Most recent news about the financial markets

- Anatomy Anatomy Anatomy Of A Recession: The Lagged Effects Of Hikes On The Economy.

The Lagged Effects of Rate Hikes Have Started, according to a new report. The report is titled “Anatomy of a Recession: The Lags Effects Of Rate Hike Have Started”. It is based on the fact that the rate hikes have started.

- Sentiment: Back To The 20s.

“Back to the 20s” is a song from Back To The 20s, a collection of songs with a nostalgic theme. “The Back to The 20’s” is an album with the same name. It’s an album of songs from “Back To The Twentys”.

- ETF designed to protect against inflation is attracting inflows.

There are signs of moderating U.S. inflation, but some investors worry that price pressures will stay high. This exchange traded fund designed to protect against inflation is attracting inflows.

- What the latest PPI inflation data signals for inflation & the stock market.

The latest PPI inflation data signals for inflation and the stock market today. PPI Inflation Report and Jobs Data Boost Markets On Thursday. Penny Stocks to Buy, Picks, News and Information are PennyStocks.com’s stock picks and information.

- 33 stocks in Russell 1000 have rallied more than 1,000%.

Bespoke Investment Group runs down the stocks in the Russell 1000 that have risen more than 1,000% in the last decade. Check out the 33 stocks that have rallied more than 1000% in last 10 years and the ’10 baggers’ here.

- Investors can use buffer ETFs to guard against market volatility.

There are Defined Outcome ETFs for Uncertain Markets. Here’s what investors should know about buffer ETFs and what to look for in them. For more information, go to: http://www.finance.com/news/investors/defined-outcome-exchange-funds-for-uncertain markets.

- Producer price index (PPI) fell 3.7% y/y in July.

PPI +2.7% YoY is 220 bps lower than the upwardly revised +4.9% the previous month. PPI is more than 4x lower than 40-year highs registered a year ago and is back near pre-Covid levels.

- E-mini futures for the S&P 500 index rise 0.3% after the print. Americans applied for jobless benefits last week at 239,000

Jobless claims for the week ending April 8th rose by 11,000 to 239,000. The figure came in higher than the projected 232,000, indicating some cooling in the labor market. E-mini futures for the S&P 500 index rose 0.3% following the print.

- Producer prices fell 0.5% in March. Year-over-year prices rose 2.7% in March

The producer price index (PPI) fell 0.5% in March, below economist forecasts for a 0.1% increase. The PPI print comes on the heels of a decline in February. On a year-over-year basis, the PPI number came in at 2.7% versus estimates of 3%.

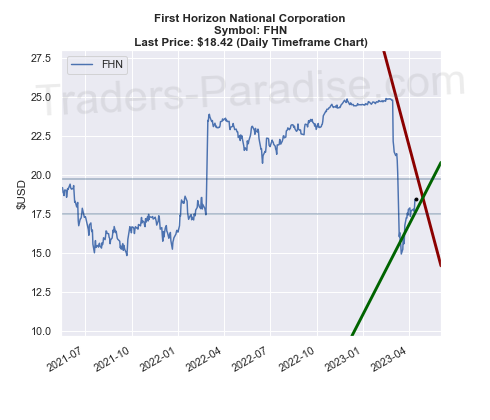

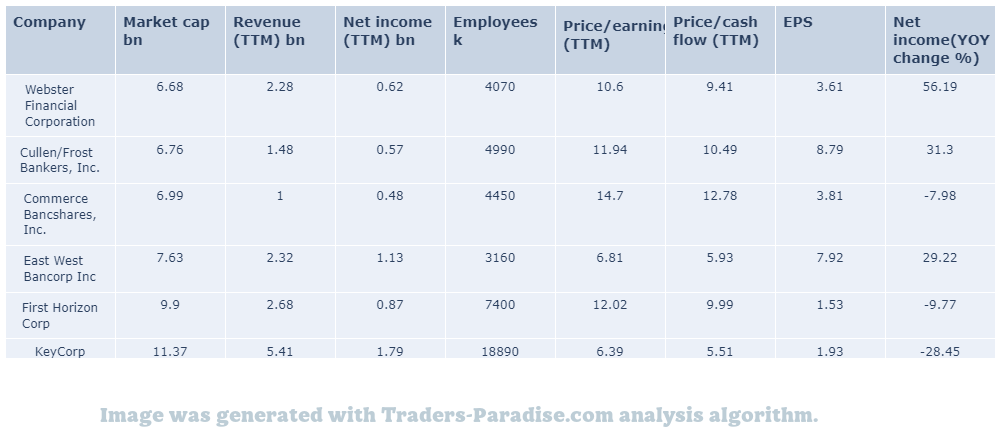

#1 Trading idea on FHN

Company Name: First Horizon National Corporation

Symbol: FHN

Sector: Financial

Company Description: First Horizon Corporation is the banking holding company for First Horizon Bank providing various financial services. The company is headquartered in Memphis, Tennessee and is the bank’s parent company. It is a publicly traded company with a market capitalization of $1.2 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for FHN — First Financial is set to report its first-quarter results on Tuesday, April 24.

First Financial Bankshares (FFIN) is going to report Q1 results. First Financial doesn’t possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations for FFIN’s upcoming results.

- News story for FHN — Traders have taken $3.7 billion of bets against the stock.

TD Bank is now the most shorted bank stock. Traders have taken $3.7 billion worth of bets against the large Canadian bank stock, which is a concern for investors. The stock is down 2.5%..

- News story for FHN — IVOV is a mid-cap value ETF.

Vanguard S&P Mid-Cap 400 Value ETF (IVOV) should be on your investing radar? Style Box ETF report for IVOV is available on the website of Vanguard’s investment advisor, who recommends IVOV as a suitable investment for investors.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

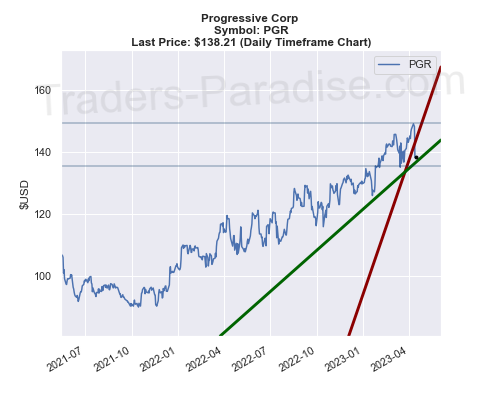

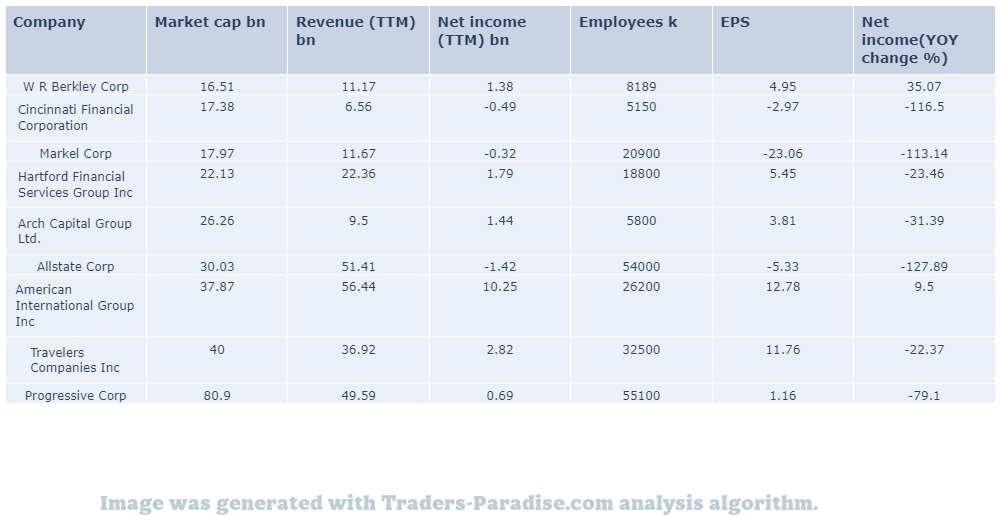

#2 Trading idea on PGR

Company Name: Progressive Corp

Symbol: PGR

Sector: Financial

Company Description: The Progressive Corporation is one of the largest providers of car insurance in the United States. The company insures motorcycles, boats, RVs, and commercial vehicles. It also provides home insurance through select companies. For more information, visit Progressive Corporation’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PGR — Earnings miss, revenues top estimates as expenses rise.

Progressive’s (PGR) Q1 earnings reflect improvement in the top line, offset by higher expenses. Revenues beat estimates, but the company missed on the bottom line by $0.01. PGR’s shares rose 1.5% on the news.

- News story for PGR — Top- and bottom-line numbers give a sense of how the business performed in the quarter.

Progressive (PGR) reported its first quarter results for the quarter ended March 2023. Key metrics of Progressive’s business compare to Wall Street estimates and year-ago values.

- News story for PGR — Earnings and revenue missed analysts’ expectations.

Progressive (PGR) delivered earnings and revenue surprises of -54.86% and 0.80% for the quarter ended March 2023, compared to the expected -0.80%. The company missed the market’s expectations by -54% and -54%, respectively.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

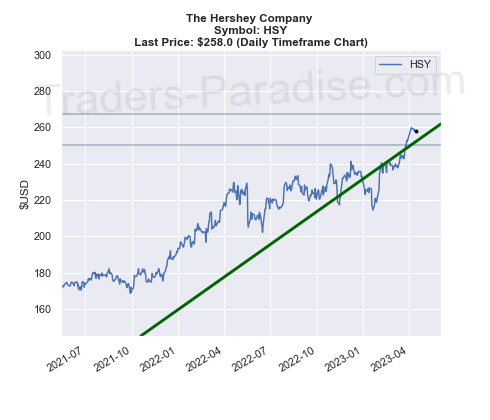

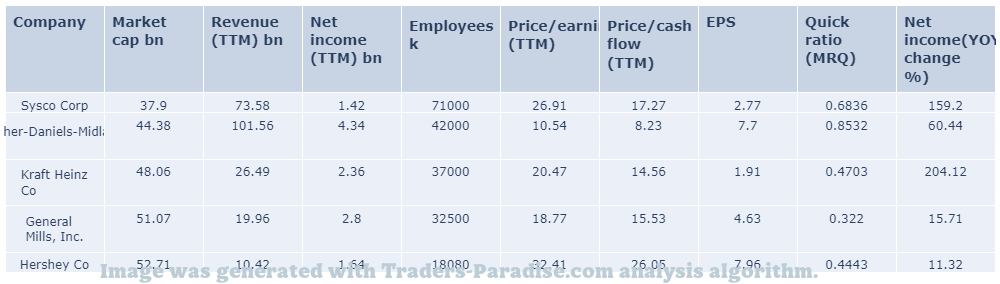

#3 Trading idea on HSY

Company Name: The Hershey Company

Symbol: HSY

Sector: Consumer Goods

Company Description: Hershey’s is one of the largest chocolate manufacturers in the world. It also manufactures baked products, such as cookies and cakes, and sells beverages like milkshakes. Its headquarters are in Hershey, Pennsylvania, and the company is based in the United States.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for HSY — Acquisitions to bolster portfolio strength, boost revenues.

Hershey’s (HSY) is undertaking buyouts to augment portfolio strength and boost revenues. The company regularly brings innovation to its core brands. Solid Pricing and Portfolio Strength Fuel Hershey’s Growth. – S&P Capital Market Analyst.

- News story for HSY — Hershey has beaten estimates in each of the last four quarters.

Hershey (HSY) has an impressive earnings surprise history. The company’s next quarterly report is expected to beat the estimates again. It currently possesses the right combination of the two key ingredients for a likely beat in its next report. It’s expected to be released on October 30th.

- News story for HSY — Hershey (HSY)

Hershey (HSY) closed the most recent trading day at $258.61. The stock moved -0.2% from the previous day’s trading session. Hsy closed the previous trading session at $259.61, up 0.2%.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

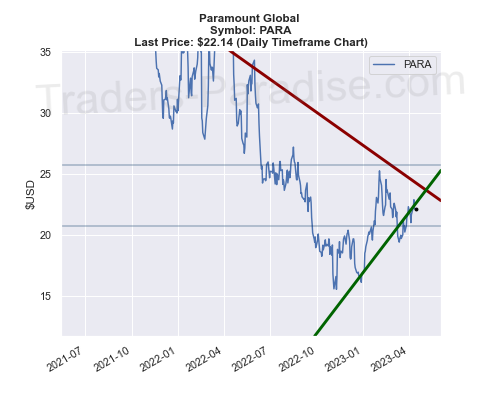

#4 Trading idea on PARA

Company Name: Paramount Global

Symbol: PARA

Sector: Technology

Company Description: Paramount Global is a global media and entertainment company. It is headquartered in New York, New York and has a global network of offices. It has more than 100,000 employees. It’s one of the world’s biggest media companies, with a turnover of over $20 billion.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for PARA — Shares of Paramount Global-B closed at $22.14 in latest trading session

. Paramount Global-B (PARA) closed at $22.14, up 0.05% from the previous day. for the latest trading session. For the previous trading session, Para-A (Para-A).

- News story for PARA — AMC, GameStop, Coinbase are the most squeezable stocks.

AMC, GameStop and Coinbase are the most squeezable stocks for short-sellers. The stock market has been on a tear for about a month and it’s looking grim for investors with big short positions now. Â

TECHNICAL ANALYSIS

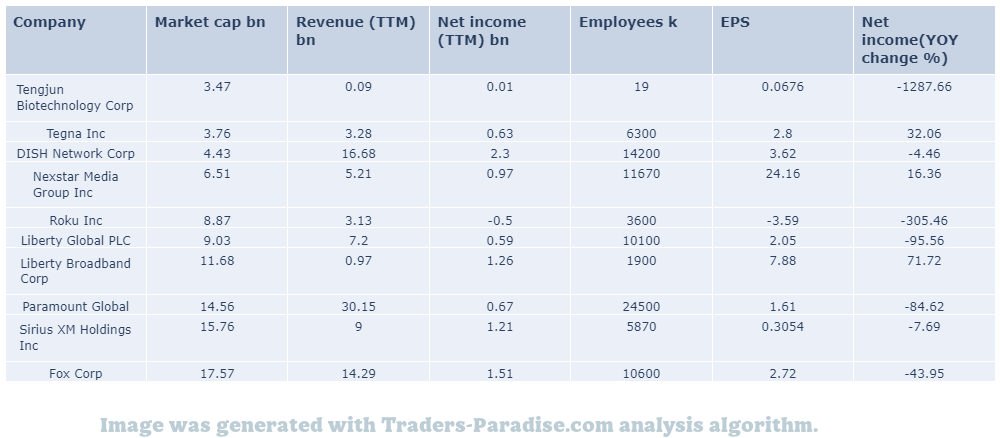

PEERS AND FUNDAMENTALS

#5 Trading idea on SJM

Company Name: J M Smucker Co

Symbol: SJM

Sector: Industrial Goods

Company Description: The J. M. Smucker Company is an American manufacturer of jam, peanut butter, jelly, fruit syrups, beverages, shortening, ice cream toppings, and other products in North America. Its headquarters are located in Orrville, Ohio.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for SJM — Negative net price realization seen in pet food, pet food segments.

The J. M. Smucker (SJM) benefits from its positive net price realization across all segments. The company is also progressing well by focusing on its core strategies. It is focusing on Pricing Efforts & Strategies. It’s also focusing on core business strategies.

- News story for SJM — Goals, current holdings, allocation, sales, and buys of Q1 2023.

Q1 2023 saw S&P 500 up 4% and gave investors a decent start for the year. Click here to read the goals, current holdings, allocation, sales, and buys of my Dividend Growth Portfolio for Q1 202023.

- News story for SJM — McCormick’s P/E ratio is higher than most of its peers

stock soared on Tuesday. McCormick stock doesn’t have a high P/E ratio, but it’s not a reason to avoid the stock either. i in the share price on Tuesday soared by 10% to $8.50.

TECHNICAL ANALYSIS

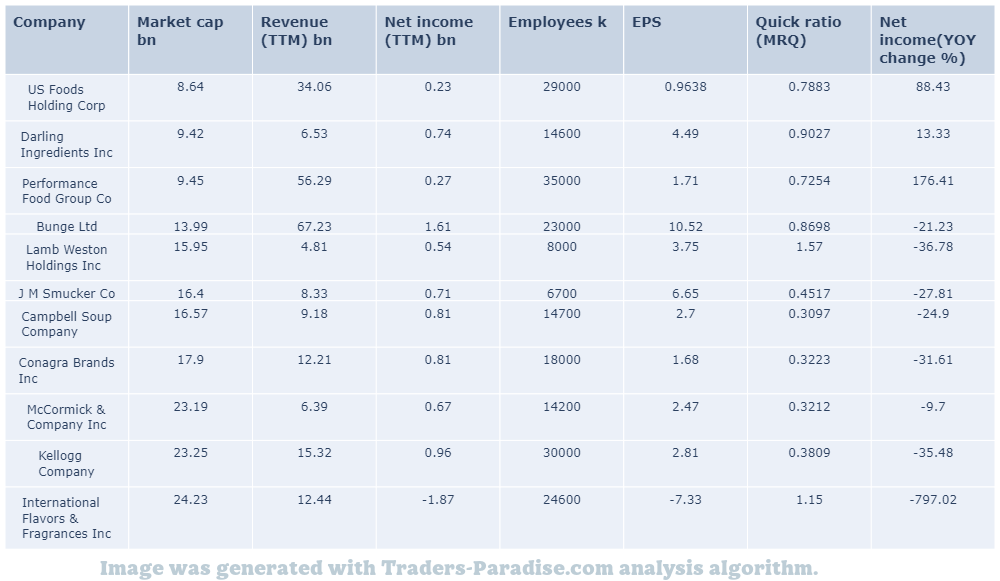

PEERS AND FUNDAMENTALS

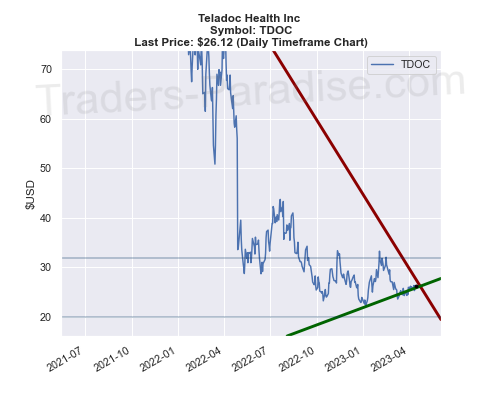

#6 Trading idea on TDOC, might be reaching some kind of top

Company Name: Teladoc Health Inc

Symbol: TDOC

Sector: Healthcare

Company Description: Teladoc Health provides business-to-business virtual health care services in the United States and internationally. The company is headquartered in Purchase, New York and provides services in both the U.S. and abroad. Teladoc is a privately-owned company.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for TDOC — Surging demand for virtual care is boosting revenues.

Teladoc Health (TDOC) is well-poised for growth on the back of solid revenues, sustained demand for virtual care services and sufficient cash-generating abilities. Here’s why you should hold Teladoc’s stock right now.

- News story for TDOC — Analyst says TDOC is well positioned to be bellwether.

Stephens analyst Jeff Garro initiated Teladoc Health coverage with an Equal-Weight rating and a price target of $25. He believes TDOC is well positioned to be the bellwether digital health company due to its unique assets and scale. TDOC has 80M+ members, 30K+ providers, 60+ NPS, 20M+ annual visits.

TECHNICAL ANALYSIS

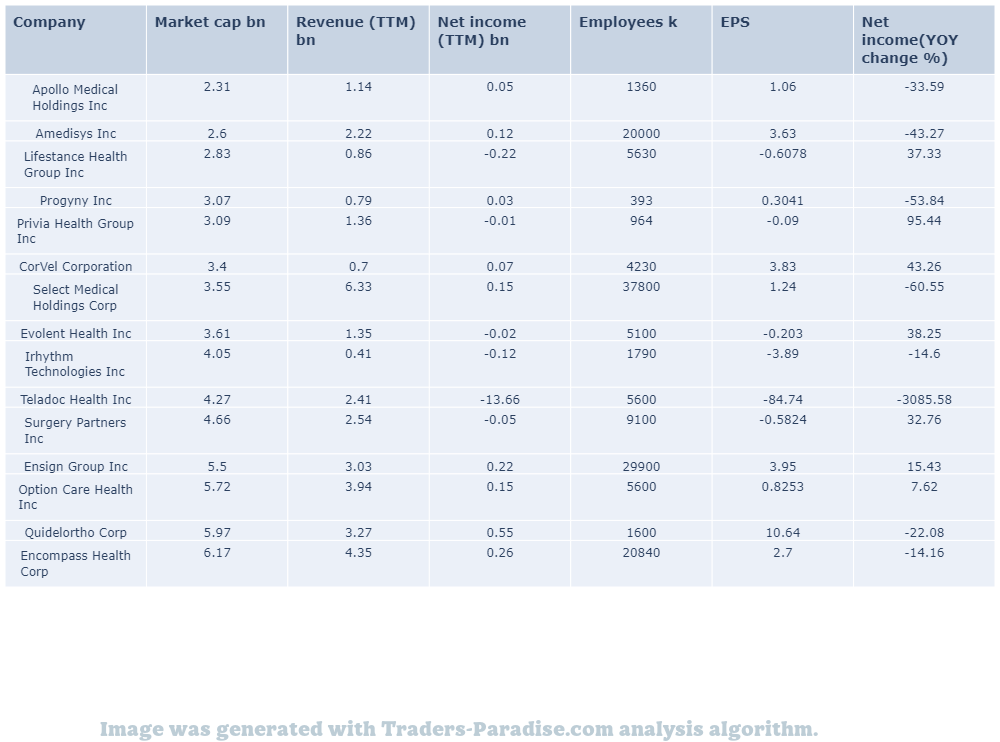

PEERS AND FUNDAMENTALS

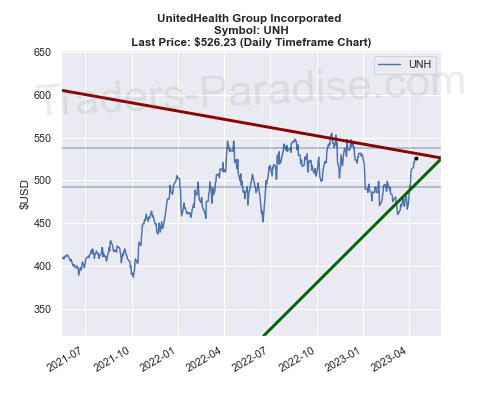

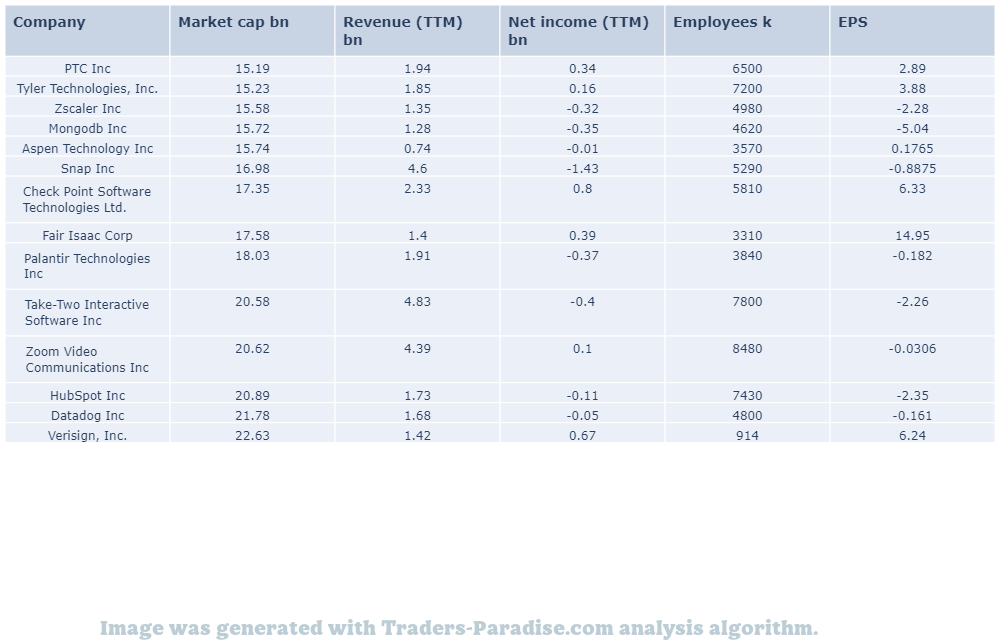

#7 Trading idea on UNH, might be reaching some kind of top

Company Name: UnitedHealth Group Incorporated

Symbol: UNH

Sector: Healthcare

Company Description: UnitedHealth Group Incorporated is an American for-profit multinational managed healthcare and insurance company based in Minnetonka, Minnesota. In 2020, it was the second-largest healthcare company (behind CVS Health) by revenue with $257.1 billion and the largest insurance company by net premiums. UnitedHealthcare revenues comprise 80% of the Group’s overall revenue.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for UNH — Health insurer to boost value-based care in New York state.

UnitedHealth Group (UNH) acquires Crystal Run to offer enhanced value-based care across the Hudson Valley and lower Catskill region, as per multiple reports. UNH will buy Crystal Run for $1.5 billion, according to some reports.

- News story for UNH — Q1 earnings season kicks off this week for S&P 500 index.

Banking turmoil hit the Dow hard last month. Recession fears have added to the woes. Dow is closely tied to the cyclical sectors and is expected to rally on Q1 earnings announcement. iReport.com: Will Q1 Earnings Fuel a Rally in Dow ETF?

- News story for UNH — Vanguard Dividend Appreciation ETF (VIG) is a strong ETF.

Vanguard Dividend Appreciation ETF (VIG) is a strong ETF right now. Smart Beta ETF report for VIG has been updated. vig is an exchange traded fund with a market capitalization of $1.2 billion. It offers investors a variety of investment options.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Sorry, no table at the moment.

#8 Trading idea on ZM, might be reaching some kind of top

Company Name: Zoom Video Communications Inc

Symbol: ZM

Sector: Technology

Company Description: Zoom Video Communications, Inc. provides a premier video communications platform in the Americas, Asia Pacific, Europe, the Middle East, and Africa. The company is headquartered in San Jose, California, and provides services in the following regions: Asia Pacific and Europe.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for ZM — U.S. economy added 236,000 jobs in March, just shy of economists’ expectations.

The U.S. economy added 236,000 jobs in March, just shy of economists’ expectations. The unemployment rate is now 3.5%. Is this the last chance for job switchers to jump ship? iReport.com:

- News story for ZM — Warren Buffett and Cathie Wood rank the best stocks for investing in artificial intelligence.

Buffett and Wood picked successful stocks despite radically different approaches to AI. Warren Buffett’s Apple and Cathie Wood’s Tesla are better AI investments than each other, according to a recent study. The study compared them on the basis of their respective AI-related investments.

- News story for ZM — Shares of Facebook, Alphabet and Amazon are up this year.

For now, these three tech stocks don’t need AI to deliver market-beating returns, but they are worth a look. for now, steer clear of the AI hype for now and focus on the real-world business opportunities. iReport.com will let you know.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

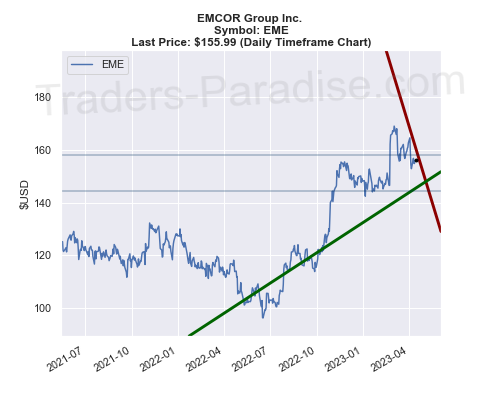

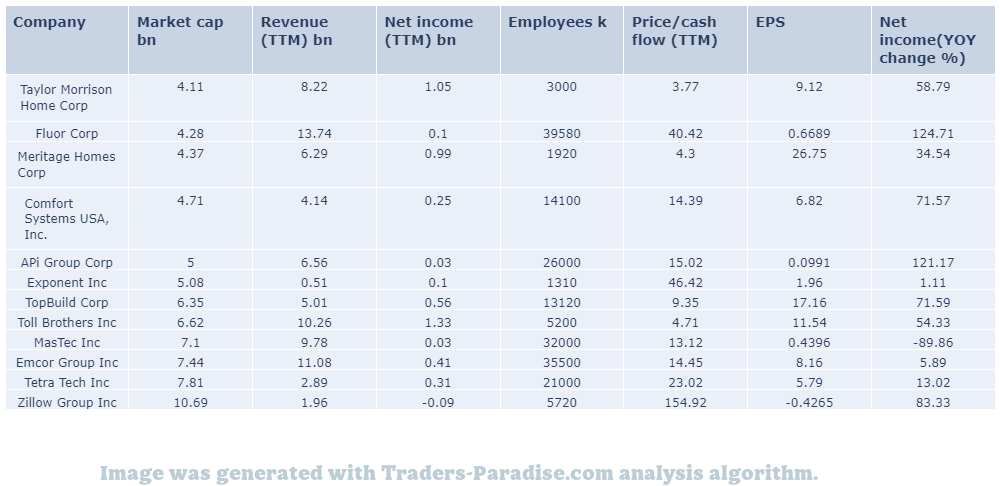

#9 Trading idea on EME, might be reaching some kind of top

Company Name: EMCOR Group Inc.

Symbol: EME

Sector: Industrial Goods

Company Description: EMCOR Group, Inc. provides electrical and mechanical installation and construction services in the United States. The company is headquartered in Norwalk, Connecticut and has a turnover of $1.5 billion. It has a workforce of about 2,000 people.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for EME — 5 stocks to watch that recently hiked dividends.

QUALCOMM (QCOM), H.B. Fuller Company (FUL), GFL Environmental (GFL), Constellation Brands (STZ) and EMCOR Group (EME) recently hiked their dividends. 5 Stocks to Watch That Recently Hiked Dividends

- News story for EME — Emcor Group has an impressive earnings surprise history.

Emcor Group (EME) is expected to beat earnings estimates again in its next quarterly report. Emcor has an impressive earnings surprise history and possesses the right combination of the two key ingredients for a likely beat in the next quarter’s report. The company has a positive outlook for the future.

- News story for EME — Fastenal to report higher demand for manufacturing amid inflationary pressures.

Fastenal’s (FAST) Q1 results are likely to reflect higher demand from manufacturing amid inflationary pressures, negative product and customer mix and adverse price/cost dynamics. Fastenal is expected to report Q1 earnings on April 25th.

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

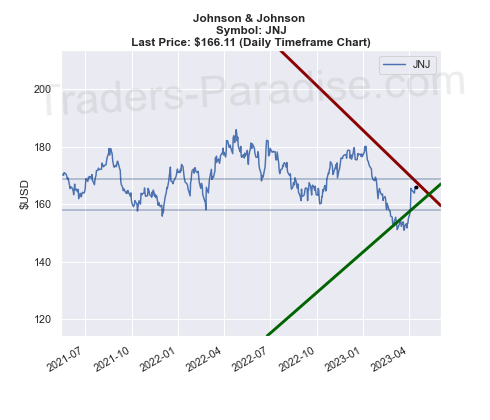

#10 Trading idea on JNJ, might be reaching some kind of top

Company Name: Johnson & Johnson

Symbol: JNJ

Sector: Healthcare

Company Description: Johnson & Johnson was founded in 1886. Its common stock is a component of the Dow Jones Industrial Average. The company is ranked No. 36 on the 2021 Fortune 500 list of the largest U.S. corporations by total revenue. J&J has a prime credit rating of AAA.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for JNJ — Q1 earnings season kicks off this week for S&P 500 index.

Banking turmoil hit the Dow hard last month. Recession fears have added to the woes. Dow is closely tied to the cyclical sectors and is expected to rally on Q1 earnings announcement.

- News story for JNJ — Why Next Week’s Earnings Report Should be Good for Johnson & Johnson

Next week’s Earnings Report should be good for Johnson & Johnson, according to some analysts. iReport.com: What do you think the next week’s earnings report should be for J&J and why should it be good or bad for the company?

- News story for JNJ — Dividend growth outpaced growth in the economy in March.

My portfolio’s dividend income in March amounted to a record $950. This represents growth of 61% Y/Y and 40% sequentially. Click here for a detailed analysis of the portfolio’s performance.

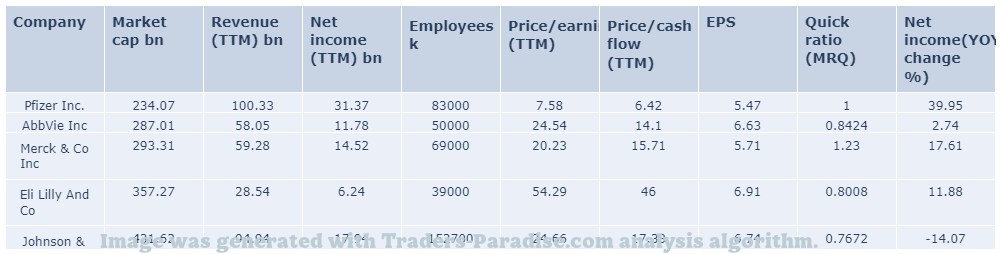

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

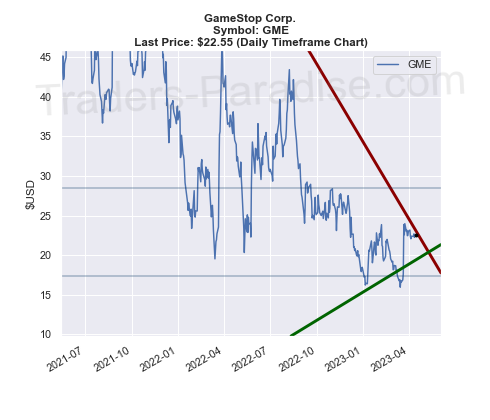

#11 Trading idea on GME, might be reaching some kind of top

Company Name: GameStop Corp.

Symbol: GME

Sector: Services

Company Description: GameStop Corp. is headquartered in Grapevine, Texas, and the company is a subsidiary of GameStop Inc., which is based in New York City. The company is valued at more than $20 billion, according to the company’s website.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for GME — Final ‘The Legend of Zelda’ trailer reveals Ganondorf, returning champions.

The Legend of Zelda: Tears of the Kingdom is the sequel to the Nintendo Switch’s wildly successful open-world videogame drops in a month. The first game has sold more than 30 million copies and is expected to be even better than the first one.

- News story for GME — Some of the biggest names in the stock market are trading at high multiples.

The Felder Report’s Jesse Felder looks at four popular Dow heavyweights whose shares and valuations are expensive and loaded with debt, according to an analyst. The report’s call of the day is “Beware of these popular Dow bigwigs”.

- News story for GME — AMC, GameStop, Coinbase are the most squeezable stocks.

AMC, GameStop and Coinbase are the most squeezable stocks for short-sellers. The stock market has been on a tear for about a month and it’s looking grim for investors with big short positions now.

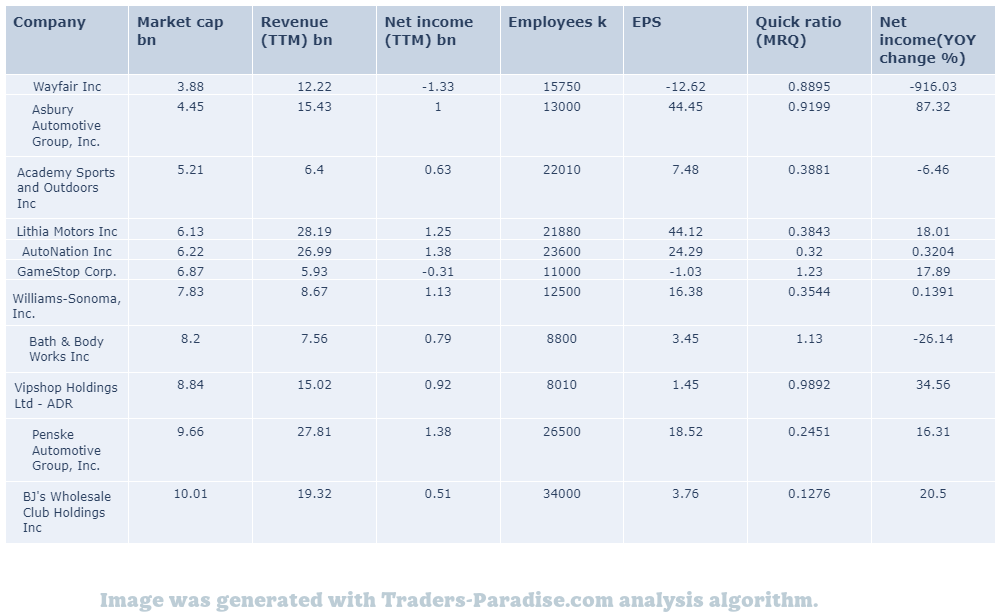

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

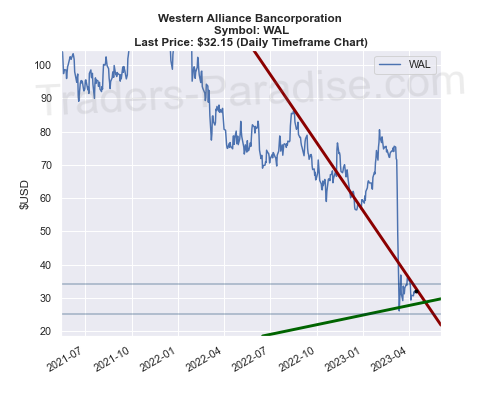

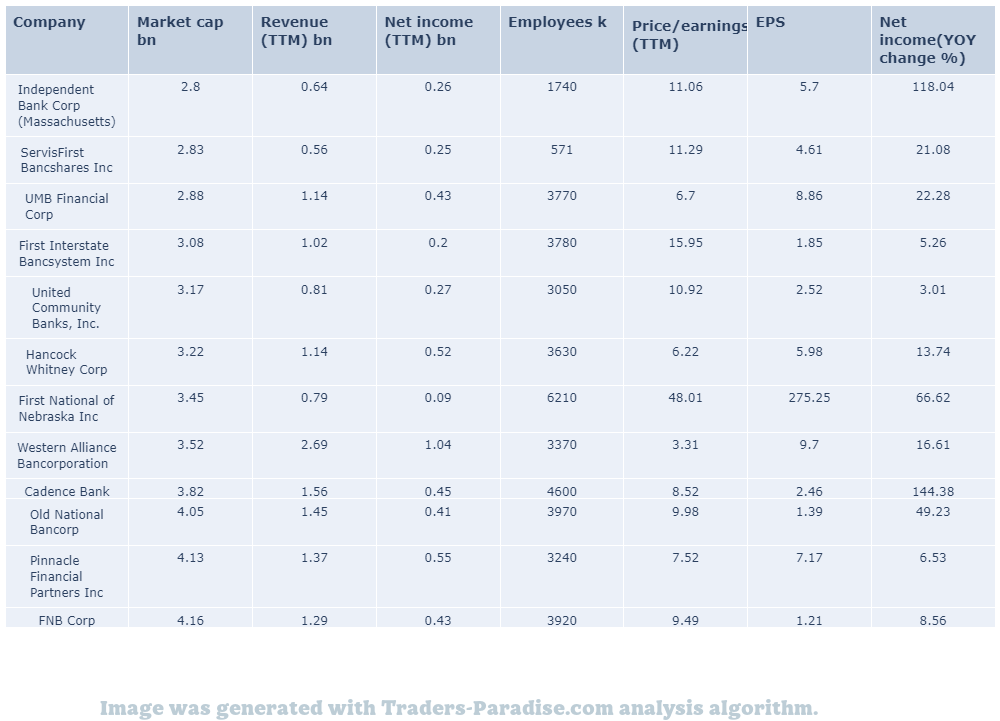

#12 Trading idea on WAL, might be reaching some kind of top

Company Name: Western Alliance Bancorporation

Symbol: WAL

Sector: Financial

Company Description: Western Alliance Bancorporation is the banking holding company for Western Alliance Bank offering various banking products and related services in Arizona, California and Nevada. The company is headquartered in Phoenix, Arizona and offers products and services mainly in Arizona and California, but also in Nevada.

NEWS THAT MIGHT INLUENCE STOCK PRICE:

- News story for WAL — Western Alliance (WAL)

Western Alliance (WAL) closed at $31.57 in the latest trading session, marking a -0.85% move from the prior day. Broader Markets (BME) closed the day at $30.57. WAL is down more than 0.85%.

- News story for WAL — Earnings Expected to Grow: What to Know Ahead of Q1 Release.

Central Valley Community Bancorp (CVCY) is expected to grow its earnings in its upcoming report. Get prepared with the key expectations for CVCY’s Q1 earnings report. for a likely earnings beat in the upcoming report and for the future.

- News story for WAL — Questions to ask banks ahead of earnings season.

This will be one of the most highly anticipated earnings seasons for banks following the recent banking crisis. The 3 most pressing questions for banks heading into the earnings season are “What are the most important things to ask them?” and “What is the most pressing question for you?”

TECHNICAL ANALYSIS

PEERS AND FUNDAMENTALS

Ideas are deleted after 3 months.

This page was generated using Traders-Paradise AI.

Leave a Reply