Golden rules for fast money and easy earnings are mostly what young people want to succeed in the business world. They are attracted with exchanges, money are invested in shares.

However, there are many curves, curvatures, spirals and twists that, and if you don’t know how to avoid them, your trip to the stock market can be very short-lived.

What are the golden rules for investing in the stock market, which should be known primarily to beginners in this business, but also to more experienced stock traders?

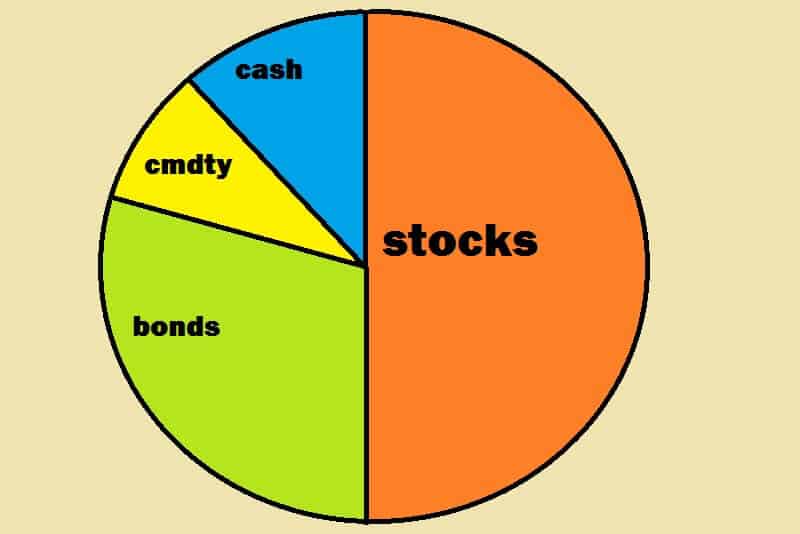

Create a trading portfolio

You can do this in a simple way. There are many free portfolio managers on the Internet, so use some of them to make a free account (click here for free demo account).

Create a fictitious portfolio in which you would potentially invest and monitor the situation for a while, a minimum of one month. This will give you the best insight into market volatility.

Before you take the first step, the goal is to create a profitable fictitious portfolio as an investor on the stock market. This is one of the golden rules.

Read business magazines

In order to successfully start investing in the stock market, you need to be aware of the world’s stock market and what are the social events that affect the rise or fall the price of shares. There are many respectable business magazines dealing with this topic (Forbes, The Economist, Kiplinger’s are some of the most famous ones). Follow the events in the global economy and finance and you will be able to swim more easily in the very turbulent waters of the stock market.

Buy stock from a field you know well

Before investing money into something, you should understand the business the company is dealing with. The first stock you will buy on the stock market should be from the sector you understand and it is familiar to you. For example, if you know the banking sector, try to explore the market and find a bank whose stocks are good and worth investing. Never invest in the action itself, but in the company.

Have realistic expectations

There may be a problem if your financial goals are based on unrealistic presumption.

Try to be realistic in your ambitions and goals. In this way, there are fewer chances to lose money or be disappointed in your stock market business.

Do your own research

You will hear from people who are dealing with the stock exchange that they have bought some stocks because the same was done by their friend or a family member who understands this business.

Accept everything with reserve. Before buying a stock, do research.

If some stocks brought in earnings in the past doesn’t necessarily mean that this trend will continue.

Always believe more in yourself than other people’s estimation.

Stock exchange is NOT a money making machine

Most of those who want to participate stock market, have an unrealistic desire to double or triple investment in a short time frame.

If you are one of them, then that’s not a job for you.

For those who want to invest, 10% to 12% of the earnings for a long period is quite a good investment. You need to realize that you are just a small fish in a big lake and that your success depends on many factors.

Follow the clues and make conclusions.

3 or 4 good stocks are enough

Don’t overplay, especially because you are a beginner in this business.

More than 10 stocks are a good portfolio, but for investment funds.

It is true that they make more profit, but if you make a smart and wise decision you will earn enough money.

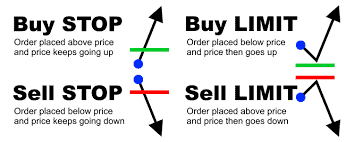

Don’t try to predict the stock price

Not even the biggest billionaires and owners of the largest multinational companies in the world are doing this.

No one is able to predict, at least for a longer period, several stock market cycles.

Ability to guess the moment when the stock will have the highest value is still a myth. Even for those who have an insight into the business of some companies.

Therefore, for successful business and investing in the stock market, you need to acquire certain knowledge and skills.

Although, there are some artificial intelligence computer software that might not predict per-se, but behave and act faster and more accurate way than a human being.

According to the research, the risk of investing in the stock exchange is most often taken over by young people who have just finished college.

But, like in every other business, the experience you get, will help you be wiser in making decisions in the future.

That’s how it works!

Leave a Reply