Which Currencies Are Traded in the Forex Market?

3 min read

The most popular currencies are those with which all forex traders should be familiarized. But, they should know some of the underlying features and attributes of each currency.

Ok, you already know this.

Forex trading is the synchronous buying of one currency and selling another. Currencies are traded through a broker or dealer and are traded in pairs.

Right?

For example the euro and the U.S. dollar (EUR/USD) or the British pound and the Australian dollar (GBP/AUD). By the way, they are the most popular currencies.

So, when you trade in the forex market, you buy or sell in currency pairs.

In Forex market you can trade majors, minors and exotic currency pairs.

Major currencies are the most popular currencies.

Major Currency Pairs and most popular currencies

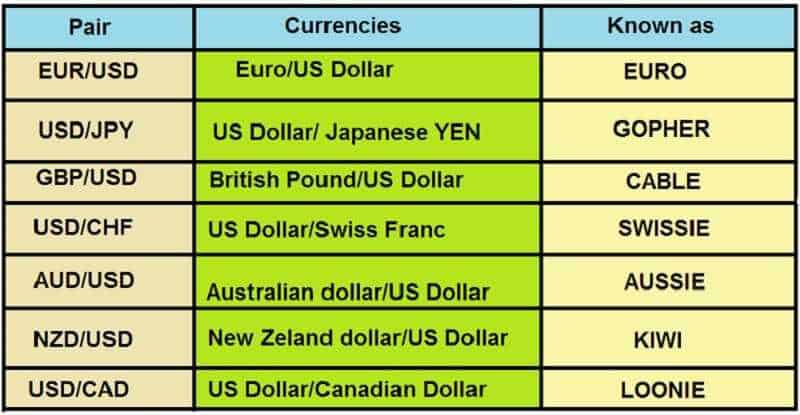

The currency pairs listed below are recognized as the “majors.”

These pairs all include the U.S. dollar (USD) on one side and are the most commonly traded.

The majors are the most liquid and the most popular currencies.

But there are also major cross-currency pairs or Minor currency pairs.

Currency pairs that don’t include the U.S. dollar (USD) are recognized as cross-currency pairs or commonly as the “crosses.”

Major crosses are also identified as “minors.”

The most-traded crosses are obtained from the three major non-USD currencies: EUR, GBP, and JPY.

Minor Currency Pairs

Yes, the major currency pairs make up the majority of the market. But you shouldn’t neglect the minors. The minor currency pairs account for all the other combination of major markets such as EUR/GBP, EUR/CHF, and GBP/JPY.

With so many options opened, are you asking yourself – which currencies should you trade?

A good rule of thumb for traders new to the market is to focus on one or two currency pairs.

Generally, traders will choose to trade the EUR/USD or USD/JPY because there are so much information and resources available about the underlying economies.

Hence, these two pairs make up much of the global daily trading volume.

Most Popular Currencies for Trading One by One

The US Dollar

So, we just can’t say it is among the most popular currencies. It is the most popular currency.

The leading is the US dollar, which is the most traded currency on the planet.

You can find the USD in a pair with all of the other major currencies. It usually acts as the intermediary in trilateral currency purchases.

This is because the USD acts as the unofficial global reserve currency. Nearly every central bank hold it and, also, every institutional investment organization in the world.

Moreover, due to the U.S. dollar’s global acceptance, it is used by some countries as an official currency.

That practice is well-known as dollarization.

The US dollar is also generally accepted in other countries. Its an informal alternative form of payment, but at the same time, that countries keep their official local currency.

The US dollar is also an important factor in the foreign exchange rate market for other currencies. There it acts as a benchmark or target rate for countries that choose to fix their currencies to the USD value.

You can find that countries pretty frequently fix their exchange rates to the USD to stabilize their exchange rate. They do it rather than to allow the forex markets to change its relative value.

If you are new in forex you have to know that it is used as the regular currency for most commodities, such as crude oil and gold or silver, for example.

Therefore, these commodities are subject to the economic principles of supply and demand. But, also, they depend on the relative value of the US dollar. All along with prices very sensitive to inflation and US interest rates.

Interest rates directly affect the dollar’s value.

The Euro

The euro has become the second most traded currency in the forex market. At the same time, it is the world’s second-largest reserve currency.

The euro is new to the world scene. It was presented to the world markets on January 1, 1999, but a real banknote came 3 years later.

Today the euro is the official currency of the large part of the countries inside the eurozone.

Also, many countries inside Europe and Africa fixed their currencies to the euro. The reason behind their decisions is the same as it is with USD.

They want to stabilize the exchange rate.

The euro is broadly used and trusted currency. Hence, it is very accepted in the forex market. Its role is to add liquidity to any currency pair.

The euro is normally traded in the forex market.

Some experts, who are not in favor of the EU, are willing to say that the euro is traded by speculators.

They like to claim that political matters inside the eurozone can lead to large trading volumes for the euro.

In one we must agree with such experts: the euro may be the most “politicized” currency traded in the forex market nowadays.

The Japanese Yen

The Japanese yen is the most traded currency out of Asia. Many use the yen to assess the overall strength of the Pan-Pacific region. Some can ask how does it come. You always must have in your mind economies of South Korea, Singapore, and Thailand. Those currencies are traded far less in the global forex markets. But there is yen.

The yen is also important in the forex market because of its role in the carry trade. That’s when traders want to profit from the difference in interest rates between two currencies.

Japan had a zero interest rate policy for more than two decades. Hence, traders have borrowed the yen practically without a cost and used it to invest in higher-yielding currencies. The rate differentials ended in their pockets.

The carry trade gives a large part of the yen’s presence on the forex markets.

The Great British Pound

The GBP, or the pound sterling, is the fourth most traded currency in the forex market. It is a large reserve currency. Its relative value compared to other global currencies is high.

Forex traders will often base the value of GBP on the general health of the British economy. Also, on the political stability of the UK government. Due to its high value, the pound is also an important currency benchmark for many countries. It is a very liquid component in the forex market.

Nowadays, GBP suffers due to the Brexit issue. Value oscillations are pretty much visible. Especially as pair with USD.

These currencies are followed by the Canadian dollar and the Swiss franc.

The Canadian dollar or loonie is probably the world’s foremost commodity currency. It moves along with the commodities markets, prominently with crude oil, precious metals, and minerals. Traders mostly trade the Canadian dollar as a hedge to their holdings of underlying contracts.

The Swiss franc is viewed as a safe currency in the forex market. The franc tends to move in a negative correlation to more volatile commodity currencies, such as the Canadian and Australian dollars, or U.S. Treasury yields. Actually, the Swiss National Bank is very active in the forex market. They want to secure that the franc trades within a tight range, in order to reduce volatility and keep interested rates.

Exotic Currencies

Many other countries have their own currencies. Outside of the major and minor currencies is the large group of the so-called “exotic currencies”.

Exotic currencies are made up of the hundreds of currencies, which are nevertheless important as well, especially in international commerce and finance. And they are among the most popular currencies too.

The exotics are:

RUB – the Russian Ruble

CNY – the Chinese Yuan or Renminbi

BRL – the Brazilian Real

MXN – the Mexican Peso

CLP – the Chilean Peso

INR – the Indian Rupee

IRR – the Iranian Rial

This the list of just a few of the most actively traded exotic currencies. In some cases, a country will use USD as its currency, like Haiti for example.

The bottom line

The pair you choose to trade might be based on the country in which you will be trading. Or you can choose based on your analysis of where you see the most opportunities for profit.

But, also you may choose on the fact what are the most popular currencies.

However, always remember to base all trade decisions on careful analysis, with adequate risk management measures in place.

Don’t waste your money!

Don’t start before you test your skills on virtual money and read this risk disclosure