I. Introduction Richard Pierce’s “Recession Profit Secrets” Guide offers a strategic approach to generating income during economic downturns. This guide provides individuals with valuable information and techniques to navigate through the challenges of a recession.…

Navigating the complex realm of trading strategy is a challenge embraced by traders of all levels. Crafting a plan that aligns goals, risk tolerance, and precise entry/exit methods is crucial. Explore invaluable insights to forge…

Introduction Delving into the intricate realm of finance and investment can be overwhelming, especially for newcomers. Amidst the multitude of strategies, technical analysis and fundamental analysis stand as prominent methods. This article unravels their…

Introduction Embarking on the world of forex trading may appear intricate to beginners, but this comprehensive guide aims to demystify the complexities. “A Beginner’s Guide to Forex Trading: Getting Started and Key Concepts” serves as…

Article by: Guy Avtalyon Choosing the Right Brokerage Company is essential as it can significantly affect your investment campaigns. In the current digital age, online brokerage firms have become more popular due to their convenience…

Written and edited: Guy Avtalyon Stock trading, also known as equity trading, involves buying and selling shares of publicly traded companies. Investors typically purchase stocks with the hope of selling them at a higher price…

Introduction: The basic of basic Trading stocks is often hailed as a lucrative avenue for creating wealth and achieving financial independence. Countless success stories exist of individuals who have amassed significant fortunes through their stock…

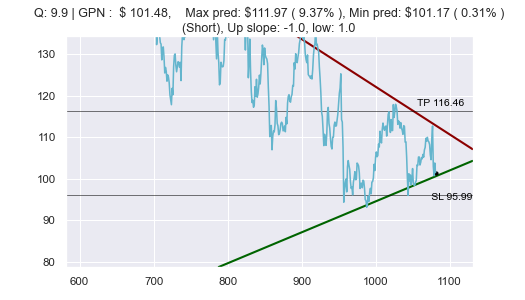

If you are interested in trading GPN stock and have identified what you believe to be a trading opportunity, it’s important to examine the sentiment and news to determine if your assessment is accurate. In…

According to Reuters, global stocks were mixed on Monday, with the U.S. stock futures pointing to a lower open. The focus is on a U.S. jobs report due later this week that may provide clues…

Biogen’s experimental drug, aducanumab, was seen as a potential breakthrough in the treatment of Alzheimer’s disease. The drug had shown promising results in clinical trials, but the US Food and Drug Administration (FDA) recently rejected…