office property woes could be tip of iceberg if credit freezes up as $1 trillion bill comes due, according to some analysts. Â y

- News story for FCNCA — Startup founder-friendly model is over for now.

The founder-friendly model of venture capital is reaching its end after the end of a long tech boom and the sudden collapse of the industry’s favorite bank. The days of money-losing tech startups getting funded because VCs liked their founder is over.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

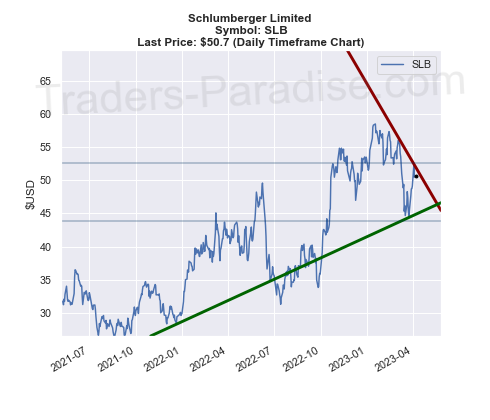

#15 Trading idea on SLB, might be reaching some kind of top

Company Name: Schlumberger Limited

Symbol: SLB

Sector: Basic Materials

Description: Company has four principal executive offices in Paris, Houston, London, and Dallas.

Schlumberger has four principal executive offices located in Paris, Houston, London and The Hague. Schlumberger is an oilfield services company based in Houston, Paris, London, and the Hague. It has a market value of over $50 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SLB — Shares of Schlumberger closed at $50.70 in recent trading session

Schlumberger (SLB) closed the most recent trading day at $50.70, moving +0.48% from the previous trading session. The stock is down 0.4% from its previous close at $49.70.

- News story for SLB — Schlumberger has beaten estimates in each of the last four quarters.

Schlumberger (SLB) has an impressive earnings surprise history. The company is expected to beat estimates in its next quarterly report. It currently possesses the right combination of the two key ingredients for a likely beat in the next quarter report.

- News story for SLB — Estimates for the current quarter have moved lower over the past few weeks.

shares rose 6.6% last session on higher-than-average trading volume. However, the latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term. The current trend in the stock is not helping the stock move higher.

TECHNICAL ANALYSIS

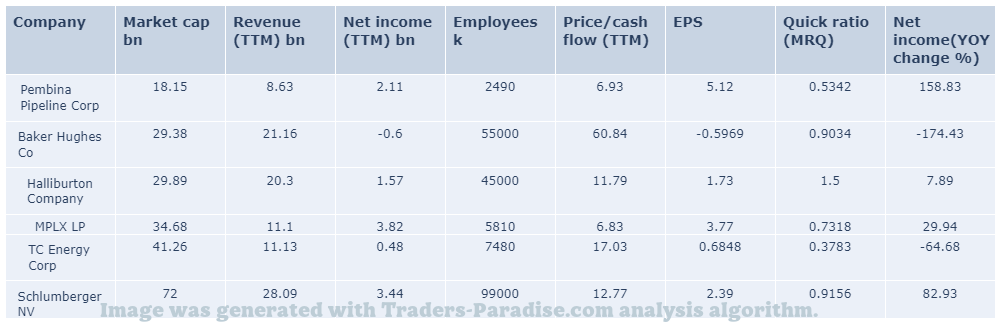

PEERS AND FUNDAMENTALS

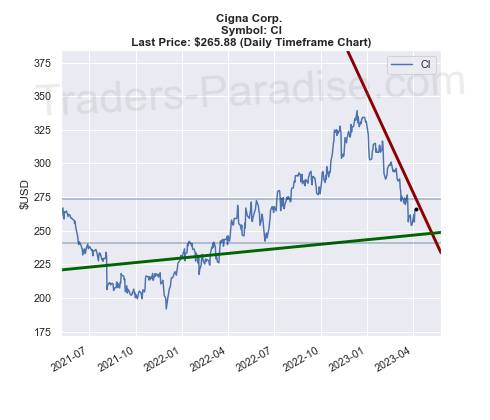

#16 Trading idea on CI, might be reaching some kind of top

Company Name: Cigna Corp.

Symbol: CI

Sector: Healthcare

Description: Cigna is one of the largest health insurance companies in the United States.

Cigna is an American multinational managed healthcare and insurance company based in Bloomfield, Connecticut. Its insurance subsidiaries are major providers of medical, dental, disability, life and accident insurance and related products and services. Most of them are offered through employers and other groups.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CI — Shares of the world’s largest health insurer surged on Wednesday.

UnitedHealth stock was a big winner on Wednesday. A new bullish take on the company from a pundit attracted the right kind of investor attention. UnitedHealth Stock was a Big Winner on Wednesday, according to the pundit’s take on UnitedHealth.

- News story for CI — Raymond Raymond Raymond Raymond James upgrades Cigna from Outperform to Strong Buy with a $350 price target.

Raymond James upgrades The Cigna Group (NYSE: CI) from Outperform to Strong Buy, reiterating the price target of $350. The company’s pharmacy benefit management assets are well-positioned to have a strong 2023, according to the analyst.

TECHNICAL ANALYSIS

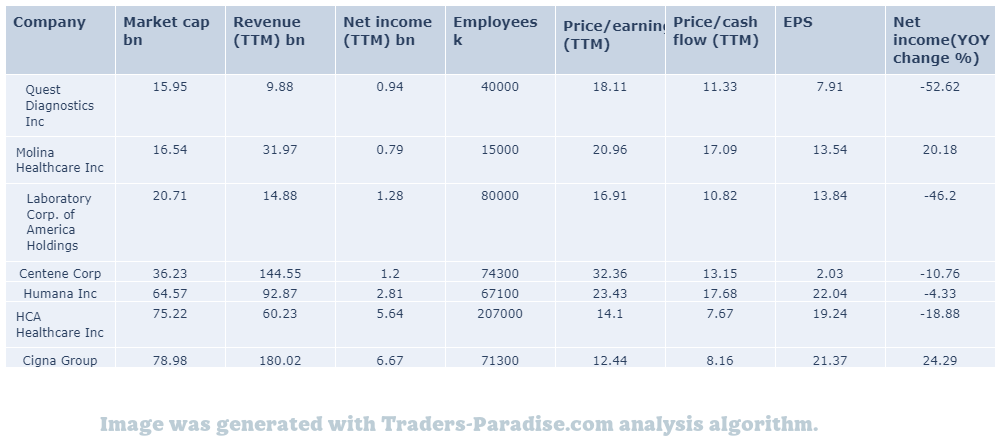

PEERS AND FUNDAMENTALS

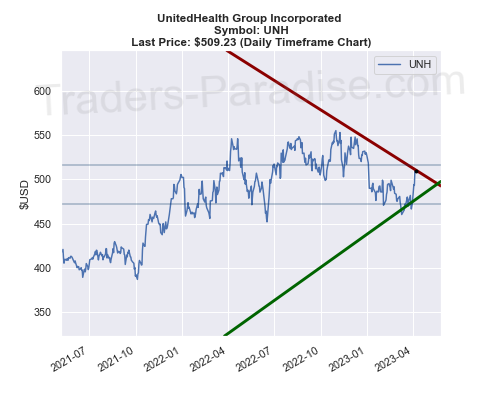

#17 Trading idea on UNH, might be reaching some kind of top

Company Name: UnitedHealth Group Incorporated

Symbol: UNH

Sector: Healthcare

Description: UnitedHealth Group is a multinational managed healthcare and insurance company.

UnitedHealth Group Incorporated is an American for-profit multinational managed healthcare and insurance company based in Minnetonka, Minnesota. In 2020, it was the second-largest healthcare company (behind CVS Health) by revenue with $257.1 billion and the largest insurance company by net premiums. UnitedHealthcare revenues comprise 80% of the Group’s overall revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for UNH — Shares of the world’s largest health insurer surged on Wednesday.

UnitedHealth stock was a big winner on Wednesday. A new bullish take on the company from a pundit attracted the right kind of investor attention. UnitedHealth Stock was a Big Winner on Wednesday, according to the pundit’s take on UnitedHealth.

- News story for UNH — Final Medicaid rates are good for UnitedHealth, says Raymond James.

Raymond James upgraded the rating on UnitedHealth Group Inc (NYSE: UNH) to Strong Buy from Outperform and raised the price target to $630 from $615. Final payment rates for Medicare Advantage plans for 2024 were announced by the Centers for Medicare & Medicaid Services last week. The analyst John Ransom models 2023 adj. EPS of $24.80 and 2024 adj. P/E of $28.02. 2025 revenue of $404B and $31.65/P/E is expected. UNH trades at 17.6x of 2024E.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

#18 Trading idea on JNJ, might be reaching some kind of top

Company Name: Johnson & Johnson

Symbol: JNJ

Sector: Healthcare

Description: Johnson & Johnson is one of the world’s most valuable companies. J&J is a member of the Dow Jones Industrial Average

Johnson & Johnson was founded in 1886. Its common stock is a component of the Dow Jones Industrial Average. The company is ranked No. 36 on the 2021 Fortune 500 list of the largest U.S. corporations by total revenue. J&J has a prime credit rating of AAA.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JNJ — Find undervalued stocks with enough time and research.

With enough time and research, finding undervalued stocks can pay off big-time for investors. How to Find Undervalued Stocks? Here’s Where I Start and How to Look for Stocks With Undervaluing Stocks: Here’s where to start.

- News story for JNJ — Revisions in estimate revisions suggest that analysts are more positive on the stock.

Johnson & Johnson (JNJ) saw its shares surge in the last session with trading volume being higher than average. The latest trend in earnings estimate revisions could translate into further price increase in the near term. JNJ shares are up 4.5% this morning.

- News story for JNJ — Goals, current holdings, allocation, sales, and buys of Q1 2023.

Q1 2023 saw S&P 500 up 4% and gave investors a decent start for the year. Click here to read the goals, current holdings, allocation, sales, and buys of my Dividend Growth Portfolio for Q1 202023.

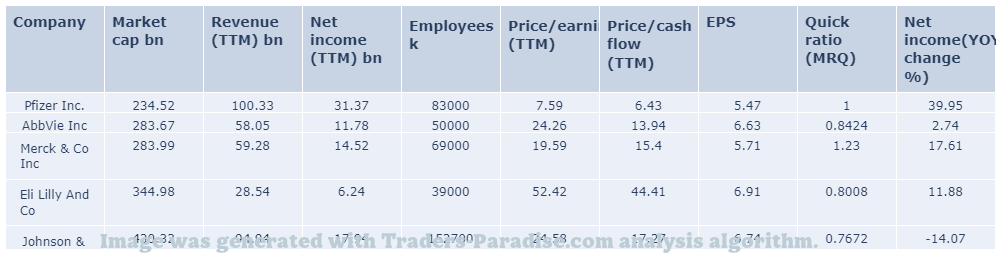

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

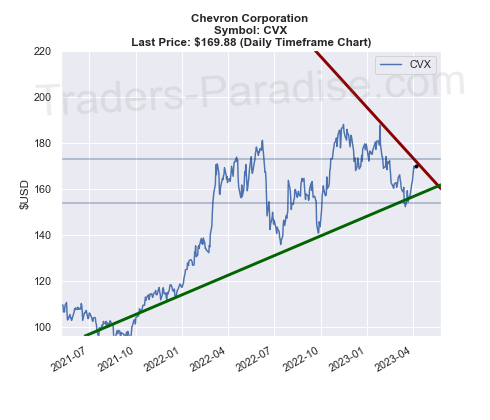

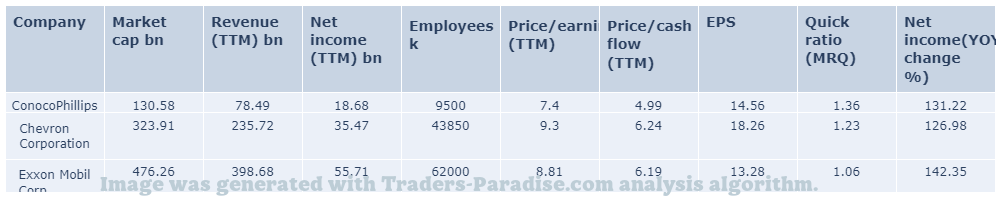

#19 Trading idea on CVX, might be reaching some kind of top

Company Name: Chevron Corporation

Symbol: CVX

Sector: Energy & Transportation

Description: Chevron’s board of directors meets for the first time since 2005 election.

Chevron Corporation is an American multinational energy corporation. It is based in San Ramon, California, and active in more than 180 countries. Chevron is engaged in every aspect of the oil and natural gas industries, including hydrocarbon exploration, production, refining, marketing and transport, chemicals manufacturing and sales and power generation.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for CVX — Goals, current holdings, allocation, sales, and buys of Q1 2023.

Q1 2023 saw S&P 500 up 4% and gave investors a decent start for the year. Click here to read the goals, current holdings, allocation, sales, and buys of my Dividend Growth Portfolio for Q1 202023.

- News story for CVX — Energy ETFs to be affected by OPEC+ decision.

OPEC+ decided to cut its production supply, which caused oil prices to rise. Check how energy ETFs are affected by the decision to cut production by OPEC+ to play on the rise in oil prices and find out which ones can play on it.

- News story for CVX — 15 oil and gas stocks expected to be backed by ample cash flow.

15 oil and gas stocks expected to be backed by ample cash flow through 2024. These companies are expected to have very high free cash flow yields and are likely to have good growth prospects through 2024, according to some analysts. Â

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

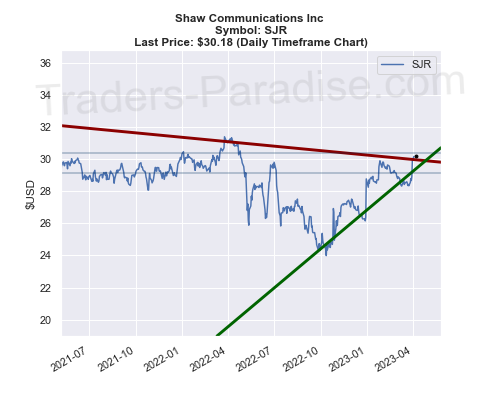

#20 Trading idea on SJR, might be reaching some kind of top

Company Name: Shaw Communications Inc

Symbol: SJR

Sector: Technology

Description: The company offers broadband, home networking, trunking and video services.

Shaw Communications Inc. is a connectivity company in North America. The company is headquartered in Calgary, Canada and is a subsidiary of Shaw Communications Inc., which is based in Toronto, Canada. It’s a technology company with a focus on fibre-optics.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SJR — Merger brings together two iconic, entrepreneurial companies.

Rogers and Shaw are merging to create one national cable, media, and wireless company. The merger is expected to bring billions in investment to Canada and bring significant benefit to the country and its citizens. Rogers and Shaw will be Canada’s first national cable and media company.

- News story for SJR — Carrier launches in Canada

Quebecor closes acquisition of Freedom Mobile. A fourth major wireless carrier is launched in Canada. Quebecor is a major player in the Canadian wireless market. Quebecer is Quebecor’s third major player. Quebec is a Quebecor-owned company and Freedom Mobile is a subsidiary of it.

- News story for SJR — Canada’s Competition Commission has approved Rogers Communication’s takeover.

Rogers Communication’s (RCI) takeover is the largest telecom deal in Canadian history. It was approved by Canada’s National Broadband Network Board (NBBB) on Wednesday. NBBB also approved the takeover of RRC by Rogers Communications.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

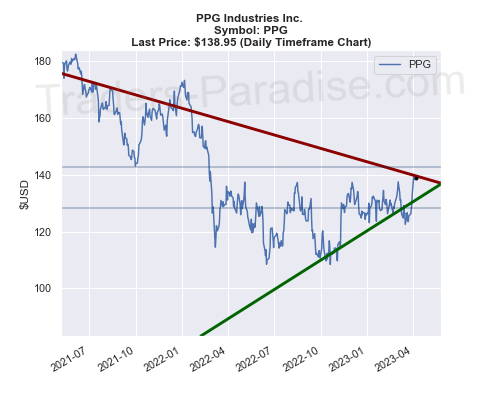

#21 Trading idea on PPG, might be reaching some kind of top

Company Name: PPG Industries Inc.

Symbol: PPG

Sector: Basic Materials

Description: Check out the latest news from PPG on social media.

PPG Industries, Inc. is an American Fortune 500 company and global supplier of paints, coatings, and specialty materials. It operates in more than 70 countries around the globe. It has its headquarters in Pittsburgh, Pennsylvania, and has operations in over 70 countries.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PPG — Higher sales volume, improved capturing of selling prices.

PPG Industries (PPG) raised its Q1 earnings guidance on higher sales volume and improved capturing of selling prices mainly from aerospace and automotive markets. PPG expects strong Q1 financial results backed by higher sales volumes and better capturing of prices, mainly from automotive and aerospace markets.

- News story for PPG — 15 analysts have a Buy rating on PPG Indus.

15 analysts have an average price target of $137.93 for PPG Indus. The greater the number of bullish ratings, the more likely it is that the target will be exceeded. PPG’s share price is currently at $138.365, implying a downside.

- News story for PPG — Q1 adjusted earnings are now expected to be $1.52 to $1.58 per share.

PPG Industries, Inc. (NYSE: PPG) said it expects Q1 adjusted earnings significantly above the company’s previous guidance. PPG is scheduled to report Q1 results on April 30th. . i

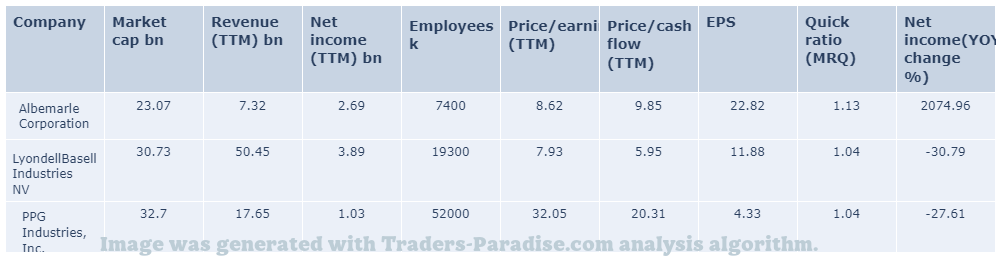

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

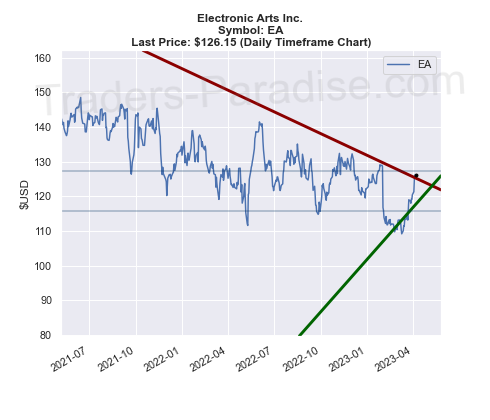

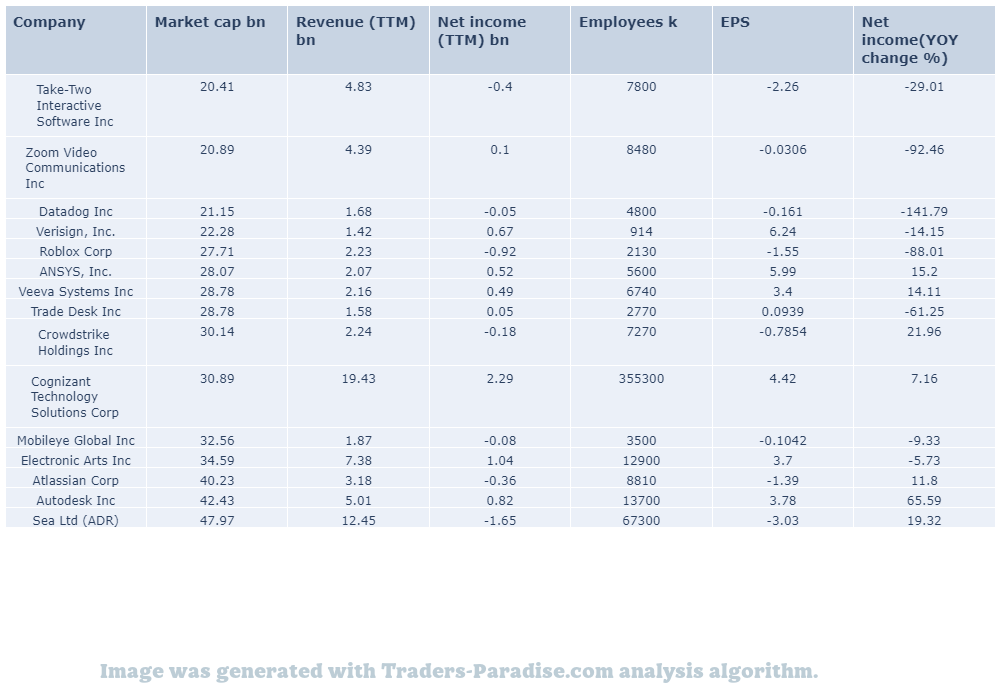

#22 Trading idea on EA, might be reaching some kind of top

Company Name: Electronic Arts Inc.

Symbol: EA

Sector: Technology

Description: Video game maker is one of the world’s most valuable companies.

Electronic Arts Inc. is the second-largest gaming company in the Americas and Europe by revenue and market capitalization after Activision Blizzard and ahead of Take-Two Interactive, and Ubisoft as of May 2020. It is headquartered in Redwood City, California.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for EA — Public Investment Fund is investing $38 billion. Gaming industry has a valuation of $184 billion

Saudi Arabia is making a $38 billion bet on the potential of its gaming industry to reduce its dependence on oil revenues. The investment is being made by the Saudi Arabian Public Investment Fund with the aim of establishing the country as a significant player in the global gaming market, which has a valuation of $184 billion.

- News story for EA — Unity Industry offering for 3D content development.

Unity Software (U) announces the release of Unity Industry. Unity Industry is an optimized offering for developing real time interactive 3D content. It’s available for free download from the Unity Software website. for developers of 3D games and games for mobile devices.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

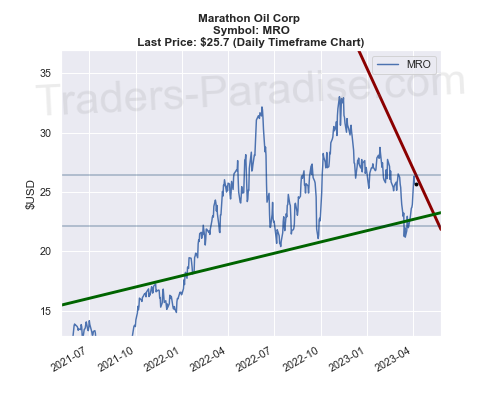

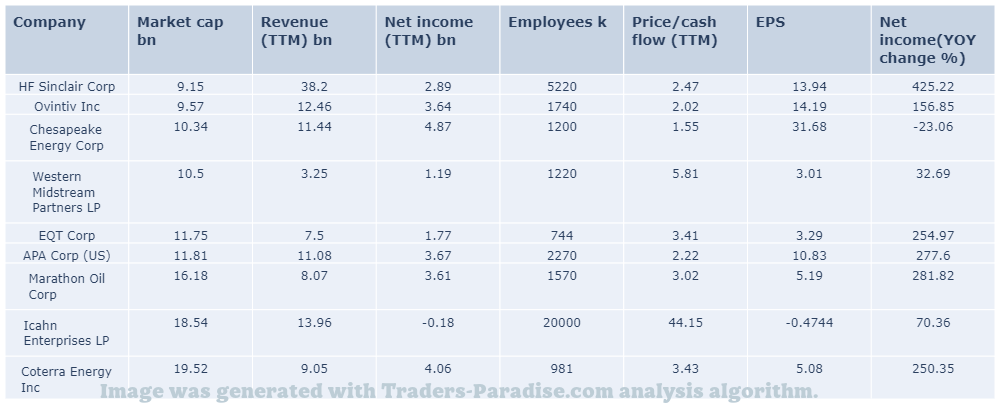

#23 Trading idea on MRO, might be reaching some kind of top

Company Name: Marathon Oil Corp

Symbol: MRO

Sector: Energy & Transportation

Description: Marathon Oil Corporation is an American company engaged in hydrocarbon exploration and production.

Marathon Oil Corporation is an American company engaged in hydrocarbon exploration. It is headquartered in the Marathon Oil Tower in Houston, Texas. The company was incorporated in Ohio and is based in Houston. It’s a subsidiary of Marathon Oil Corp. of Ohio.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for MRO — Marathon Oil (MRO)

Marathon Oil (MRO) closed the most recent trading day at $25.70. The stock moved -0.12% from the previous day’s trading session. MRO’s stock closed the previous trading session at $26.70, up 0.12%.

- News story for MRO — 15 oil and gas stocks expected to be backed by ample cash flow.

15 oil and gas stocks expected to be backed by ample cash flow through 2024. These companies are expected to have very high free cash flow yields and are likely to have good growth prospects through 2024, according to some analysts. Â

- News story for MRO — OPEC+ decided to cut oil production by 1.16 million barrels per day.

OPEC+ decided to cut oil production by 1.16 million barrels per day starting in May. Click here to see what this means for the investment community and read what I think it means for oil investors. i.e. OPEC+ Production Cut: A Massive Gift To The Oil Sector.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

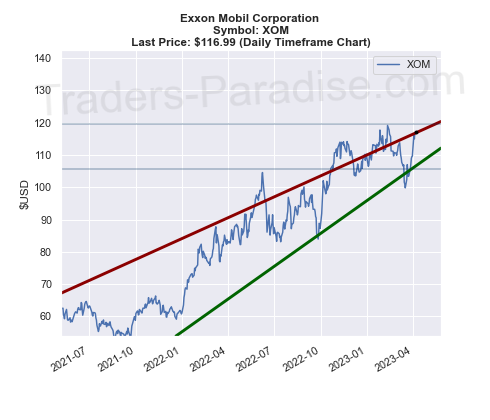

#24 Trading idea on XOM, might be reaching some kind of top

Company Name: Exxon Mobil Corporation

Symbol: XOM

Sector: Basic Materials

Description: Company is the largest direct descendant of John D. Rockefeller’s Standard Oil.

ExxonMobil is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil. ExxonMobil’s primary brands are Exxon, Mobil, Esso, and ExxonMobil Chemical. It was formed on November 30, 1999 by the merger of Exxon and Mobil.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for XOM — AT&T, Exxon Mobil, Home Depot are the best dividend stocks to buy.

AT&T, ExxonMobil and Home Depot are the best dividend stocks to buy for dividend investors. AT&T is the best stock to buy. ExxonMobil is the second best stock. Home Depot is the third best stock, according to Value Investor’s Choice.

- News story for XOM — Goals, current holdings, allocation, sales, and buys of Q1 2023.

Q1 2023 saw S&P 500 up 4% and gave investors a decent start for the year. Click here to read the goals, current holdings, allocation, sales, and buys of my Dividend Growth Portfolio for Q1 202023.

- News story for XOM — Energy ETFs to be affected by OPEC+ decision.

OPEC+ decided to cut its production supply, which caused oil prices to rise. Check how energy ETFs are affected by the decision to cut production by OPEC+ to play on the rise in oil prices and find out which ones can play on it.

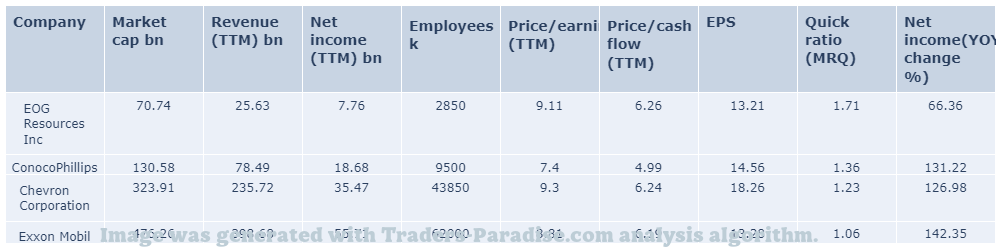

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply