Commodity analysts have been turning more bullish on gold

1 min read

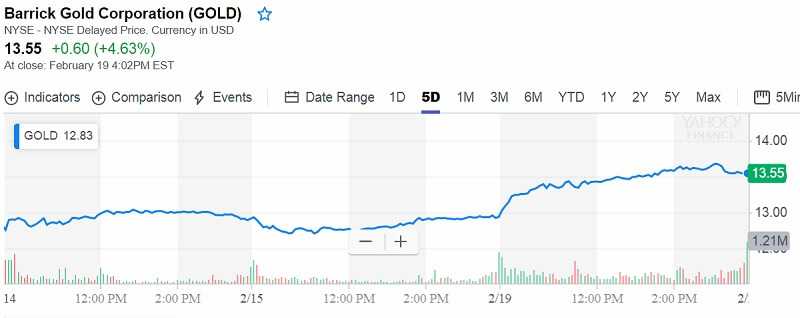

Gold markets rallied significantly during the trading session on Tuesday. If the US dollar continues to fall, and it certainly shows itself likely to do so, the Gold markets will quite often rally by proxy. This market has a significant amount of resistance above. We are towards the top of the overall consolidated range, you have to keep in mind.

At this point, there is a lot of sounds spreading to the $1350 level. So, this is a very bullish looking candle. It would not be surprising to see some sort of pullback in this marketplace but now the $1325 is support level. It was resistance before.

If gold can break above the $1350 level, the break will become the gate opened, and the market should very promptly go towards the $1400 level.

Hence, the idea of buying pullbacks in this precious metal sounds quite good. Well, as we can see, the strong uptrend certainly looks likely to continue.

Take a look at this chart. You can see that the market just broke out above a bullish flag, and of course, have cleared a significant resistance. So look for value and you will be rewarded.

But the $1300 level underneath is a massive floor in the market. It will be difficult for this market to break down through there. If so, then the $1275 level should offer support. There’s a couple of various places where the buyers will return. Look at short-term charts, but you should get the opportunity to pick up gold cheaply fairly soon.

Maybe too many traders have rallied to buy on this level.

It would make sense that the pullback happens.

A precious metals bullion coin sales rebounded in January with the strongest monthly sales in two years. The U.S. Mint sold 65,500 troy ounces of the gold American Eagle and 4,017,500 troy ounces of the silver American Eagle in January 2019 – 12% and 24% increases respectively over the same month last year. In January 2018, investors purchased 58,500 troy ounces in gold bullion coins and 3,235,000 in silver bullion coins.

Many analysts credit the Washington Gold Agreement of 1999 as the seminal document at the heart of this precious metal secular bull market. In it the top central banks agreed to gradually curtail the sale and lease of gold reserves, two activities that kept the price rangebound for much of the 1990s. At the time, it was stuck in the $270 to $300 price range. From there, it never looked back.

Fast forward to 2011 and we begin to see central banks moving from the net seller side of the gold fundamentals ledger to become net buyers. Some analysts applauded the simple retreat from sales and leases as a major victory for gold bulls. The move to becoming net buyers was the icing on the cake. In 2018, central bank gold purchases reached their highest level in fifty years according to World Gold Council data – a profound development the machinations of which have yet to be fully digested in the marketplace.

The bottom line

The gold market fresh 10-month high could be the start of a renewed uptrend in the precious metal. Because the market has broken important resistance levels, according to some economists.

Commodity analysts have been turning more bullish on gold since last month. It came after the Federal Reserve signaled that it would pause its interest rate hike cycle for the foreseeable future.

Analysts have noted that a “patient” U.S. central bank, will keep real interest rates low and provide less of a tailwind for the U.S. dollar. Growing economic risks and the rising fear of a global recession will also keep the pressure on equity markets, economists have also said.