Traders Paradise will walk you through some suggestions on how to manage money in your 20s

Traders Paradise will walk you through some suggestions on how to manage money in your 20s

By Guy Avtalyon

Update on Feb 12, 2019

We received an email from our visitor Christopher Trum, Content Manager LendingTree Brands, that asked us:

”I was reading a recent article on Traders Paradise (traders-paradise.com/magazine/2019/01/personal-finance) and wanted to thank you for including data from our research study!”

With his permission, here is the link with full access to the original source

https://www.lendingtree.com/finance/places-millennials-carry-the-most-debt/

Personal finance is something that has to be well managed no matter how old is someone.

Who is going to take care of your own personal finance so early, for example in the 20s?

You may not think of your 20s as the time to buckle down financially. Between beginner salaries and student loans, many young people at their 20s bearly sustain to live from paycheck to paycheck. I know that. But what I also know is that your 20s are the best time to set the base for your financially secure existence. Yes, it is the right time to take care of your personal finance. Both, now and in the future.

Current status and future

You’ve probably graduated from college, started your first job, and are starting to make decisions on your own. Your adult life has just begun and retirement seems years away. But this is the right time to discuss your personal finance choices, how to manage your money responsibly, and to plan your financial future.

Personal finance exactly that: how you manage your money, your income, expenses, and savings, all of them. The truth is that you have to put an effort into managing your personal finances. In that way, you’ll better understand where your money is going. Also, you’ll better recognize if you have to make changes to meet your future financial goals.

Managing your personal finance better is something that can literally pay off. It can help you stay on top of your bills and save thousands of dollars each year. With that extra savings, you can pay off any debts you might have. Or maybe you would like to put that money towards your pension or spend them on your holiday or new car.

Create a budget to protect your personal finance

I know, for many of you creating a budget is critical. But without a budget, you’ll have difficulties to track your finances. Moreover, how will you identify key savings opportunities? So, if you don’t have one yet, take a time to map out your living costs.

Budgeting is the process of tracking your income, bills, and expenses in order to assess how much you can spend and what you can afford each month. Creating a budget and sticking to it is the foundation for personal financial success as it helps you to live within your means and avoid debt.

You don’t need any advanced tools to create a budget. All you need is to open up a spreadsheet on your laptops or phones and add your all expenses. It’s okay to add the random ones that pop up once a year. Then compare what you’re spending on what you’re earning. If the numbers don’t align, then you’ll need to work on making some changes to ensure that you leave yourself enough space for savings.

When creating a budget, you have to write down:

- Your income: How much are you making per pay period?

- Your expenses and payments: How much you spend on rent/mortgage, utilities, groceries, etc each month?

- Debts owed: How much do you owe for student loans, credit card debt, and similar?

Pay yourself first – Start your emergency savings

The recommendation is to pay yourself first. That means the first bill paid each month should be some paybacks if you have any. The second is to pay for utilities, put aside money for living buyings. And everything left over at the end of the month is your extra money. Open a savings account and put it there. The biggest mistake is the young people make is not saving early enough. They tend to put off savings until their 30s. That is wrong.

Just because you’re on the younger side doesn’t mean you’re immune to financial emergencies. Quite the contrary. Without emergency savings, you may have no choice but to get out costly loans. A better choice is to have an emergency fund. It has to be at least the amount you need for three months’ living expenses. Ideally, more like six months’ worth.

Having emergency savings is very important. In fact, it should trump any other financial aim you may have.

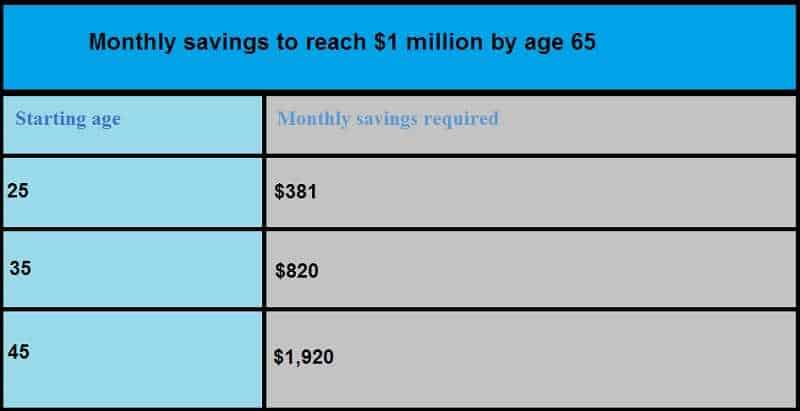

Let’s look at an example: Assuming you want to have $1 million in savings by the time you retire at age 65. This is how much you’ll need to invest each month:

Time is on your side when you’re young. You should save about 20% of your earnings. That should help you maintain your current lifestyle in retirement. If you want to travel more and more entertainment when retire, you should save about 30% of your earnings. That will help you have a lifestyle better than what you currently have.

A little bit of money saved now is going to make a big difference later in your personal finance.

Pay off present debt to secure personal finance

According to a recent study by LendingTree, the average millennial has an average of $24,000 in debt. This can paralyze your financial, and even your physical and mental health.

AVAILABLE FOR US residents ONLY

Large amounts of debt can seem daunting to pay off. Hence, it’s important to make a plan. You have to start paying it off quickly. Just include it in your budget as a monthly payment. But if you have more than one debt, which to pay off first?

You have to consolidate debt to one payment with a lower interest rate when possible.

But you may be more driven to try the debt avalanche or debt snowball methods of repayment.

Never focus on just one expense at a time.

If you owe money to a friend or family member and paying that debt off is a mental relief, pay that as first and then move on to other debts.

It’s important to make a plan to pay off and manage your debt to avoid heavy interest fees.

Get out of credit card debt

Credit cards are the worst enemy in anyone’s personal finance. Anyone who runs out of cash simply turns to credit cards. But can you afford to pay the balance? Combat the urge to use your credit cards for the shopping things you can’t afford.

The U.S. credit card debt increases every year. For example, the average household debt is nearly $16,000. So much!

The essential part of your good account balance is to eliminate the debt from the credit card as soon as possible. Actually, you’re wasting your hard-earned money on interest costs. By doing so you’ll have a double benefit: you’ll get out of debt and you’ll improve your credit score. And that is crucial if you plan to buy a home or lease a car in the near future.

Build credit

Never live above your resources and use credit for money that you don’t have. Never buy things on credit if you don’t have the resources to pay it off in full at the end of the month.

A credit report is a report that shows your credit history and is used to determine your creditworthiness. Building a strong credit history and maintaining a high credit score is essential for your financial health. In your early 20s, it’s important to build your credit by paying your credit cards and utilities on time but avoiding debt in the process. Instead, use a credit card to build credit. That could be a smart use example. Of course, if you can’t afford to pay it off by the end of the billing statement, you apparently can’t afford it.

It is important to make sure you don’t break the terms of your agreements. So even if you want to pay down added debt, you have to pay at least the minimum on your credit cards.

Investing your savings if you want to take care of your personal finance

When your savings start to grow, you can add more money to your pension. It’s a great way to make sure you’ll be able to live more comfortably later in life. Or you can make an investment plan based on your goals and timeframes.

If your savings goal is more than five years away, putting some of your cash into investments would allow you to earn more from your money and keep up with rising prices. Investments are something where you put your money to get a profit. You can choose from four main types of investment:

Shares – you buy a stake in a company

Cash – the savings you put in a bank or building society account

Property – you invest in a physical building, whether commercial or residential

Fixed interest securities bonds) – you loan your money to a company or government

There are other types of investments available too, including:

Collectibles, such as art and antiques

Commodities like oil, coffee, corn, rubber or gold

Contracts for difference, where you bet on shares gaining or losing value

The different assets owned by an investor are called a portfolio.

As a general rule, spreading money among the different asset classes will lower the risk of your overall portfolio. More on this you can find HERE.

For emergency savings, the best place for your cash is the bank. For long-term savings, investing in stocks is efficient for growing wealth. And you don’t need to take an extreme amount of risk. Sure, the stock market can be volatile, and it’s had its share of ups and downs through the years. But it’s also historically delivered a roughly 9% average annual return, which is about nine times more than what you’ll get from a savings account today.

The good news is, you don’t need to be an expert to enter the stock market. If you’re not comfy investing in a particular company, just put your money into exchange-traded funds or ETFs. These low-cost funds simply seek to track existing indexes, like the S&P 500, and because they offer instant diversification, they’re a less risky prospect than buying up individual companies’ stock.

Protect yourself financially

As you enter maturity, you’ll want to make sure that you are protecting yourself and your finances with adequate insurance. Take advantage of the benefits offered at work: health insurance, life insurance, short and long-term disability insurance. You may consider some benefit packages outside of your current work offers.

Fight for a higher salary if you want to take care of your personal finance.

Your 20s are a time to pay your dues but that doesn’t mean you shouldn’t fight for more money along the way. In fact, the more money you receive at your current job, the more you’ll probably get at your new job. So, boosting your salary won’t just put more money in your wallet now, but also throughout your working years.

Knowing how to manage your money and where start with financial planning can be terrifying and difficult. Especially when you’re in your 20s. Finances can be complicated, but it’s crucial to find out what is available to you. So, it’smart to start working on financial matters earlier rather than later in life.

Leave a Reply