(Updated October 2021)

2 min read

What is a lot? A lot is the smallest available trade size that you can place when trading the Forex market. The brokers will point to lots by parts of 1000 or a micro lot. You have to know that lot size directly influences the risk you are taking.

Hence, finding the best lot size with a tool like a risk management calculator can help you determine the desired lot size. It has to be based on the size of your accounts. No matter if you exercise or trade for real. You must understand the amount you would able to risk.

In the stock market, lot size refers to the number of shares you buy in one transaction.

In options trading, lot size signifies the total number of contracts contained in one derivative security. The theory of lot size allows financial markets to regulate price quotes.

It basically refers to the size of the trade that you make in the financial market. With the regulation of prices, investors are always aware of exactly how many units they are buying an individual contract. Hence, they can quickly evaluate what is the price they are paying for each unit.

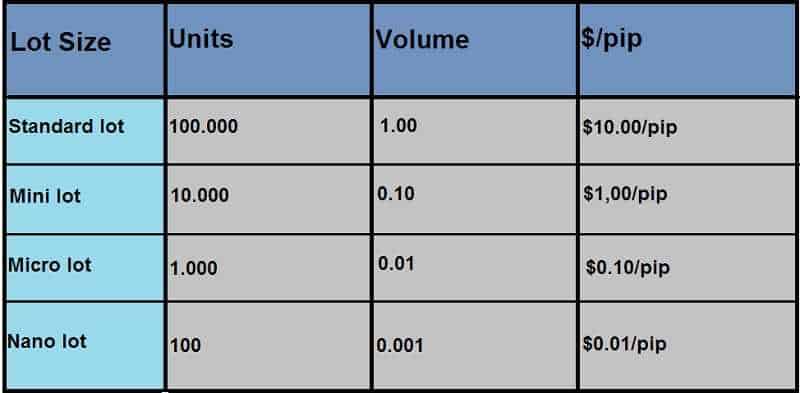

As it is already written in our previous post, currency movements are measured in pips and depending on your lot size a pip movement will have a different monetary value.

How much is 1 Lot?

In Forex, 1 standard lot refers to the volume of 100.000 units. So when you buy 1 lot of a forex pair, that means you purchased 100.000 units from the base currency.

Assume that you want to buy EUR/USD and let’s say that the EUR/USD exchange rate is 1.10.

When you buy 1 lot of EURUSD you will be making $110.000 worth of purchase.

If you are using leverage on your broker you don’t need to have $110.000. With 1:100 leverage, you will only need $1.100 (110.000 / 100 = $1.100) in order to be able to execute the order.

When the leverage goes higher, the margin you need to open the trade goes lower.

For example, if you are using 1:500 leverage, you need only $220 (110.000 / 500 = $220) to buy 1 standard lot of EUR/USD.

For 1 lot or standard lot, worth of one pip is equal to $10 if USD is on the counter currency in that pair. Therefore, if EUR/USD goes upwards for 100 pips after you buy, you will make $1000 of profit.

Every trader must define the volume of the trades based on own risk perception. The bigger lot means bigger the profit/loss from the trades.

Of course, it is reasonable sometime to open trades under 1 lot using the mini lot, micro lot and nano lot.

Mini Lot size

Suppose you are new in forex trading, it is strongly recommended to use mini, micro or nano lots to avoid big losses.

Mini lot is equal to 10% of standard lot (100.000 x 0.10 = 10.000 units). Thus, when you open 0.10 lot, you will trade 1 mini lot. With every mini lot, the worth of 1 pip for EUR/USD equals to $1.

If you are a novice and you want to start trading using mini lots, be well capitalized.

$1 per pip seems like a small amount but in forex trading, the market can move 100 pips in a day, occasionally even in an hour. If the market moves against you, that is a $100 loss. To trade a mini account, you should start with at least $2000.

Micro Lot size

Micro lot is equal to %1 of standard lot (100.000 x 0.01 = 1.000 units).

When you trade 0.01 lot of EUR/USD, you buy or sell 1.000 units of EURUSD.

The worth of every 1 pip for EUR/USD is $0.10 if you use a micro lot (0.01).

Micro lots are the smallest tradable lot.

A micro lot is a portion of 1000 units of your accounting funding currency.

If your account is financed in US dollars a micro lot is $1000 worth of the base currency you want to trade. If you are trading a dollar-based pair, 1 pip would be equal to 10 cents.

Micro lots are very good for beginners.

Nano Lot size

Nano lot, named cent lot by some forex brokers, is equal to either 100 or 10 units. In some forex brokers, nano lot refers to 10 units while in some other brokers, it may refer to 100 units.

Nano lot is not offered by many forex brokers.

Truly, only a few brokers offer this option as an account type such as FXTM and XM.

Nano lot is the safest way to trade if you are a novice trader or if you want to test a new trading strategy.

You can go through the training process with much less risk and loss.

Also, if you bought a new expert advisor or are trying a new trading strategy, it is smart to use nano lot for the first few weeks. Just in order to avoid big losses.

The bottom line

It is smart to likening the lot size that you trade and how a market move would affect you to the amount of support you have when something suddenly happens.

When you place an extremely large trade size relative to your accounts, you can be faced with many troubles.

Even small movement in the market could send a trader the point of no return.

Leave a Reply