2 min read

Nothing more represents the term diversified investment than proverb “Don’t put all your eggs in one basket.” Instead, invest in many baskets and hold a substantially diversified portfolio based on your long-term asset allocation strategy.

A diversified investment is exactly that.

A diversified investment represents a portfolio of various assets that earn the highest return for the smallest risk. This kind of portfolio has a mixture of stocks, fixed income, and commodities. These assets react differently to the same economic occasions and because of that, diversification works. With diversified funds, you can access financial markets while spreading your investments across several asset classes and geographic regions. In this way, you reduce the impact of market fluctuations while maintaining an attractive potential performance.

In a diversified portfolio, the assets don’t match each other. When one rises, the other falls. It drops down overall risk because some asset classes will benefit, no matter what the economy does. They equalize any losses of the other assets. There is also less risk because it’s difficult the entire portfolio would be destroyed by any single event. A diversified portfolio is the best protection against a financial crisis.

How does Diversification work?

Stocks do well when the economy grows. Investors want the highest returns, so they bid up to the price of stocks. They are willing to accept a greater risk because they are optimistic about the future.

Bonds do well when the economy slows.

Investors are more interested in protecting their holdings. They are willing to accept lower returns for that reduction of risk.

The prices of commodities vary with supply and demand. Commodities include wheat, oil, and gold. For example, wheat prices would rise if there is a drought that limits supply. Oil prices would fall if there is additional supply. As a result, commodities don’t follow the phases of the business cycle as closely as stocks and bonds.

Diversification typically has low correlations to, or do not move in lockstep with, more traditional asset classes. As such, their inclusion in an investment portfolio tends to result in lower overall volatility. Because they have a wider universe in which to invest (public and private) and do not have some of the same investment constraints (can short and hedge), alternative investments have the potential for higher long-term performance than traditional investments.

Investing in diversified funds can, therefore, be an effective tool to:

- Seek growth in your savings with a medium-term outlook and moderate risk

- Benefit from exposure to several markets (equity, bonds) that is adjusted to match current conditions in order to both take advantage of market rallies and cushion against the impact of declines

- Manage your portfolio simply with access to turnkey management: the manager adjusts the make-up of your portfolio over time.

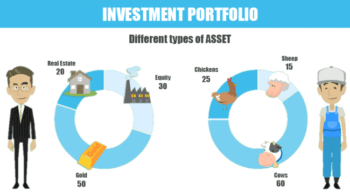

Where can you execute the diversified portfolio?

A diversified portfolio should contain securities from the following six asset classes.

Stocks. Different sized companies should be included. Company size is measured by its market capitalization. Therefore, include small-cap, mid-cap, and large-cap in any portfolio.

Fixed income. The safest are savings bonds. These are guaranteed by the government. Municipal bonds are also very safe. You can also buy short-term bond funds and money market funds that invest in these safe securities. Corporate bonds provide a higher return with greater risk. The highest returns and risk come with junk bonds.

Foreign stocks. These include companies from both developed and emerging markets. You can achieve greater diversification if you invest overseas. International investments can generate a higher return because emerging markets countries are growing faster. But they are riskier investments because these countries have fewer central bank safeguards in place, can be susceptible to political changes, and are less transparent.

Foreign fixed income. These include both corporate and government issues. They provide protection from a currency decline. They are safer than foreign stocks.

Commodities. This includes natural resources such as gold, oil, and real estate. Gold should be a part of any diversified investment because it’s the best hedge against a stock market crash. Research shows that gold prices rise dramatically for 15 days after the crash. This is why people invest in gold. Gold can be a good defense against inflation. It is also not correlated to assets such as stocks and bonds.

Maybe you should include the equity in your home in your diversification strategy.

If your equity goes up, you can sell other real estate investments in your portfolio. You might also consider to sell your home, take some profits, and move into a smaller house.

Most investment advisors don’t count the equity in your home as a real estate investment. They assume you will live there to the end of the time. They saw it as a consumable product, so that encouraged many homeowners to loan against the equity in their homes to buy consumable goods. When housing prices declined, they owed more than the house was worth. Many people walked away from their homes while others declared bankruptcy.

Expected return

Investors often focus too much on the expected return of their portfolio. While the expected return is important, you must also consider the amount of risk that you need to assume in order to achieve that expected return – the higher the expected return, the more risk you must take on to achieve it. When planning your investment strategy, it is important to be truthful with yourself in evaluating how much risk you can manage, and how long you are able to stay on the course through the ups and downs of the market rhythm. With other words, you should determine how much short-term volatility you are willing to accept.

A little bit of history.

An academic named Harry Markowitz introduced the research on what he called modern portfolio theory that people were able to understand diversification in an objective, mathematical sense. This research was so innovative and Markowitz earned a trip to Sweden to pick up a Nobel Prize.

The bottom line

In Shakespeare’s play, “The Merchant of Venice,” written more than 400 years ago, the character Antonio demonstrates his understanding of the concept. He says: “I thank my fortune for it – my ventures are not in one bottom trusted, nor to one place, nor is my whole estate upon the fortune of this present year.” That is a diversified investment.

Risk Disclosure (read carefully!)

Leave a Reply