Demat and trading accounts are important to start trading

By Guy Avtalyon

Since 2000, the stock markets have become electronic all you need to start trading are demat accounts and trading account to invest in the stock market. Trading is conducted online A trading account you’ll open with a stockbroker.

What are the demat accounts?

A Demat Account is an account that allows investors to hold their shares in an electronic form. Stocks in the Demat account remain in dematerialized form. So, dematerialization is the process of converting physical shares into electronic format. A demat account can be opened with no balance of shares.

The benefits of demat accounts:

– An easy and convenient way to hold securities

– Immediate transfer of securities

– No stamp duty on transfer of securities

– Safer than paper-shares (earlier risks associated with physical certificates such as bad delivery, fake securities, delays, thefts, etc. are mostly eliminated)

– Reduced paperwork for transfer of securities

– Reduced transaction cost

– No “odd lot” problem: even one share can be sold

– Change in address recorded with a Depository Participant (DP) gets registered with all companies in which investor holds securities eliminating the need to correspond with each of them separately.

– Transmission of securities is the duty of DP, it eliminates the need for notifying companies.

– Automatic credit into demat account for shares arising out of bonus/split, consolidation/merger, etc

– A single demat account can hold investments in both equity and debt instruments.

– Traders can work from anywhere (e.g. even from home).

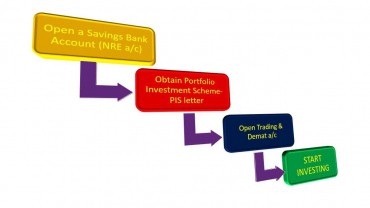

How to open demat accounts?

– You have to approach a depository participant (DP), an agent of the depository, and fill up an account opening form.

Along with the account opening form, you must enclose photocopies of some documents for proof of identity and proof of address.

– You will have to sign an agreement with DP in the depository prescribed standard format. It gives details of the rights and duties of investor and DP.

– You have the right to receive a copy of the agreement and schedule of charges for future reference.

– The DP will then open an account and give you the demat account number. This is also, beneficial owner identification number (BOID).

– All your purchases/investments in securities will be credited to this account.

– If you sell your securities, your demat account will be debited.

How to open a trading account?

– Select the stockbroker or company.

Ensure that the broker is good and will take your orders in a timely manner.

Time is the most important in the stock market. Even a few minutes can change the market price of the stock. Ensure that you select a good broker.

– Compare brokerage rates.

Every broker charges you a certain fee for processing your orders. But, some may charge more, some less. Some give discounts on the basis of the number of trades conducted.

Take all this into account before opening an account. It is not necessary to choose a broker who charges the lowest fees. Good quality brokerage services provided often may need higher than average charges

Next step,

– Get in touch with the brokerage company or broker and inquire about the account opening procedure.

Very often, the firm would send a representative to your house with the account opening form and the Know Your Client (KYC) form. Fill these two forms up. Submit along with two documents to prove your identity and address.

– Your application will be verified either through an in-person check or on the phone. They will ask you to reveal your personal details.

After processing, you will get your trading accounts details and, you are ready to conduct trades in the stock market.

Documents required

It’s like the procedure for opening a Demat account.

You need to submit proofs of identity and address along with a passport size photograph and the account opening form for opening a trading account.

PROOF OF IDENTITY:

Like PAN card, voter’s ID, passport, driver’s license, bank attestation, IT returns electricity bill, telephone bill.

Also, ID cards with applicant’s photo issued by the central or state government and its departments, public financial institutions, colleges affiliated to universities, etc.

PROOF OF ADDRESS:

Like Ration card, passport, voter ID card, driving license, bank passbook or bank statement, verified copies of electricity bills.

Also, residence telephone bills, leave and license agreement or agreement for sale, self-declaration by High Court or Supreme Court judges, identity card, or a document with address issued by the central or state government and its departments, commercial banks, public financial institutions, etc.

And now you are ready to start your first trade.

Leave a Reply