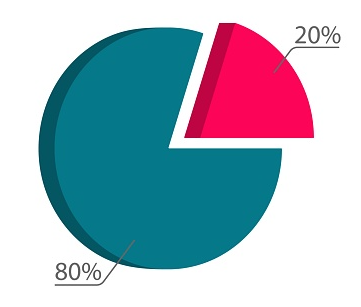

The Pareto Principle is one of the world’s most popular theories for management. In particular, it’s pointed out that 20 percent of the actions are the impact of a circumstance in most cases.

In some companies, for example, a majority of sales are generated by a few customers. The Pareto principle is currently used in stock and financial markets, also known as the 80/20 or 80-20 rule.

- According to the 80-20 rule, 80% of outcomes (outputs) are the result of 20% of causes (inputs).

- The 80-20 rule states that you should focus on the 20% of things that will create the best results.

- The 80-20 rule states that an entity’s best assets should be identified and used efficiently to maximize value.

- This “rule” is more of a guiding principle than a hard-and-fast mathematical rule.

In the trading industry, the 80-20 rule is often used. You might find that trading a particular currency pair or stock yields the maximum returns for you as a trader. Trading firms may discover that 20% of their traders generate the majority of their income.

Similarly, businesses may find that trading a certain asset type, such as stocks or cryptocurrencies, generates the majority of their revenue.

The 80-20 guideline can be used to trading days or seasons. For example, you might find that the morning sessions or the first part of the year provide 80% of your income.

It’s important to note that 80-20 is only a starting point. It’s possible to modify the ratio to 70-30 or 60-40.

In company management, the 80-20 rule has proven to be useful. 20% of a company’s clients account for 80% of sales. In addition, 20% of the workforce is responsible for 80% of the outcomes. Many managers have observed that the first 20% of a project’s effort delivers 80% of the project’s results. As a result, the 80-20 rule can assist managers and business owners in focusing 80% of their time on the 20% of their firm that produces the best outcomes.

The 80-20 rule in investing states that 20% of a portfolio’s holdings account for 80% of its growth. On the other hand, 20% of a portfolio’s assets may be responsible for 20% of the portfolio’s losses.

In finance, when does the 80/20 rule come into play?

In the corporate world, this idea has been used to assess and improve management (when 20% of workers create 80% of outcomes), sales tactics (20% of clients generate 80% of revenues), and operations (80 percent of product defects come from 20 percent of production problems).

The 80/20 rule is frequently used to assist budgeting in personal finance. It instructs people to deposit 20% of their monthly income into savings, whether in a typical savings account, a brokerage or retirement account, to ensure that they have adequate money set aside in case of financial trouble, and to spend the remaining 80%. In investing, it’s been discovered that 20% of a portfolio’s assets account for 80% of its growth. On the other hand, 80 percent of investment losses may be traced back to 20 percent of assets. However, due of the volatile nature of the stock market, this rule is frequently used to assess past purchases rather than to direct future ones.

Pareto rule is not an actual math law

The 80/20 rule is neither a rigid or precise mathematical formula, and it is based on anecdotal data rather than scientific research. The fact that the two figures sum up to 100 percent is just coincidental, and the inputs (80%) and outputs (20%) are simply designed to symbolize distinct units rather than be used to guide exact computations.

Examples to Pareto Principal:

80 percent of traffic comes from 20% of posts.

The Pareto 80/20 rule may be used by content marketers to assess the most productive postings. Find out what they have in common and try to incorporate them into your future content efforts.

Additionally, with the remaining 80%, strive to optimize them by adapting them to the 20% that are successful.

80 percent of the program’s functionality is accounted for by 20% of software development efforts.

Programming hours are costly, and understanding the Pareto 80/20 rule may be a deciding factor in the development of new software, allowing the production of a best-practices handbook and a database of successful projects to reference.

How to apply 80 / 20 principal to my portfolio

Despite the fact that the 80/20 rule has a wide range of applications, investing professionals advise against using it to create a portfolio.

When people put 80 percent of their money into safer assets like savings bonds and the remaining 20% into riskier growth equities, the 80/20 rule may be utilized to successfully manage risk. The 80/20 rule, on the other hand, should not be used to try to hand-pick stocks that can possibly generate 80% of your profits.

The monetary takeaway

The 80/20 rule states that the majority (80% ) of a situation’s or process’s outcomes arise from only a few (20%) of its causes. Although this rule may be used in a variety of situations, financial professionals warn against utilizing it to make portfolio decisions.

Rather of trying to design a portfolio where a few assets shine, it’s better to set clear, quantifiable investing goals and protect yourself with a diverse portfolio.

Leave a Reply